The UAE's Federal Tax Authority (FTA) recently released a guide in August 2023 that will help navigate the Corporate Tax Registration of juridical persons. This guide offers valuable insights into crucial areas, such as Corporate Tax Registration rules, the criteria for determining the necessity of registration, and the Corporate Tax Deregistration process.

This document aims to clarify and answer key questions on Corporate Tax Registration within the UAE.

Who should obtain the Tax Registration Number (TRN)?

All taxable persons will be required to register for Corporate Tax and obtain a TRN. The taxable persons include a company, a branch office, individuals who conduct business and non-resident persons in some situations.

Whether Free Zone companies eligible for a 0% Corporate Tax rate should obtain the TRN?

Yes, Free Zone companies are regarded as taxable persons for the purpose of UAE Corporate Tax and are, therefore, required to obtain the TRN.

Can you use the VAT Registration Number for Corporate Tax purposes?

No, the taxable persons are required to obtain a separate TRN for Corporate Tax-related compliances.

If you have formed a Tax Group, whether all entities in the Tax Group are required to obtain the TRN separately?

No, the Tax Group will be treated as a single taxable person for the purpose of Corporate Tax; therefore, a single TRN would suffice.

Whether non-resident persons are required to obtain the TRN?

A non-resident person having a Permanent Establishment (PE) in UAE shall obtain the TRN.

When should a taxable person obtain the TRN?

The taxable person can obtain the TRN on or before the due date for filing a Corporate Tax return. For example, a person following the accounting year of 1 January 2024 to 31 December 2024 should obtain the TRN on or before 30 September 2025.

Whether 'Qualifying Investment Fund' is required to obtain the TRN?

Article 4 of the Federal-Decree Law No. 47 of 2022 provides an exemption to 'Qualifying Investment Funds,'' subject to the fulfillment of specified conditions mentioned in Article 10.

Notably, the 'Qualifying Investment Fund' is also required to obtain the TRN as of 1 June 2024.2024.

How to register?

For the purpose of registration, a person has to log in to the Emara Tax Account (using login credentials or UAE pass) and carry out Corporate Tax Registration under the concerned taxable person.

What are the documents required for registration?

- Trade License/Business License details

- Passport and Emirates ID of owner owning more than 25% of shares directly

- Passport and Emirates ID of authorized signatory

- Proof of authorization for authorized signatory.

Can the FTA request additional documents?

Yes, the FTA has the authority to request additional information through email/SMS. In such instances, the application status will be changed to 'Awaiting information.'

If a person receives exempt income, are they liable for Corporate Tax Registration?

Yes, even if a person receives only exempt income, they are still considered taxable and are required to register for Corporate Tax. However, exempt income itself does not incur any tax liability.

Do foreign juridical persons need to register for Corporate Tax?

Yes, foreign juridical persons who are effectively managed and controlled in the UAE, regardless of the residency of their board members, are considered Resident Persons for Corporate Tax purposes and must register accordingly.

Do UAE branch offices need to register for Corporate Tax?

UAE branch offices of Resident Persons are treated as part of the same Taxable Person and cannot register for Corporate Tax individually. The head office is responsible for registering on behalf of all UAE branches. This applies to branches of Free Zone companies as well.

Is it possible to deregister for Corporate Tax?

Yes, juridical persons who are no longer subject to Corporate Tax due to business cessation, dissolution, or other reasons can apply for Deregistration.

What is the procedure for deregistering from Corporate Tax?

To deregister from Corporate Tax, a juridical person must submit an application to the FTA. Once approved, the Deregistration date will be the date of business cessation unless determined otherwise by the FTA.

Are there any prerequisites for Deregistration from Corporate Tax?

Yes, a taxable person must fulfill all their tax compliance obligations, including filing relevant Tax Returns and settling all Corporate Tax liabilities and administrative penalties before applying for Deregistration.

When should a Deregistration application be submitted?

Deregistration applications must be filed with the FTA within three months from the date of entity ceasing to exist, cessation of business, dissolution, liquidation, or similar circumstances.

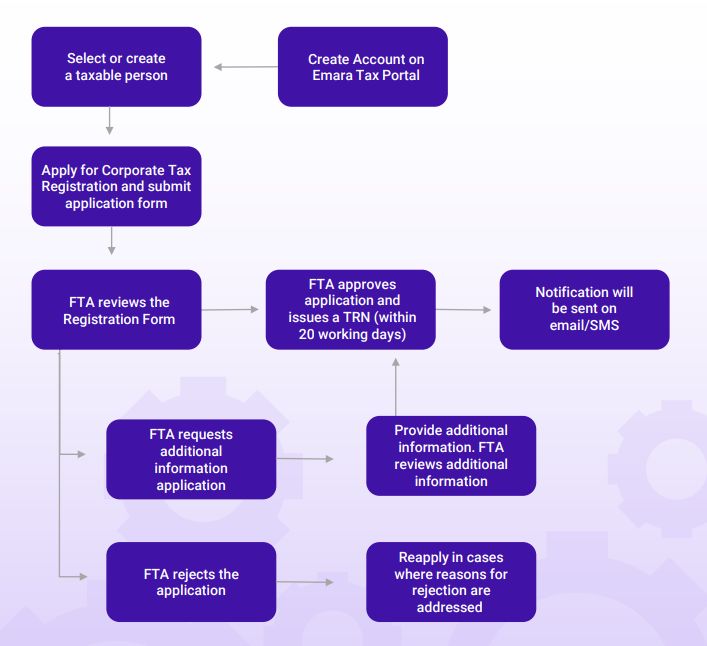

An Overview of the Registration Process is as follows:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.