The UAE Ministry of Finance (MoF) issued the first-ever Transfer Pricing Guide (TPG) on October 2023 to provide general guidance on the Transfer Pricing regime. The provisions of Corporate Tax are applicable to the tax period commencing on or after 1 June 2023 and the issued guidelines are to be read alongside for accurately decoding provisions of Decree1. The guide solely acts as the primary source of guidance for Transfer Pricing matters in the UAE and does not hold the power of enforceability. If and only if certain aspects are left uncovered by this guide, one may resort to international standard guidance like OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations (OECD TPG) and other supporting documents realized by the OECD.

The focal intent of the TPG is to define the ambit of related parties and connected persons in detail. Thereby determining the related party transaction and identifying the correct choice of transfer pricing methods. Additionally, it specifies the applicability of maintaining Transfer Pricing Documentation (TPD). The TPG also touches upon certain miscellaneous topics which taxpayers may adopt.

Purpose of Transfer Pricing Policy

In the situation wherein the heightened surfacing of cross-border trade activities can boost the economy of the country, it can also be the genesis of tax evasion. The transfer pricing provisions hold significance in determining the related party transaction from a tax perspective. Transfer Pricing Policy adopted by any group may lead to underpayment of tax in one or more jurisdictions without affecting the group's consolidated profit. The transactions between the different entities under the same group can be arranged in a manner to artificially shift profits from higher tax jurisdiction to lower tax jurisdiction or high tax entities to low or no-tax entities. Such arrangements result in price distortions, resulting in an overall lower tax burden, hence, having a monitored transfer pricing policy will keep transactions under control.

Comparability Analysis and Substance of Transaction

The transaction or arrangements between related parties or connected persons, which is influenced by the relationship between transacting parties, ought to be priced as per the arm's length principle. During transactions, the commercial and financial relations between independent parties are swayed by market forces and negotiations. Whereas in the case of related parties and connected persons, similar factors may not exist, leading to the adoption of non-arm's length pricing and alteration of profits in the relevant jurisdiction.

Under Corporate Tax Law, the arm's length principle requires that transactions and arrangements between related parties or connected persons are priced as if they occurred between independent parties under similar circumstances. The same can be determined by analyzing the conduct of parties and economic analysis of transactions. The conduct of parties should be in line with the substance of intercompany activities and allocation of Functions, Assets and Risks (FAR). For determining the substance of the transaction, the company may enter into a formal pricing agreement or legal agreement. The agreement defines the terms of the contract, nature of services, rights and obligations, compensation, credit policy, etc., which enables an entity to delineate FAR effectively. Ergo, the UAE TPG requires an agreement to be formulated in a manner that would not fall against business acumen if entered into between unrelated/independent parties. In order to ensure the same, the taxpayer should ensure that the agreement is at par with the conduct of the parties and define value-creation between the parties.

Wherein the agreement facilitates the determination of the pricing policy, FAR and ambit of services, there are instances of unavailability of legal agreement. In such cases, it becomes difficult to analyze the FAR of the transaction and the basis for deriving a pricing policy. Therein, microscale analysis of the conduct of parties on a transaction basis would facilitate an accurate understanding of FAR allocation. All in all, the economic conduct between the parties has been given importance over the written contract. However, it is highly recommended to conclude written contracts for material transactions, which enables the definition parameters the preference will still be given to the actual conduct of parties involved in controlled transactions. The functions performed, characteristics, economic circumstances, and business strategies will provide an important understanding of the actual conduct of the parties, thereby relying on substance over form. While drawing reference to the analysis, the attention should be on the nature of a controlled transaction and whether the conditions would be different if observed in Comparable Uncontrolled Transactions. The process of comparison analysis is indispensable and forms the heart of the arm's length principle. Comparability Analysis should be performed in order to justify that the Transfer Price between related parties and connected persons is according to respective fair share. Therefore, while recording operating profits, related parties or connected persons shall consider their respective FAR and contributions to the value chain across the group.

Detailed description of Related Parties and Connected Person

Related Parties

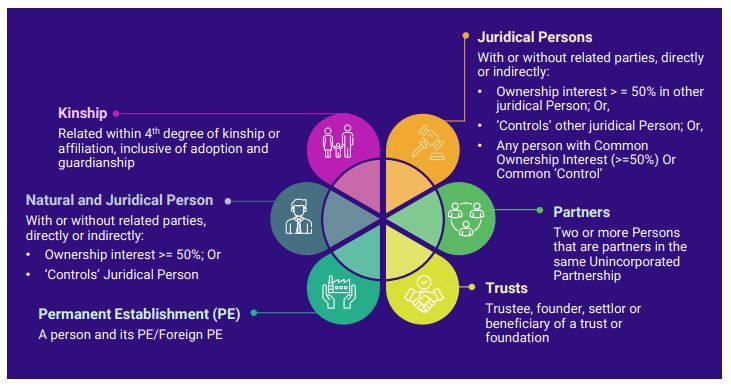

Article 35 of the Corporate Tax Law demands any associated person to comply with the provision of Transfer Pricing Rules in proportion to the degree of association. Following a pre-existing relationship (association) with another person, irrespective of the residence in UAE, can be categorized as a related person:

It also defines the ability to determine the exercise of significant influence upon another person's conduct of business and affairs to be categorized as a related party. UAE TPG illustrated certain examples indicating factors and circumstances creating significant influences as follows:

- A person is contributing a significant amount of funds to another person's business in the nature of a loan.

- Royalty arrangement entitling 50% or more of profit for the relevant year.

- A person undertaking important decisions for another person's business.

These examples illustrated were entered into between entities, not in the capacity of being called Associated Enterprise (AE) but creating the impact equivalent to one when determining the relationship of related parties. Therefore, each transaction should be evaluated and examined on a cost-to-cost basis.

Connected Person

The Corporate Tax Degree embraced the application of Transfer Pricing rules on connected persons due to the absence of personal income tax in the UAE. Individuals in the UAE may shift excessive payments to themselves or persons connected to them, thereby leading to income generation and eroding the tax base of taxable businesses in the UAE. The relationship of a connected person can be:

- An individual who directly or indirectly holds ownership interest/controls the taxable person.

- A director or officer of the taxable person.

- An individual bearing a relationship with the owner/director/officer of a taxable person by fourth degree of kinship or affiliation.

- A partner of Unincorporated Partnership and any related parties of the partner.

A connected person will be entitled to claim a deduction of any payments and benefits only if it is transacted exclusively for business activities and at market value. Post arm's length analysis, if the deduction claim is not found to be at Market Value, it can result in denial of the claim. Therefore, it becomes salient for a taxpayer to claim a deduction within the bounds of the arm's length principle. Nevertheless, the obligation of being bound by the arm's length principle will not be applicable if the following connected person claims the deductions:

Taxable Person whose shares are traded on a recognized stock exchange;

Taxable Person subjected to the regulatory oversight of a competent authority in the UAE; and

Any other Person as may be determined in a decision to be issued by the Cabinet.

Transfer Pricing Methodologies

Transfer Pricing Methods are adopted for accurately deriving the price of controlled transactions. UAE TPG has placed reliance on OECD TPG to determine the ambit and mechanism of Transfer Pricing methodology. As acclaimed by OECD TPG, there is no hierarchy in adopting a method for deriving at arm's length. The methods are adopted based on a keen analysis of FAR and pricing policy. UAE TPG laid down six methods which can be resorted by taxpayers for deriving at arm's length price:

- Comparable Uncontrolled Price Method (CUP)

- Resale Price Method (RPM)

- Cost Plus Method (CPM)

- Transaction Net Margin Method (TNMM)

- Profit Split Method (PSM)

- Other Method

The methodology and its mechanism are in line with OECD TPG, leading to the assumption that taxpayers framed the Transfer Pricing policy within the set standards. In this case, tax authorities perform the Transfer Pricing audit and derive that the adopted method is not appropriate. It holds the power to change the method after detailed analysis and sufficient explanation from the taxpayer. Hence, it is important to adopt an appropriate transfer pricing method on a transactional basis. Consequently, the UAE TPG gives importance to transaction-wise applications in comparison to company-wide transactions. The same can be analyzed when the guide suggested applying TNMM on a transactional basis instead of a companywide basis. This is because when a taxable person engages in multiple controlled transactions, the transaction becomes less reliable. The TNMM can be applied on an aggregated basis only when aggregate activities are sufficiently interlinked with economic and commercial functions.

Identification of Potential Comparables

Approaches for Identification

The identification of potential comparables is dependent on the analysis of controlled transactions, economic relevance and comparability factors. UAE TPG specified two approaches that can be followed for the identification of potentially comparable uncontrolled transactions:

Additive Approach – Under this, independent parties that are believed to undergo potentially comparable transactions are initially analyzed. Furthermore, information on these independent parties is collected to confirm if they can be categorized as accepted comparables based on predetermined comparability criteria.

Deductive Approach – Under this, initially, a wide set of companies operating in the same sector of activity as that of the tested party gets picked. Furthermore, the list goes through the refined selection criteria and publically available information.

Once the comparables are identified using either of the approaches, the taxpayer ought to apply qualitative and quantitative criteria based on the facts and circumstances. The choice of selection criteria significantly influences the outcome of the analysis, thereby showcasing the economic characteristics of the compared transaction. UAE TPG suggests maintaining supporting information as the Federal Tax Authority (FTA) can demand the presentation of such information to assess the reliability of comparable finalized. Hence, potential comparables and their selected criteria should be transparent, systematic and verifiable.

Preference of Database/Region of Comparables

UAE TPG doesn't specify the preference of commercial databases and pillars for the availability of reliable sources of information, thereby assisting taxable persons in performing comparability analysis. However, it provides the order of geographical region to be followed while conducting a search - local and then foreign regions. While domestic companies are preferred, regional (Middle Eastern) or global companies can be resorted to, presuming unavailability of insufficient data. Considering the current scenario, the UAE and Middle East region have limited published data on the database; hence, adopting foreign companies is a welcome move for all UAE-based groups.

Arm's Length Range

The interquartile range is calculated for arriving at arm's length price using the apt benchmarking methodology. The UAE TPG endorses the usage of the interquartile range (25% - lower quartile and 75% upper quartile) to ascertain the arm's length range and outlines a methodology to compute the arm's length range by illustrating a case study. While calculating the arm's length range, the taxpayer is required to consider comparables having data for at least two out of three years. The benchmarking search process can be repeated for consecutive years if conditions of controlled transaction remain unchanged. Whereas, the financial data of comparable and its consideration as a comparable for the relevant year should be updated on a yearly basis. Hence, a fresh benchmarking search process can be performed once every three years, but for interim years, it becomes mandatory to update it regularly.

Transfer Pricing Documentation

General Transfer Pricing Disclosure Form

The disclosure form covers the details of a controlled transaction entered into during the tax period. It must be submitted along with the tax return by the taxpayers crossing the material threshold (yet to be prescribed). The form will be available in due course on the FTA's website and will include details like nature of transaction, value of transaction, details of related party/connected person and Transfer Pricing methodology adopted for determining arm's length price.

Local File

The Local File is a detailed version of the disclosure form. It provides information on the operation of a local entity, Transfer Pricing analysis and outcomes of controlled transactions. It requires the taxpayers to define the management structure, business description and strategies incorporated, intra-company transactions, industrial analysis, transfer-pricing methodology, financial information, FAR analysis, and economic analysis. The details of the Local File reflect the actual conduct of business and has enormous information. Therefore, large businesses must only comply with Local File documentation as described in the Corporate Tax Law. The small taxpayers are not required to maintain a Local File, thereby reducing the compliance burden. The taxpayer exceeding the revenue threshold of AED 200 million in the relevant tax year or annual consolidated group revenue of AED 3.15 billion is required to maintain a Local File. Therefore, if a small taxpayer escaping from the former threshold of AED200 million falls within the threshold of AED 3.15, it will be required to maintain the Local File.

Master File

The Master File provides eagles' eye analysis of the group business, allocation of income and economic activity of the group. The details to be disclosed in the Master File include organization structure, description of business, intangible, intercompany financial arrangements, financial positions, etc. The preparation and maintenance of the Master File should be in line with the threshold described in Corporate Tax Law. However, UAE TPG exempts the entity headquartered in the UAE with no business establishments outside the UAE from maintaining a Master File. The taxpayer exceeding the revenue threshold of AED 200 million in the relevant tax year or annual consolidated group revenue of AED 3.15 billion is required to maintain a Master File. Therefore, if a taxpayer escaping from the former threshold of AED200 million falls within the threshold of AED 3.15, it will be required to maintain the Master File.

Country-by-Country Report

UAE TPG specifies that Country-by-Country-Report (CbCR) is the third requirement stipulated in the threetiered approach of Base Erosion Profit Shifting (BEPS) Actions. It provides information relating to global income allocation, taxes paid, and economic activity indicators of the MNE group across tax jurisdictions. The ultimate parent entity ought to be submitted by CbC notification for each reporting fiscal year. It must be filed within 12 months after the end of the UAE MNE group's reporting year.

Additionally, the exempt entities or entities that opted for the small business relief, as well as standalone entities with no related party transactions, are subject to Transfer Pricing rules and need to meet the arm's length principle in case of controlled transactions but are not required to prepare and keep TPD.

Transfer Pricing Audit

While Transfer Pricing Audit, the burden of proof lies with taxpayers to substantiate the arm's length nature of the controlled transactions. It can be supported by displaying the actual commercial purpose of the transaction and documentation maintained. According to UAE TPG, the taxpayer should comply with the Transfer Pricing regulations in order to showcase that the arrangement was modeled considering business acumen and not just for enjoying Corporate Tax advantage. The routine maintenance of TPD adds up to justify the benefits test.

The provision of Transfer Pricing adjustment is available with the taxpayer and FTA, wherein the transactions are believed not to be at arm's length. The taxpayer performs a self-assessment of the transaction while submitting the disclosure form. In case the transaction reported in the disclosure form is found to be not at arm's length, it can be adjusted by the taxpayer on a suo-moto basis only before filing the tax return. Whereas in the case of FTA, the Transfer Pricing adjustments can be made only after the taxpayer files a tax return. The taxpayers can make suo-moto adjustments after filing the return. However, no selfassessment regime for Transfer Pricing cases is in place under UAE TPG, but such adjustments can be implemented only during FTA-conducted audits. The FTA has the power to adjust the taxpayer's taxable profits to achieve arm's length results reflecting the actual economic circumstances of the arrangement. Consequently, it is also vested with the power to make adjustments to the arrangement/transaction, which ought to be entered between the parties but are not entered into on the basis of commercial reasons. In totality, while conducting a tax audit, the critical analysis should be whether a controlled transaction retains commercial rationality and the same would have been retained in an uncontrolled transaction.

Special Cases

The UAE TPG specified the special consideration for special cases like financial transactions (treasury function, Intra-group loans, cash pooling, hedging, financial guarantee and captive insurance), intra-group services, intangibles, business restructuring, business restructuring, group synergies and Permanent Establishments. The reference is drawn to OECD TPG for explaining the UAE pathway in every special case.

Footnote

1. Ministerial Decision No. 97 of 2023.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.