- with readers working within the Utilities industries

- within Government and Public Sector topic(s)

This article aims to highlight the key valuation triggers that stem from the application of various International Financial Reporting Standards (IFRS) and outline the valuation-specific differences between IFRS and the Accounting Standards Codification (ASC). The comprehensive analysis presented here would give readers a broad understanding of the valuation practices under IFRS as well as the nuances that differentiate valuations under IFRS from that of ASC.

IFRS – 1 (First-Time Adoption)

This standard sets out the procedures that an entity must follow when it adopts International Financial Reporting Standards (IFRS) for the first time as the basis for preparing its generalpurpose financial statements.

Valuation Trigger

A first-time adopter may elect to measure individual items at their fair value as on the date of transition to IFRS.

Measurement at Fair Value

Assets carried at cost may be measured at their fair value as on the date of transition.

Exceptions:

- The entity must revalue assets under previous GAAP either to their fair value or to a price-index-adjusted cost.

- The entity must make a one-time revaluation of assets or liabilities to fair value due to privatization or an initial public offering.

Differences between IFRS & ASC

ASC does not have a dedicated standard for first-time adoption. Instead, guidance for first time adoption is available within the respective standards.

IFRS – 2 (Share-Based Payments)

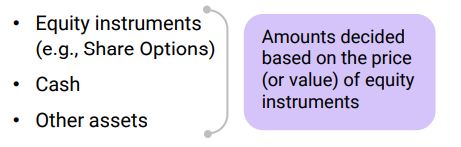

Share-based payments is a transaction in which an entity receives goods or services in exchange for consideration in the form of:

Valuation Trigger

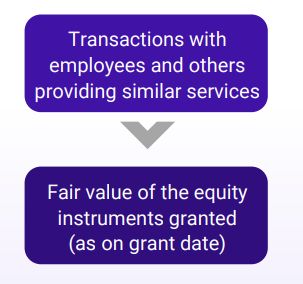

1. Transactions with employees and others providing similar services: Fair value as on grant date.

2. Receipt of goods or services in exchange for equity instruments: Fair value as on the date of receipt of goods/services.

Measurement at Fair Value

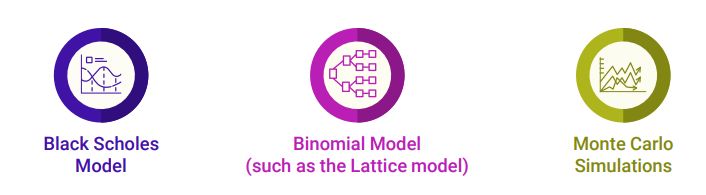

The fair value of instruments should be determined using an appropriate option-pricing models such as:

For complex financial instruments, advanced models such as the Binomial or Monte Carlo models are to be used.

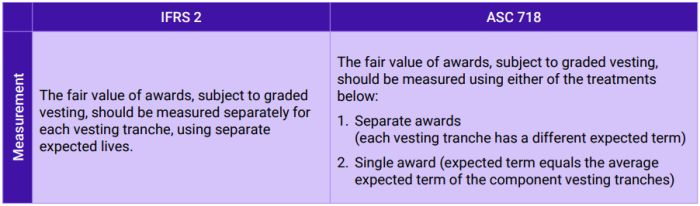

Differences between IFRS & ASC

IFRS – 3 (Business Combinations)

A business combination is a transaction or any other event in which an acquirer obtains control of one or more businesses.

Purchase Price Allocation (PPA) is an exercise conducted after a business combination to recognize the fair value of all identifiable assets (tangible and intangible) and liabilities assumed. The exercise typically results in recognition of goodwill or bargain purchase gain.

Valuation Trigger

For PPA, all identifiable assets acquired, and liabilities assumed are recognized at their fair value on the date of the business combination.

Measurement at Fair Value

Measurement of the fair value of the consideration including valuation of contingent consideration such as earnouts.

Valuation of identifiable tangible and intangible assets and liabilities assumed

Acquired intangible assets if separable or arising from other contractual rights are recognized at their fair value irrespective of whether the acquiree had recognized the asset prior to the business combination or not.

Some common methods of valuing Intangible assets include:

- Cost Approach

- Replacement Cost

- Reproduction Cost

- Income Approach

- Relief from Royalty Method

- With- and Without Method

- Multi-period Excess Earnings Method

- Market Approach

- Guideline Pricing Method

- Price/Valuation Multiples/Capitalization Rates Method

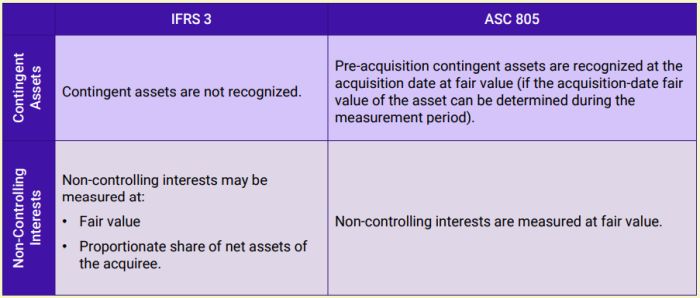

Differences between IFRS & ASC

IFRS – 9 (Financial Instruments)

A financial instrument is a contract that gives rise to a financial asset for one entity and a financial liability or equity instrument for another entity.

There are two types of financial instruments - financial assets and financial liabilities.

Valuation Trigger

Initial Measurement: All financial Instruments are recognized at fair value at initial recognition.

Subsequent Measurement: Performed annually at the end of each reporting year.

Measurement at Fair Value

Initial Measurement

Initially, financial assets and liabilities should be measured at fair value (including transaction costs, for assets and liabilities not measured at fair value through profit or loss ("FVTPL"))

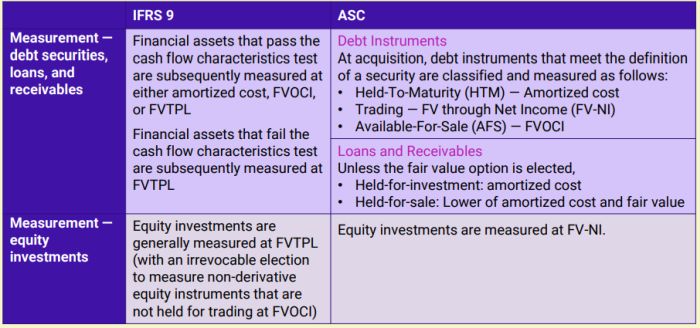

Subsequent Measurement - Financial Assets

- Debt instruments: Measured at amortized cost or fair value through other comprehensive Income (difference in fair value adjusted through OCI. Also known as FVOCI)

- Equity Instruments: All equity investments within the scope of IFRS 9 are to be measured at FVTPL, except for those elected to be measure through FVOCI.

- Derivatives: Measured at fair value.

Reclassification: Reclassification of financial assets is required if and only if the entity's business model objective for its financial assets change.

Fair Value Option: Additionally, IFRS 9 permits an entity, at initial recognition, to irrevocably designate a financial asset to the FVTPL category if this would eliminate or significantly decrease an inconsistency (accounting mismatch) in measurement or recognition

Subsequent Measurement - Financial Liabilities

Differences between IFRS & ASC

Impairment of Assets under IFRS

Impairment refers to a permanent reduction in the value of an asset. The following assets can be impaired - land, buildings, machinery and equipment, investment property (carried at cost), intangible assets, goodwill, investments in subsidiaries, associates, and joint ventures (carried at cost).

The standard also specifies when an entity should reverse an impairment loss.

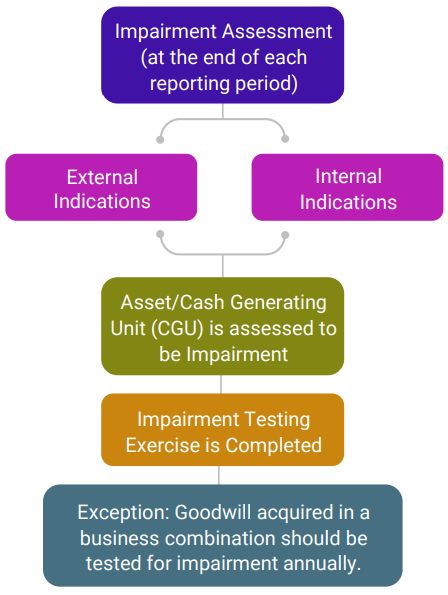

Valuation Trigger

In assessing whether there is any indication that an asset may be impaired, an entity shall consider, as a minimum, the following indications:

External Indications

- Decline in value significantly more than due to the passage of time or normal use.

- Adverse changes in the technological, market, economic, or legal environment in which the entity/asset operates.

- Changes in market rates used to calculate discount rate used.

- Carrying amount of the net assets of the entity is more than its market capitalization.

Internal Indications

- Obsolescence or physical damage of an asset.

- Economic performance of an asset is, or will be, worse than expected.

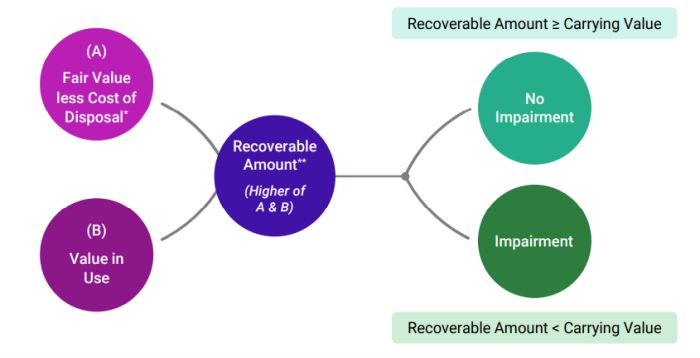

- Fair value less costs to sell is the arm's length sale price between knowledgeable willing parties less costs of disposal.

- The value in use of an asset is the expected future cash flows that the asset in its current condition will produce, discounted to present value using an appropriate discount rate.

*If fair value less costs of disposal cannot be determined, then recoverable amount is equal to value in use.

**For assets to be disposed off, recoverable amount is the fair value less costs of disposal

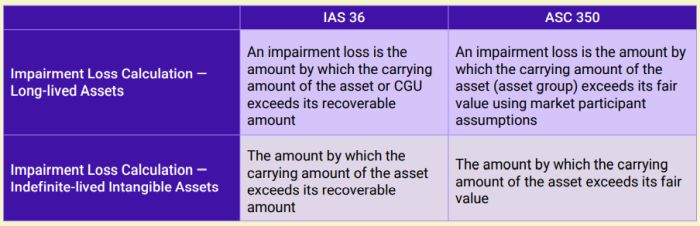

Differences between IAS & ASC

Note: This text does not cover all the differences between IAS 36 and ASC 350.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]