01

Review of accounting policies and financial statements to ensure they are aligned with the best practices.

02

Review Group structure. Assess whether any realignment or restructuring is required.

03

Review the applicability of tax laws and understand critical and high-impact areas for your business to prevent tax leakages and tax inefficiencies.

04

Understanding tax exemptions and incentives offered by UAE for companies located in Free Zone, small businesses, etc. as they can benefit your business.

05

Review accounting systems to ensure smooth tax compliance.

06

Examine all your related party transactions. This would include reviewing whether all agreements are in place, what is basis of charge, need for the charge, documentation available, etc.

07

Ensure tax positions are not contrary to tax positions adopted under VAT/Customs regime.

08

Employee Training. This is critical as they would be required to ensure compliance with the law and maintain appropriate records to be prepared for any future inquiry.

09

Stay updated on the various Clarifications and Notifications issued by Authorities to ensure correct preparation for Corporate Tax.

10

Seek professional help to facilitate proper compliance and appropriate guidance on tax planning, tax compliance, and other tax-related matters.

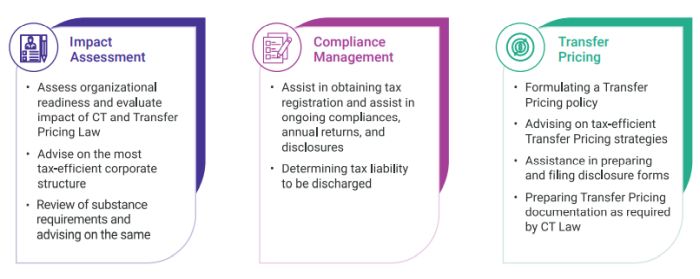

How we can help?

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.