The Organization for Economic Co-operation and Development (OECD) has played a key role over the last decade or so with the introduction of key tax policies and proposals, which have helped in shaping the global tax regime.

The OECD's Inclusive Framework for Base Erosion and Profit Shifting (BEPS) has evolved and introduced certain key proposals recently to address tax avoidance, tackle challenges associated with the digitalization of the economy, and ensure consistency of the international tax rules with the introduction of BEPS Pillar 1 and Pillar 2 amongst the many tax proposals introduced.

Following the global trend and observing the impact, many of the GCC countries have already committed to introducing BEPS recommendations in their respective domestic tax legislations.

The UAE introduced the Economic Substance Regulations (ESR) to restrict harmful tax practices, largely in line with the Action Plan 5 of the BEPS Project. ESR was launched on 30 April 2019 and was applicable for the accounting year starting on or after 1 January 2019.

Furthermore, the UAE Federal Tax Authority (FTA) released the final version of the UAE Corporate Tax (CT) law through Federal DecreeLaw No. 47 of 2022 on 9 December 2022. The law is largely based on the public consultation document issued earlier during the year 2022. The CT regime would be effective for the financial year starting on or after 1 June 2023.

ESR and its impact on entities in the UAE

The ESR was introduced to ensure that entities doing business in the UAE, pursuant to obtaining a trade license from the Authority (Licensee), meet the Economic Substance Test. ESR applies to all private/public shareholding companies, joint venture companies, partnership firms, etc. In other words, ESR is not applicable to individuals, sole proprietorships, trusts, or a foundation under its ambit.

Furthermore, there are certain categories of Licensee, such as (i) Investment Fund, (ii) a company that is a tax resident of a country outside the UAE (iii) a Licensee who is completely domiciled in the UAE (not part of an MNE Group and no cross border activities) (iv) branch of a foreign entity that is taxed outside the UAE who are exempt from the ESR subject to furnishing certain evidence.

The ESR has laid down a list of relevant activities/businesses wherein the Licensee who has undertaken the said activities needs to demonstrate and satisfy the Economic Substance Test as enunciated in the Regulations. In a nutshell, most of the business activities other than those entities engaged in undertaking manufacturing business fall under the ambit of ESR.

The Licensee undertaking the above Relevant activities needs to satisfy the following criteria to meet the Economic Substance Test:

- Conduct core income-generating activities in the UAE

- Licensee shall be directed and managed in the UAE

- To employ adequate number of qualified fulltime employees or adequate outsourcing expenditure incurred for a third-party service provider

- To possess adequate physical assets in the UAE

The ESR is in its third year and has evolved in terms of clarity as well as ensuring stringent compliance for the Licensee who has undertaken Relevant Activities.

The Regulatory Authorities have started issuing notices to Licensee's wherein the Regulatory Authorities are seeking additional information/clarification with respect to the ESR Notification and ESR Annual Report filed by the Licensee.

In lieu of the above, it is imperative that the MNCs be proactive and revisit their existing operational activities to mitigate/avoid the potential risk of non-compliance with the ESR.

Introduction of the Transfer Pricing Regime in the UAE

The introduction of the CT Regime in the UAE has led to the introduction of the Transfer Pricing (TP) rules and TP documentation requirements in the UAE. The TP law would apply to entities in the UAE Mainland as well as Free Zones. The effective date of the TP regime is the same as the CT law,i.e., the financial year starting on or after 1 June 2023.

The TP regime in the UAE applies to domesticrelated party transactions and cross-border transactions or arrangements.

The TP rules and documentation requirements are principally in line with the OECD TP guidelines. The TP law introduced provides guidance/details with respect to certain key TP principles as under:

i. Article 34 – The Arm's Length Principle

ii. Article 35 – Related Parties and Control

iii.Article 36 – Payments to Connected Persons

iv.Article 55 – Transfer Pricing Documentation

The Decree-Law has prescribed five Transfer Pricing Methods which are in line with the OECD TP guidelines to determine the arm's length result. The taxable person can choose to apply any other method if it is considered more appropriate to meet the arm's length standard.

Furthermore, while the concept of arm's length price has been introduced, the arm's length range has not been specified (i.e., the use of inter-quartile range, 35th to 65th percentile, minimum to maximum, etc.). Where the pricing in relation to the transaction or arrangement does not fall within the arm's length range, the Authorities can make a TP adjustment on the taxable income to achieve the arm's length result.

In a scenario where the Authorities decide to make a TP adjustment, the Authorities shall also make a corresponding adjustment to the taxable income of the related party.

The Decree-Law has also introduced documentation requirements which inter-alia include the following (i) Filing of a disclosure form, (ii) Prepare and Maintenance of both Master File and Local file (iii) Country by Country Reporting (CbCR) for large multinational groups effective 1 January 2019.

The documentation as mentioned above must be submitted to the Authorities within 30 days following a request by the Authorities or by any other later date as directed by the Authorities.

Furthermore, Article 18 of the Decree-Law encapsulates the conditions for an entity in the Free Zone to be categorized as a 'Qualifying Free Zone Person,' wherein one of the conditions is interlinked with Article 34 and 55 of the Decree-Law, i.e., for an entity in the Free Zone to be categorized as a 'Qualifying Free zone entity,' the said entity has to maintain adequate substance.

Also, under Article 36, the law seeks to ensure that the payments made by taxable persons to certain connected persons are not excessive and, as per market standards, and to determine market value, TP provisions should be applied.

Interplay between ESR and the TP Laws

To begin, UAE ESR and UAE TP aim to align the revenue/profitability of the business to actual economic activities. While UAE TP focuses only on transactions with related parties, UAE ESR covers situations where there are no related party transactions, but still, business is required to prove the economic substance.

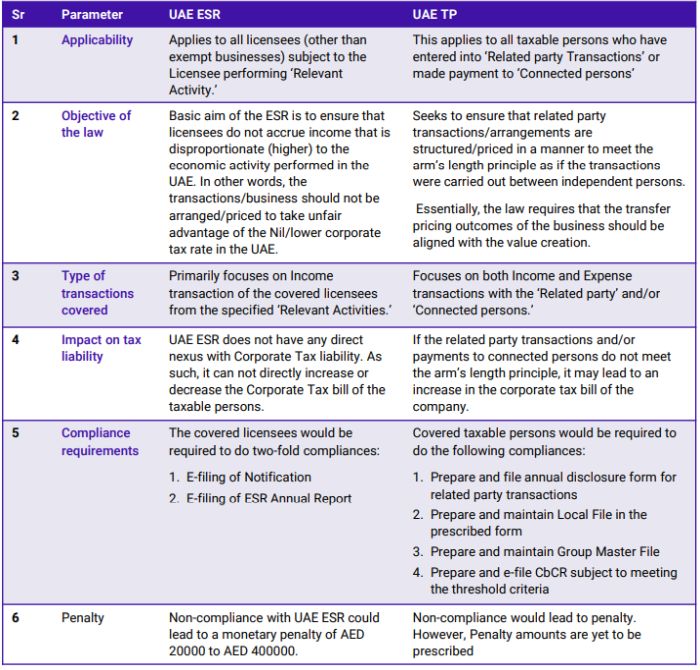

Below is a summary of certain key concepts in UAE ESR and UAE TP:

On a plain reading of the conditions required by a Licensee to demonstrate adequate substance under ESR regulations shows some interlinkage with the OECD TP Guidelines as well. This is because the Guidelines also address the complexity in inter-company arrangements by requiring an evaluation of their substance rather than relying on their form. Thus, one can say that under the CT regime, economic substance and TP are intertwined.

Concluding Remarks

UAE ESR was introduced to honor the commitment made by the UAE as a member of the OECD Inclusive Framework. As a member, UAE was required to introduce certain minimum standards and ESR originated from BEPS Action Plan 5 of the OECD project.

Notably, ESR was introduced when the CT regime did not exist in the UAE. In the absence of CT regime, the basic objective of the ESR was to ensure that the businesses have adequate economic substance that corresponds to the revenue accrued in the UAE.

On the other hand, under the recently introduced UAE CT regime, one of the conditions for an entity in a Free Zone to be categorized as a 'Qualifying Free Zone person' is to ensure that adequate substance is maintained. While there is no specific guidance as to what would construe as 'maintaining adequate substance,' however in the absence of specific guidance, recourse can be taken to the existing ESR regulations, which lays down the criteria to demonstrate adequate substance.

Furthermore, it is relevant to note that the definitions of related party/connected person under UAE ESR and UAE TP are different. UAE Corporate Tax regime focuses more on ownership and controlling power between the legal entities in order to regard them as related party/connected person. Whereas, the ESR law provides additional emphasis on the consolidation of financial statements of the related parties along with ownership and controlling power.

For example, if an individual, Mr. A, individually owns a 90% share in each company; Company ABC and Company PQR. This implies that the financial statement of Company ABC and PQR are not getting consolidated into a single entity.

In the above example, Company ABC and Company PQR would not be regarded as connected persons /related parties for the purpose of UAE ESR. However, according to UAE transfer pricing provisions Company ABC and Company PQR would be related as related parties. The transactions between Company ABC and PQR would have to meet the arm's length principle as given under UAE TP provisions.

All in all, both the substance test (covered under the ESR Law) and Arm's Length Principle (covered under UAE Corporate tax law) are important pillars of the overall tax landscape in the UAE.

Therefore, businesses in the UAE are advised to analyze the existing business model/operations to ensure that they fulfill the substance-related criteria and have an efficient TP policy in place that justifies the arm's length nature of all related party transactions and payments to connected persons.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.