GST return mismatches, a term that refers to the misalignment between the data provided by taxpayers in their Goods and Services Tax ('GST') return and the corresponding data filed by suppliers or recipients, are a crucial aspect of tax compliance. These mismatches, which can be seen as a verification of the correctness of any return, can lead to potential errors, discrepancies, or even tax evasion. They pose significant challenges for tax authorities in ensuring accurate tax collection and compliance. Resolving these mismatches involves a thorough reconciliation of GST invoices and transactions between the parties to rectify the discrepancies and ensure compliance with GST regulations as per the CGST Act, 2017 ('CGST Act') read with CGST Rules, 2017 ('CGST Rules').

Meaning of GST Returns

GST returns play a significant role in tax liability calculation. The term 'return' ordinarily means a statement of information (facts) furnished by the taxpayer to tax administrators at regular intervals. The information to be furnished generally consists of the details of sale price, turnover, or value; deductions and exemptions; and determination and discharge of a tax liability. The filing of returns allows the tax authorities to calculate the taxpayer's net tax liability. GST returns must be submitted periodically, typically monthly, quarterly, or annually, depending on the taxpayer's category and turnover. The key components of a GST return include information about the taxpayer's sales, purchases, output GST (tax collected on sales), and input GST (tax paid on purchases). The net tax liability is calculated as the difference between output GST and input GST. If output GST exceeds input GST, the business must pay the tax authorities the difference. If input GST exceeds output GST, the business may claim a refund or carry forward the credit.

In any tax law, filing of returns constitutes the most important compliance procedure, which enables the government to estimate the tax collection for a particular period and determine the correctness and completeness of taxpayers' tax compliance. Filing GST returns helps taxpayers estimate tax liability on a 'self-assessment' basis, deposit the tax amount, and file such returns.

Types of Mismatches in GST return

Turnover Mismatch

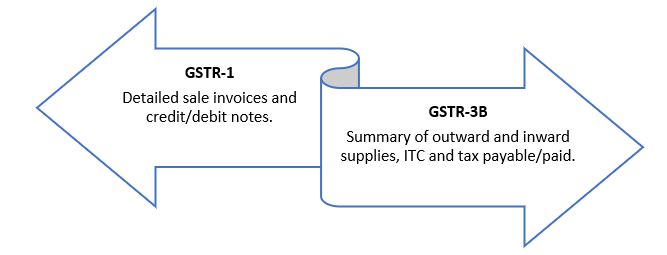

Turnover mismatch deals with the mismatch in turnover reported in GSTR-1 and GSTR-3B. If there is a difference in turnover in GSTR-1 and GSTR-3B, it would lead to a turnover mismatch.

The GST authorities regularly compare the turnover declared in GSTR-1 with the turnover declared in GSTR-3B. Discrepancies between these two forms trigger a mismatch alert.

This is a lighter form of mismatch, such as clerical errors, timing differences, or other minor issues that may be considered less severe.

For instance, XYZ is a private limited company registered under the GST. For the financial quarter, XYZ filed the following returns:

| GSTR-1 | GSTR-3B |

|---|---|

| Reported Sales: Rs. 28 lakhs | Reported Sales: Rs. 20 lakhs |

| Output GST Collected: Rs. 5.04 lakhs (@18%) | Output GST Paid: Rs. 3.60 lakhs |

Here, the sales turnover reported in GSTR-1 is Rs. 28,00,000, while in GSTR-3B, it is Rs. 20,00,000. Hence, there is a discrepancy of Rs. 8,00,000 in the turnover reported. This could be due to a typo error. Similarly, the output GST reported in GSTR-1 is Rs. 5.04 lakhs, but in GSTR-3B, it is Rs. 3.60 lakhs. There is a discrepancy of Rs. 1.44 lakhs in the GST paid.

Reasons for mismatches in GSTR-1 v. GSTR-3B (Not exhaustive)

- Misplacement of supplies within the reporting framework: Zero-rated supplies, duly recorded in Table 6A of the GSTR-1, might have inadvertently not been recorded under Table 3.1(a) in the GSTR-3B, thus needing rectification.

- Unreported Transactions: Some sale invoices might have been omitted in GSTR-1 but included in GSTR-3B, and vice versa. Adjustments through credit or debit notes might not have been consistently recorded in both returns. Failing to report nil-rated or exempted supplies in GSTR-1 while accounting for them in GSTR-3B could have caused mismatches.

- Reversal and reclaim of ITC: Reversal of ITC due to ineligibility might not have been accurately reflected in both returns. Reclaiming ITC after reversing it in a prior period without reflecting it in GSTR-3B could have led to discrepancies.

- Difference in Reporting Sales: Errors in categorizing sales as Business-to-business (B2B) or Business-to-consumer (B2C) could have led to discrepancies. Incorrect reporting of export sales, which are zero-rated, might have caused mismatches.

- Misattribution of taxes: Reporting Integrated Goods and Services Tax (IGST) instead of Central Goods and Services Tax (CGST) or State Goods and Services Tax (SGST) posed a notable concern.

- Clerical Errors: Typographical or data entry errors in the reporting process, such as mistakes in entering invoice details or totals, might have resulted in mismatches.

- Technical Issues: Problems with GST software might have resulted in incorrect data being reported. Technical glitches during the submission of returns might have led to incomplete data.

ITC Mismatch

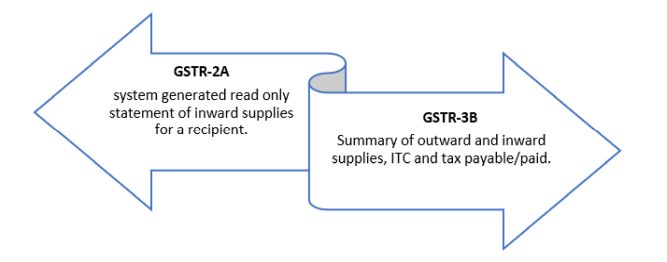

ITC mismatch occurs when there is a discrepancy between the ITC claimed by a taxpayer in their GSTR-3B return and does not match the details of the ITC available as per the auto-generated GSTR-2A form.

For instance, ABC Ltd. claims an ITC of Rs. 18,000/- in their GSTR-3B for April 2024. However, their supplier, XYZ Ltd, mistakenly reported the invoice for May 2024 instead of April. As a result, ABC Ltd.'s GSTR-2A for April does not reflect this credit, leading to an ITC mismatch.

Reasons for mismatch in GSTR-2A v. GSTR-3B

- Delayed Reporting: Suppliers might have delayed filing their GSTR-1, leading to a mismatch in the ITC available in GSTR-2A and what was claimed in GSTR-3B. However, such an issue is not considered to be very serious. In the case of M/s Bharat Aluminium Company Ltd. V. Union of India1, the Chhattisgarh High Court held that the ITC claimed by the petitioner could not be denied because the seller had not uploaded their invoices on time.

- Claiming ITC on Unreported or Ineligible Invoices: Recipients might have mistakenly or fraudulently claimed ITC on invoices not reported by the suppliers or ineligible invoices.

- Delay in claiming ITC within s. 16(4) of the CGST Act: For instance, ITC for goods and services received in FY 2020-21 but availed in FY 2021-22 could have caused mismatches.

- GST credit utilization under reverse charge mechanism: The recipient might have incorrectly reported or failed to report the GST paid under RCM in their GSTR-3B return. This could have led to discrepancies since the ITC claim might not have aligned with the details in GSTR-2A, which primarily reflects supplier-reported transactions.

- Transitional credit availed through TRAN-1 and TRAN-2 mechanisms:

-

- TRAN-1 (Transition form 1) is used by businesses to carry forward eligible ITCs from the pre-GST regime to the GST regime for inputs, semi-finished and finished goods in stock as of 30.06.2017.

- Dealers and traders use TRAN -2 (Transition form 2) to claim transitional credit for inputs held in stock as of 30.06.2017 when they do not have duty-paid invoices.

- § Errors or discrepancies in the details filled in TRAN-1 or TRAN-2 can lead to mismatches when the credits are carried forward and claimed in GSTR-3B.

- § The amount of transitional credit claimed in GSTR-3B must match the credit declared in TRAN-1/TRAN-2. Any discrepancy between these amounts will lead to mismatches.

- Credit/Debit notes not accounted for properly: The issue of an invoice in a particular month, followed by the issue of a debit/credit note at a later date, or failure to properly account for credit notes, leads to mismatches.

The issue of mismatch of GSTR-2A v. GSTR-3B is frequently seen and dealt with by the Hon'ble Courts, which have granted relief until and unless the discrepancy is fraudulent. In Suncraft Energy Pvt. Ltd. v. Assistant Commissioner, State tax, Ballygunge Charge2, the Calcutta High Court ruled that in the GST regime, an assessee could not be denied ITC due to discrepancies between GSTR-2A and GSTR-3B.

In the case of Makhan Lal Sarkar and Sons and another v. Assistant Commissioner of Revenue, State Tax3, the Calcutta High Court held that there were no reasons for disallowing the claim for ITC on the grounds of a mismatch in Form GSTR-3B and GSTR-2A when the suppliers had not mentioned the GSTIN number of the petitioner in the invoice.

Late Filing Interest Mismatch

Late fees are applicable for delays in furnishing returns as per the provisions of s. 50 of the CGST Act after the due date, i.e., the 20th of every month for filing GSTR-3B. If the GST dues are not paid within the due date, interest at 18% p.a. is payable on the amount of outstanding tax to be paid for the delayed payment. This can lead to a mismatch in the calculated interest.

Note: The late fee is paid in cash separately for CGST and SGST in separate electronic cash ledgers. GST returns cannot be filed without paying the late fee. The time period will be from the next day of filing of return till the date of actual tax payment.

For instance, a taxpayer fails to make a tax payment of Rs. 20,000 for the month of March 2024, where the due date was 20th March 2024. If the payment is made on 20th April 2024, the interest for the 31-day delay (from 21st March to 20th April) will be calculated as follows: - Rs. 20000*31/365*18% = Rs. 306/-

Reasons for mismatch in Late filing interest

- Incorrect Calculation: The taxpayer might have miscalculated the number of days for which the interest is applicable.

- Payment Date Discrepancies: The date the payment is considered can differ if there are banking delays or procedural errors.

- System Errors: Differences between manual calculation and system-generated interest could cause discrepancies.

Differential Tax Mismatch

Differential tax mismatches refer to the discrepancies that arise between the tax liability declared by the taxpayer in their GST returns and the tax liability assessed by the GST authorities or reflected in the records of the suppliers/recipients.

Reasons for differential tax mismatch

- Incorrect classification of Goods/Services: This can lead to the wrong application of tax rates. If proper classification procedures are not followed correctly, it can result in mismatches.

- Incorrect Application of Tax Rates: Frequent changes or updates to tax rates via notifications can also lead to errors if not properly accounted for.

- Mismatch in ITC claims: Discrepancies often arise if the recipient claims ITC but the supplier fails to report or pay the corresponding tax.

- Non-matching of GSTR-2A and GSTR-3B: Filing returns by the supplier (GSTR-1) and matching with the returns filed by the recipient (GSTR-3B).

- Errors in Reporting Turnover: Errors in reporting turnover in monthly or annual returns can lead to mismatches.

- Inconsistencies in Tax Payment: Payment of tax, interest, penalty, and other amounts. Any discrepancies in tax payment records or delayed payments can cause mismatches.

GSTR 2A Mismatch

GSTR-2A of a taxpayer (trader) shows inward supplies at a particular tax rate, but no outward supplies appear at the same tax rate. In such a case, the ITC pertaining to those invoices not uploaded or delayed will not appear in GSTR-2A of the relevant tax period.

Reasons for mismatch in GSTR-2A

- Credit claimed for ineligible ITC: Claiming ITC for Goods/Services that are ineligible under the CGST Act, such as personal expenses or blocked credit, which is under s. 17(5) of the CGST Act will not match the eligible credits in GSTR-2A.

- Supplier's Non-filing or Delayed Filing of GSTR-1: If the supplier fails to file or delays filing their GSTR-1, the details of the purchase made by the recipient will not appear in GSTR-2A timely, leading to a mismatch.

- Time Gap in Reporting: Suppliers might report transactions in tax periods different from the recipient, leading to timing mismatches. For example, if the supplier reports an invoice at a later month, it will not reflect in the GSTR-2A for the earlier period.

- Incorrect or Incomplete Reporting by Supplier: Errors or omissions by the supplier while reporting details in GSTR-1 can result in incorrect or incomplete data being reflected in GSTR-2A.

- ITC claimed on Provisional Basis: If the recipient claims ITC on a provisional basis without matching it with GSTR-2A, there could be discrepancies when the actual data is populated.

Other Possible Mismatches in GST Returns

- Mismatch/excess availment of ITC as per GSTR-2A (an auto-populated form that captures the details of inward supplies) and Table 8A of GSTR-9 (part of the annual return that consolidates the data from GSTR-2A for the entire financial year).

- Mismatch in tax liability as per GSTR-1 (details of outward supplies) and GSTR-9 (annual return form mandated by the GST regime in India, which registered taxpayers must file).

Legal impact and tax implications

A. Legal impact

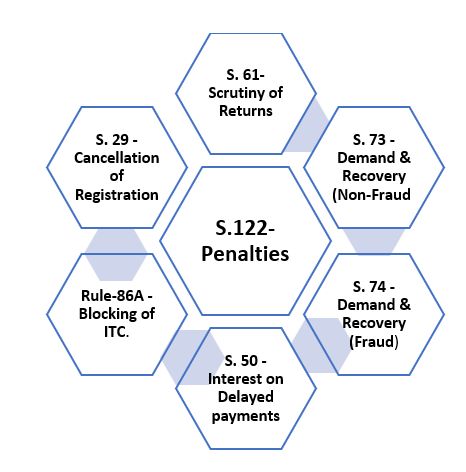

- Notices and Scrutiny: S. 61 of the CGST Act empowers tax authorities to scrutinize the GST returns. If discrepancies are found, taxpayers may receive notices to explain or rectify the mismatches. Non-compliance with these notices can lead to further legal action and penalties.

- Demand and recovery proceedings: Ss. 73 and 74 of the CGST Act provide for the determination of tax not paid or short paid, erroneously refunded, or ITC wrongly availed or utilized.

- Penalties and Interest: S. 50 of the CGST Act imposes interest on delayed payment of tax, which can accumulate if mismatches lead to unpaid or underpaid taxes.

- Blocking of ITC: Under r. 86A under CGST Rules, tax authorities can block the utilization of ITC if they believe it has been availed fraudulently, leading to a temporary halt in the usage of ITC.

- Cancellation of Registration: Persistent mismatches and non-compliance with GST provisions can lead to the cancellation of GST registration under s. 29 of the CGST Act.

B. Tax Implications

- Denial of ITC: Discrepancies between the ITC claimed by the taxpayer and the details available in GSTR-2A can lead to the denial or reversal of the ITC. This can significantly impact the cash flow of businesses, as they may need to pay additional taxes out of pocket.

- Increased Tax liability: Mismatches can lead to additional tax liabilities, as discrepancies need to be rectified by paying the correct amount of tax along with interest.

- Compliance Costs: Regular reconciliation and resolution of mismatches involve additional compliance costs.

Remedies available

- Regular Reconciliation: Regularly compare GSTR-3B with GSTR-1 and GSTR-2A. Identify and correct discrepancies on a monthly basis to avoid accumulation of errors. Ensure invoices match with recorded transactions and tax amounts.

- Timely Amendments: Use subsequent returns to correct errors identified in earlier filings. Ensure amendments are made within the permissible time frame specified by GST law. Collaborate to ensure their records are also updated to prevent future mismatches.

- Auditor Assistance: Hire experienced GST auditors to conduct periodic audits. Conduct internal audits before filing annual returns. Regularly update internal teams on GST compliance requirements.

- Rectification of Returns: S. 39 of the CGST Act allows taxpayers to rectify any errors or omissions in the return filed for a particular tax period. The rectification can be made in subsequent returns before the due date for filing returns for the month of September following the end of the financial year or the actual date of furnishing the relevant annual return, whichever is earlier.

- Credit/Debit Notes: S. 34 of the CGST Act provides for issuing credit notes and debit notes to rectify mismatches related to the value of supplies, tax charged, or goods returned. This helps in correct reporting on subsequent returns.

- Annual Reconciliation: Conduct annual reconciliation before filing the annual return (GSTR-9) and audit report (GSTR-9C) as per s. 44 of the CGST Act. This helps identify and rectify any discrepancies that might have been overlooked during monthly filings.

- Utilization of Rectification Window: R. 59(3) under CGST Rules allows rectification of errors in the details of outward supplies furnished in GSTR-1.

- Voluntary Disclosure: Utilize the voluntary disclosure scheme under s. 73(5) of the CGST Act requires paying any tax dues with interest before issuing a show cause notice to avoid penalties.

- Regular Communication with GST authorities: Engage with GST authorities to resolve any disputes or issues promptly and provide complete and accurate information to authorities. Respond to GST notices and queries in a timely manner.

- Continuous Monitoring and Review: Schedule regular compliance reviews to monitor adherence to GST laws. Regularly update internal GST policies and procedures to reflect legal changes.

- Other remedies:

-

- R. 88C and Form DRC-01B, which have been inserted vide GST notification No. 26/2022-Central Tax, dated 26.12.2022, provide the mechanism for dealing with the difference in liability reported in the statement of outward supplies between GSTR-1 and GSTR-3B. Accordingly, where the tax liability as per Form GSTR-1 for a tax period exceeds the tax liability as per Form GSTR-3B for that tax period by more than a specified extent, the registered person would be intimated on the portal of such difference and be directed to either (i) pay the differential tax liability along with interest, or (ii) explain the difference, within 7 days period.

- SMS reminders are sent on the due dates of every month to the authorized signatories of firms to gently remind them of the upcoming due date for filing the summary return GSTR-3B.

- If there is a mismatch in tax liability declared in GSTR-3B and GSTR-1 or in the ITC claimed in GSTR-3B and GSTR-2, a comparison of this is visible on the GST dashboard to induce the taxpayer to correct it and avoid future litigation.

- At the time of filing an Annual return in Form GSTR-9, a reconciliation of outward supplies is done to ensure that the details disclosed in GSTR-1 and GSTR-3B should tally.

- Keep proper documentation of the reconciliation process with the suppliers/customers. This documentation will be helpful in case of any future audits.

Compliance

Complying with GST return mismatches regulation is crucial for several reasons:

- Timely compliance helps avoid financial burdens like penalties, interest, etc.

- Compliance helps avoid disruptions in business operations due to blocked ITC, increased tax liabilities or other legal issues.

- Ensuring compliance helps to avoid legal actions, such as scrutiny, audits, or demand notices from tax authorities.

Authorized officers of the GST authority can initiate action against taxpayers for discrepancies and non-compliance.

Evaluation

GST return mismatches are evaluated by comparing the details furnished in various GST returns filed by taxpayers and their suppliers or recipients. This typically involves reconciling the taxpayer's GSTR-3B with GSTR-2A and GSTR-1. Discrepancies are identified by examining differences in invoice details, taxable values, tax amounts, and ITC claims. The GST authorities use data analytics and automated systems to flag inconsistencies, issuing notices for explanations, corrections, or additional tax payments. Proper evaluation ensures that the taxpayer's filings are accurate, compliant and reflective of actual and true transactions.

Our Analysis

Analysing GST return mismatches involves identifying the root causes of discrepancies and understanding their implications on tax liability and compliance status. Common reasons include data entry errors, timing differences in reporting, and non-compliance by suppliers. The focus should be on the frequency and magnitude of mismatches, their impact on ITC claims, and potential legal consequences such as interest, penalties or audits. Identifying and analysing mismatches involves regular reconciliation practices, detailed transaction analysis, and trend analysis to pinpoint recurring errors. Remedies and best practices to address mismatches include regular and automated reconciliation, timely amendments within permissible timelines, engaging professional auditors for periodic reviews and pre-audit checks, efficient record-keeping with a preference for digital solutions, and continuous monitoring and review of compliance policies. Case studies, such as those involving retail companies and manufacturing firms, highlight practical approaches to resolve mismatches and emphasize the importance of proactive compliance measures. By adopting these practices, businesses can mitigate the risks associated with GST return mismatches and ensure smoother operations and compliance with GST regulations. Through detailed examination, businesses can implement corrective measures and improve internal controls and timely communication with suppliers to prevent future mismatches, thus maintaining smooth GST compliance and avoiding financial and legal repercussions.

Footnotes

1. WPT No. 94 of 2021

2. 2023 SCC OnLine Cal 2226

3. 2023 SCC OnLine Cal 4230

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.