This article delves into the critical role of the Financial Intelligence Unit-India under the Prevention of Money Laundering Act, 2022. It highlights how FIU-IND enhances India's Anti-Money Laundering capabilities through stringent compliance, data analysis, and international cooperation, ensuring the integrity of the financial system. Explore how FIU-IND's enforcement of PMLA standards safeguards against financial crimes, aligning domestic efforts with global anti-money laundering regulations.

I. Introduction

The Prevention of Money Laundering Act ('PMLA'), enacted in 2002 and brought into effect on 01.07.2005, is a landmark legislation fighting money laundering in India. The primary objective of PMLA is to prevent and control money laundering activities. The statute also provides for confiscating and seizing property derived from or arising from money laundering activities. The PMLA represents a comprehensive and evolving framework to combat money laundering in India. Through its amendments and establishment of specialized agencies like the Financial Intelligence Unit-India ('FIU-IND'), it has strengthened enforcement mechanisms and aligned India's Anti-Money Laundering ('AML') measures with global standards.

Under PMLA, FIU-IND was established on 18.11.2004. The body is now responsible for receiving, analysing, and disseminating financial intelligence to combat money laundering and terror financing.

This insight focuses on the exalted role and profound responsibilities entrusted upon the FIU-IND, delving deep into its pivotal duties, authoritative powers, and consequential impact within the realm of financial governance and integrity.

II. The Evolution of PMLA and FIU-IND

Before proceeding, it is essential to understand money laundering, as FIU-IND's primary objective is to detect transactions involving such activities. Money laundering, as defined under the PMLA, involves any individual who directly or indirectly engages in or assists with any process or activity related to the proceeds of crime, such as concealment, possession, acquisition, use, or presenting it as untainted property.1 The proceeds of crime include property derived or obtained from the commission of (i) a scheduled offense and/or (ii) direct or indirect criminal activity related to a scheduled offense, whether within the country or abroad.2 If a person commits a scheduled offense and is involved in handling the resulting property, they are guilty of money laundering.3

Prior to the enactment of PMLA, India addressed the issue of money laundering primarily through the Indian Penal Code ('IPC'), inter alia, and certain other related statutes. However, their inadequacy in dealing with fast-advancing and evolving financial crimes paved the way for a dedicated legal framework governing money laundering, thus giving rise to PMLA.

The PMLA was amended in 2005, shortly after its enactment, to include the following two key changes:

i. The 'predicate offenses' concept targeted the underlying criminal activities generating illicit proceeds. This also expanded the scope of money laundering provisions, facilitating the more effective prosecution.

ii. FIU-IND was established as a centralized body to facilitate information exchange among regulatory authorities, law enforcement agencies, and financial institutions. It is also tasked with receiving, analysing, and disseminating financial intelligence to combat money laundering and terrorism financing.

In 2009, significant amendments expanded the scope of money laundering offenses, including stringent penalties, imprisonment, and fines. However, the 2009 amendment enhanced financial institutions' reporting obligations while also providing for the confiscation and forfeiture of illicit funds and reinforcing enforcement mechanisms.

The PMLA has evolved through various amendments and extensive judicial scrutiny, with the Supreme Court and High Courts clarifying various aspects. Further, India's Financial Action Task Force ('FATF') membership and adherence to its recommendations have strengthened the AML regime, facilitated international cooperation, and mandated financial entities to verify client identities, maintain records, and report to FIU-IND.

III. FIU-IND: Guardian of Financial Integrity and Its Key Functions

FIU-IND serves several critical functions in combating money laundering and terrorist financing. It collects Cash Transaction Reports ('CTRs'), Non-Profit Organisation Transaction Reports ('NTRs'), Cross Border Wire Transfer Reports ('CBWTRs'), Reports on the Purchase or Sale of Immovable Property ('IPRs'), and Suspicious Transaction Reports ('STRs'). FIU-IND meticulously analyses these transactions to detect patterns indicative of money laundering activities. The unit shares financial intelligence with national and international agencies, enhancing global efforts against financial crimes. As a central repository, FIU-IND maintains a comprehensive national database based on the reports received.

It also coordinates the strengthening of financial intelligence collection and sharing networks. Additionally, FIU-IND continuously conducts research and analysis to monitor trends and typologies in money laundering and can thus proactively combat evolving financial threats. FIU-IND's team, consisting of 75 personnel, includes officers from the Central Board of Direct Taxes ('CBDT'), Central Board of Excise and Customs ('CBEC'), Reserve Bank of India ('RBI'), Securities and Exchange Board of India ('SEBI'), Department of Legal Affairs, and several other intelligence agencies.

IV. FIU-IND's Essential Role in Ensuring Financial Integrity

Chapter IV of the PMLA provides a procedure for ensuring reporting entities' compliance with the AML regime.

Reporting entities, as per the s. 2(wa) of the PMLA is defined as a banking company, financial institution, intermediary, or a person carrying on a designated business or profession. Subsequently, the Ministry of Finance notified changes to the PMLA 2002, widening its lens to include several transactions facilitated by professionals vide notification dated 03.05.sup>4

. Through the aforementioned notification, Chartered Accountants ('CAs'), Company Secretaries ('CSs'), and Cost and Works Accountants ('CMAs') were also designated as reporting entities under the Act. However, the professional would only be designated as a reporting entity if and when they engage in specific financial transactions such as buying and selling property, managing client money or assets, handling bank accounts, organizing contributions for business management, and creating or managing business entities, on behalf of their clients. Merely providing professional services without any element of a financial transaction being involved, the aforementioned professionals would not qualify as reporting entities under the Act.

Further, in Paypal Payments Private Limited v. FIU-IND5, the Delhi High Court has ruled financial technology companies ('Fintechs') to be 'reporting entities' under PMLA by broadly interpreting the same. FIU-IND classified PayPal as a 'Payment Service Operator' ('PSO'), and even though PayPal contended that it was an Online Payment Gateway Provider and was not directly handling funds, it was to be registered as a reporting entity under the PMLA. The High Court ruled that the PMLA's definition of PSOs should be broad and include any entity facilitating fund transfers, thus enabling FIU-IND to scrutinize transaction data comprehensively. Though the High Court dismissed the penalty imposed on PayPal, it extended the scope of reporting entities to include Fintechs.

SEBI also issued new guidelines on 06.06.2024, as per which SEBI-registered intermediaries have been mandated to implement a three-step verification process, as per which the intermediaries have to (i) identify their clients, (ii) verify their identity using reliable and independent sources, and (iii) obtain information on the purpose and intended nature of their business relationship. The new guidelines issued by SEBI also mandate that intermediaries understand the nature of the business conducted by their clients as part of the Client Due Diligence ('CDD') process.6

Elaborating upon the statutory provisions, Chapter IV of PMLA is briefly summarised herein below: -

|

Section |

Description |

|

S. 11A |

Verification of Identity by reporting entity The section mandates that reporting entities verify the identity of their clients and beneficial owners through Aadhaar authentication or verification of other government-notified modes of identification. The reporting entities must also ensure that the clients respect their choice of identification method and are not denied services due to a lack of Aadhaar. |

|

S. 12 |

Reporting entity to maintain records As per this section, reporting entities are required to maintain comprehensive transaction records, including client identity verification documents, up until five years after the business relationship ends. |

|

S. 12A |

Access to information This section empowers the Director of FIU-IND to request records and additional information from reporting entities. The reporting entities must comply promptly while maintaining the confidentiality of the requested data. |

|

S. 13 |

Powers of Director to impose fine This section grants FIU-IND significant investigative powers, allowing it to initiate investigations, issue warnings, give compliance instructions, or impose monetary penalties (Rs. 10,000 to Rs. 100,000 per violation) in case of non-compliance. |

|

S. 14 |

No civil/criminal proceedings against reporting entities This section protects reporting entities and their staff against civil or criminal liability for providing confidential information as required under s. 12(1)(b) of the PMLA. |

FIU-IND is authorized to summon individuals, enforce their attendance, compel the production of records, and receive evidence. Its powers are akin to those of a Civil Court under the Code of Civil Procedure, 1908, thus enabling FIU-IND to conduct thorough examinations to uphold compliance with PMLA.7

In any instances of non-compliance, FIU-IND can issue warnings, direct specific compliance actions, require periodic compliance reports, or impose monetary penalties, as provided for under s. 13 of the Act. Moreover, suppose a penalty is not paid within six months. In that case, the Director or an authorized officer is empowered to recover the amount as per Schedule II of the Income-tax Act, 1961('IT Act'), thus exercising the powers of a Tax Recovery Officer.8 However, it is pertinent to note that in addition to the monetary penalty, s. 13 also provides for certain other measures, which are (i) issuing a written warning, (ii) directing compliance with specific instructions, and (iii) requiring periodic reports on compliance measures. Each measure is mutually exclusive, i.e., only one of the aforementioned three methods can be imposed at a particular time.

In the case of Kotak Mahindra Bank v. FIU-IND9, the penalty FIU-IND imposed on the bank subsequent to the issuance of a written warning was set aside by the Appellate Tribunal on the ground that once a warning was issued under s. 13, no other penalty, including monetary penalty, could have been imposed under s.13 of the PMLA.

Further, reporting entities are aggrieved by any order passed by the Director under s. 13(2) of the PMLA can appeal to the Appellate Tribunal under s. 26 of the PMLA. It is, however, pertinent to note that the civil courts are, under s. 41 of the PMLA, barred from entertaining suits or proceedings concerning matters determined by the Director, Adjudicating Authority, or Appellate Tribunal under the PMLA. Further, the civil courts are not authorized to grant injunctions against actions taken under the PMLA.

The comprehensive procedural framework with which FIU-IND has been established ensures its structured and effective functioning, thus enabling FIU-IND to fulfill its mandate with precision and accountability.

A recent example is that the FIU-IND, under the authority granted by s. 13(2)(d) of the PMLA, imposed a monetary penalty of Rs. 5,49,00,000/—on Paytm Payments Bank Ltd. for violating its obligations under the Prevention of Money Laundering (Maintenance of Records) Rules, 2005 ('PML Rules') and applicable guidelines and advisories issued by the Director FIU-IND thereof.

The PML Rules outline compliance frameworks for reporting entities like banking companies and financial institutions. In alignment with and furtherance of the PMLA provisions, the PML Rules mandate the maintenance of transaction records, client identity documents, and business correspondence for a minimum of five years. FIU-IND oversees enforcement and ensures adherence to these rules through investigations and penalties.

V. PML Rules for Reporting Entities and Oversight by FIU-IND

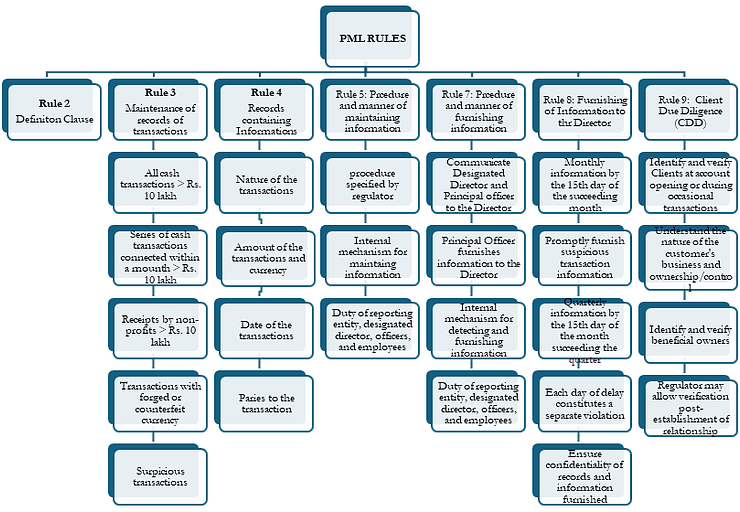

While r. 3 of the PML Rulesenlists the transactions whose records are to be maintained, r. 5, 7, and 8 of the PML Rulesprescribe the procedure, manner, and time of maintaining and furnishing such information, and r. 9 of the PML Rulesprescribes the procedure and manner of verifying the records pertaining to clients' identities.

Specific records, as mandated by r. 3 of the PML Rules include cash transactions over Rs. 10 lakhs, a series of connected transactions aggregating over Rs. 10 lakhs within a month, transactions involving receipts by non-profits over Rs. 10 lakhs, transactions with counterfeit currency, suspicious transactions, cross-border wire transfers over Rs. 5 lakhs, and purchases and sales of immovable property valued at Rs. 50 lakh or more.

Suspicious transactions, defined under r. 2 of the PML Rules, encompass transactions suspected to involve proceeds of crimes, those of unusual or unjustified complexity, transactions lacking economic rationale or bona fide purpose, and those suspected to involve terrorism financing or links to terrorist activities. Further, r. 4 prescribes that records mandated by r. 3 must include transaction nature, currency amount, transaction date, and detailed party information to facilitate reconstruction.

Further, the records, whether maintained in books, stored electronically, or in any prescribed form, must be retained for five years from the date of the transaction or five years post the termination of the business relationship.10 FIU-IND requires that information be furnished online in a prescribed format through its portal, with designated directors and principal officers of reporting entities responsible for submitting this information.11

Additionally, timely reporting is also crucial under the PML Rules. Cash and other specified transactions must be reported by the fifteenth day of the succeeding month, while suspicious transactions within seven working days of determining suspicion.12 Moreover, the reporting entities must implement a CDD program and verify client identities using officially valid documents such as passports, driving licenses, Aadhaar, Voter IDs, NREGA job cards, and documents issued by the National Population Register. For CDD, reporting entities must collect specific documents based on the type of client, such as certificates of incorporation and board resolutions for companies, partnership deeds, PAN for partnership firms, and trust deeds for trusts. Identifying and verifying beneficial owners, who ultimately own or control clients or exercise effective control over a juridical person is also essential.13

This comprehensive explanation delineates FIU-IND's pivotal role in enforcing the PMLA, outlining reporting entities' obligations, the procedural requirements for compliance, the imposition of penalties, and the enforcement mechanisms as per the PML Rules.

VI. FIU-IND's Global Collaboration: Strengthening International Partnerships

FIU-IND has also strengthened its global cooperation to further its objective of combating money laundering and terrorist financing. For instance, FIU-IND's alignment with FATF standards is pivotal in combating money laundering and terrorist financing globally. FIU-IND's adherence to these international standards plays a crucial role in enhancing cooperation and trust among member countries. This alignment strengthens FIU-IND's operational framework and ensures its effective contribution to global efforts against financial crimes, bolstering India's position in international AML initiatives.

FIU-IND's participation in the Egmont Group, a network of 177 FIUs, and its membership in the Asia/Pacific Group on Money Laundering ('APGML') and the Eurasian Group on Combating Money Laundering and Financing of Terrorism ('EAG') enhance India's capacity to combat financial crimes globally and more effectively.

Overall, FIU-IND has been a formidable instrument in curbing money laundering transactions. Its recent imposition of Rs. 18.82 crore penalty on Binance Holdings Pvt. Ltd serves as a significant precedent for other reporting entities, compelling strict adherence to the requirements of the PMLA and associated rules, notably the PML Rules.

VII. Conclusion

FIU-IND plays a pivotal role in enforcing the PMLA, thereby providing a robust framework to combat money laundering and terrorist financing. It is responsible for collecting and analysing various financial transaction reports, maintaining a central repository of financial intelligence, and facilitating information sharing with national and international agencies. As mandated by the PMLA and its associated rules, the stringent compliance and reporting requirements ensure that reporting entities uphold high standards of due diligence and record-keeping. Through its investigative powers and authority to impose penalties, FIU-IND ensures adherence to these standards, thereby fortifying India's AML regime. The comprehensive provisions of the PMLA, supported by the detailed compliance framework outlined in the PML Rules, highlight the critical role of FIU-IND in safeguarding the financial system against illicit activities. This framework enhances national security and aligns India's measures with global standards, reinforcing international cooperation in the fight against money laundering and terrorism financing.

Footnotes

1 s. 2(p) and s. 3, PMLA.

2 s. 2(u), PMLA.

3 s. 2(y), PMLA.

4 Notification no. S.O. 2036(E). dated 03.05.2023.

5 W.P.(C) 138/2021 & CM APPL. 421/2021 (Interim Relief), CM APPL. 37179/2022.

6 Master Circular, SEBI/HO/MIRSD/MIRSDSECFATF/P/CIR/2024/78, dated 06.06.2024.

7 s. 50, PMLA.

8 s. 69, PMLA.

9 2017 SCC ONLINE ATPMLA 10.

10 s. 12(3), PMLA.

11 r. 7, PML Rules.

12 r. 8, PML Rules.

13 r.9, PML Rules.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.