Introduction

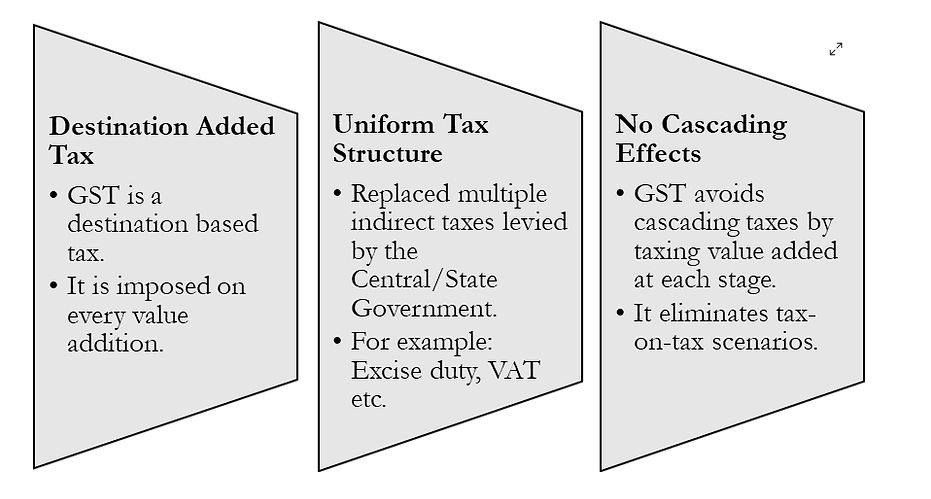

The goods and service tax ('GST') is a comprehensive, multi-stage, destination-based tax levied on every value addition throughout the economic supply chain. It consolidates various indirect taxes previously imposed by central and state governments, such as excise duty, service tax, and value-added tax ('VAT'), into aunified system. This unification simplifies the tax structure and eases compliance for businesses. GST is imposed at each stage of the production and distribution process—from the manufacturer to the consumer—ensuring that tax is collected at every point of sale. As a destination-based tax, GST is applied where goods or services are consumed rather than where they are produced. This approach helps eliminate the cascading effect of taxes, leading to a more transparent and efficient tax system.

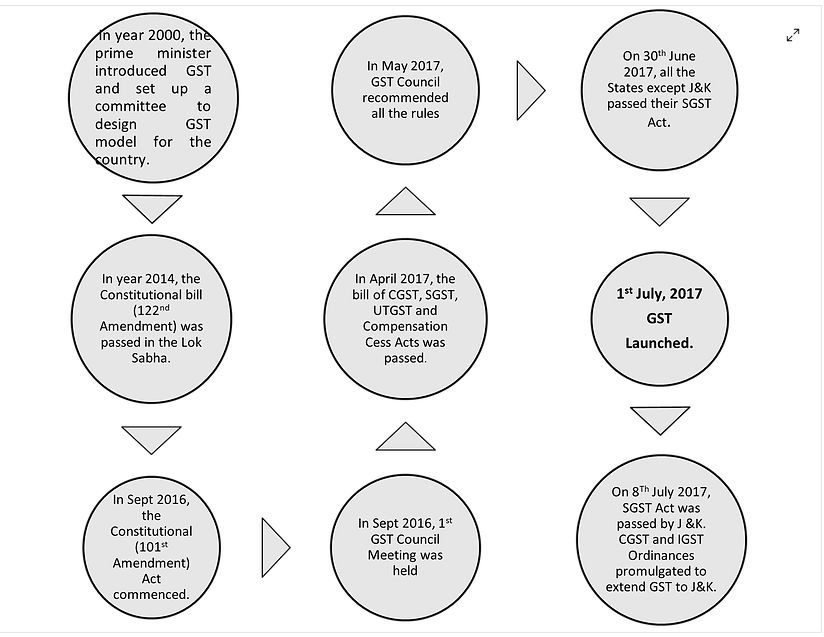

Unveiling the History and Background of GST

Key Objectives of GST

Overview of the Electronic (E) Commerce Sector

The e-commerce sector, a digital marketplace where goods and services are bought and sold via the internet or computer-mediated networks, has witnessed a meteoric rise over the past decade. Technological advancements, increased internet penetration, and evolving consumer behaviour fueled this growth. The global e-commerce market has soared to several trillion dollars, with North America, Europe, and the rapidly expanding Asia-Pacific region leading the charge. Global giants like Amazon, Alibaba, and eBay, along with regional leaders like Flipkart in India and Rakuten in Japan, dominate this landscape, offering a wide range of products, competitive pricing, and efficient delivery services. India, in particular, stands out as one of the world's largest and fastest-growing e-commerce markets, brimming with potential for further growth and innovation.

Understanding the Impact of GST on the E-commerce Sector

The purpose of the GST law is to levy GST on every transaction of supply of goods or services, as elucidated in the text of the Constitutional (One Hundred and First) Amendment Act, 2016 ('Constitutional Amendment Act of 2016'). To tax is the rule, and exemptions are to be kept to a bare minimum. One of the stated objectives of introducing GST in India is to comprehensively tax all supplies of goods and services so that the tax burden does not fall only on a few suppliers of goods and services.

Understanding the GST's implications in the e-commerce sector is essential for ensuring compliance and achieving operational efficiency. GST, as a unified tax regime, supersedes a multitude of indirect taxes, thereby streamlining the tax structure and mitigating complexities for e-commerce entities operating across diverse jurisdictions.

GST amalgamates various indirect taxes previously imposed by the central and State Governments, such as excise duty, service tax, and VAT. This consolidation simplifies the tax framework, which benefits e-commerce businesses by reducing burdens and compliance costs.

Under the GST regime, e-commerce operators are mandated to collect tax at source ('TCS'). This provision requires operators to deduct a percentage of the transaction value and remit it to the government. TCS ensures that the tax on the supply of goods and services through e-commerce platforms is collected upfront, enhancing tax compliance and revenue collection.

The GST regime allows businesses to claim input tax credit ('ITC') on taxes paid for inputs used in producing goods or services. For e-commerce operators, ITC is pivotal in reducing the overall tax.

GST Framework for E-commerce

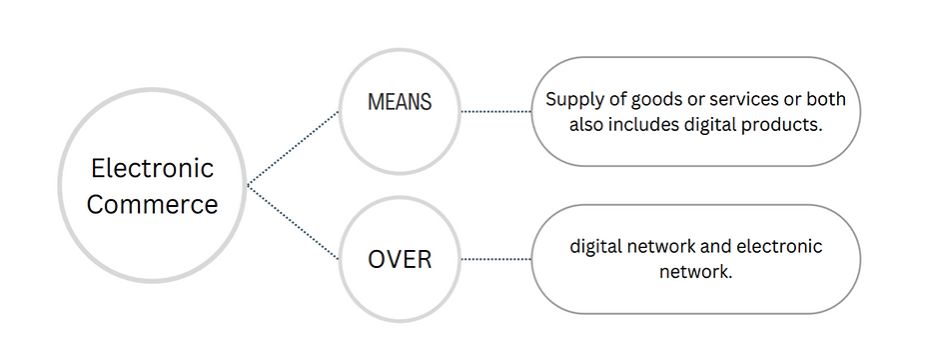

S. 2(44) of the Central Goods and Services Act, 2017 ('CGST Act') defines electronic commerce as: "electronic commerce means the supply of goods or services or both, including digital products over digital or electronic network."

E-commerce Operators

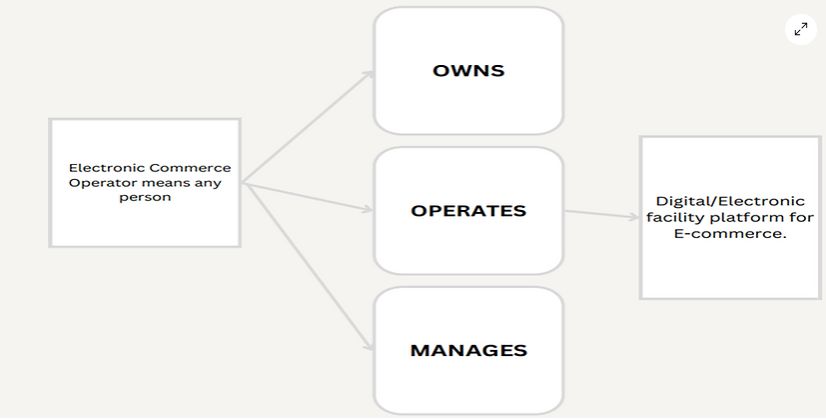

S. 2(45) of the CGST Act defines an electronic commerce operator ('ECO') as any person who owns, operates, or manages adigital or electronic facility or platform for electronic commerce.

In simpler words, an ECO is a person who owns, runs, or manages a digital or online platform for buying and selling goods and services. Some platforms are online marketplaces, travel agencies, food delivery platforms, ride-hailing apps, and others that connect buyers and sellers.

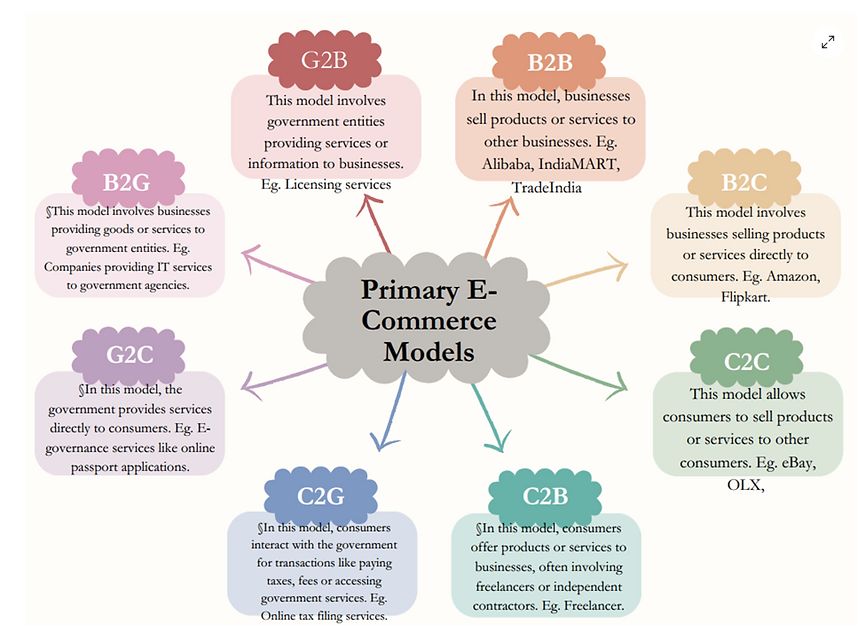

E-commerce involves several business models, each catering to different types of transactions and interactions between buyers and sellers. Here are the primary e-commerce models:

Applicability of GST on E-commerce Transactions

E-commerce transactions for the supply of goods, services, or both are subject to GST like other supply transactions unless they are specifically exemptfrom GST.

S. 9(5) of the CGST Act:

Levy and collection for ECOs: Under this section, the responsibility for paying GST is shifted from the service provider to the ECOs. It applies to the specified categories of services provided through an electronic commerce platform. The government notifies these servicesfrom time to time.

|

Provided that where an ECO does not have a physical presence in the taxable territory |

Any person representing such ECO for any purpose in the taxable territory shall be liable to pay tax. |

|

Further, it was provided that an ECO does not have a representative in the taxable territory if he does not have a physical presence there. |

Such ECO shall appoint a person in the taxable territory to pay tax, who shall be liable to pay tax. |

ECO is liable to collect and pay GST to the government rather than the actual service provider. For example, services such as passenger transportation by radio-taxi or motorcar, accommodation services provided by hotels, inns, and guest houses, except where the supplier is liable to be registered under GST, and housekeeping services such as plumbing, carpentering, etc., provided through electronic commerce operators.

The Government vide Notification No. 17/2017 CT(R) dated 28.06.2017/Notification No. 14/2017 IT (R) dated 28.06.2017 ('Notifications') as amended has notified the following categories of services supplied through ECO for this purpose:

-

Services by way of transportation of passengers by a radio-taxi, motocab, maxicab, motorcycle, omnibus or any other motor vehicle.

-

Services by way of providing accommodation in hotels, inns, guest houses, clubs, campsites or other commercial places meant for residential or lodging purposes, except where the person supplying such service through ECO is liable for registration under s. 22(1) of the CGST Act.

-

Services by way of housekeeping, such as plumbing, carpentering, etc, except where the person supplying such service through ECO is liable for registration under s. 22(1) of the CGST Act.

-

Supply of restaurant services other than those supplied by restaurants, eating joints, etc., located at specified premises (means Tariff above Rs. 7500 per unit per day or equivalent).

In a landmark case,Uber India Systems Private Limited v Union of India1, the petitioners challenged clauses (iii) and (iv) of Notification No. 16/2021- Central Tax (Rate) and Clauses 1(i) and 2(i) of Notification No. 17/2021 - Central Tax (Rate), both dated 18.11.2021 ('Impugned Notifications'), as ultra vires to the Constitution of India ('Constitution') and ss. 9(5) and 11 of the CGST Act. The background of this case was that the State issued a notification providing the rate of tax on the supply of services. Another notification relating to Central Tax (Rate) dated 28.06.2017 ('Parent Notification') was also issued by the which provided for unconditional exemption from payment of GST on the 'fare' to the individual autorickshaw driver, bus operator and the ECO irrespective of the mode of booking availed by the consumer, i.e., online/offline or offline agents. However, the impugned notification amended the earlier notification and withdrew the exemption to the ECOs granted vide the parent Notification for the services.

The Hon'ble Court dismissed the petitioners' submissions. It held that the impugned Notifications are not violative of a. 14 of the Constitution, fulfill the test of 'reasonable classification', and are not ultra vires of the Act of 2017.

Registration under GST

S. 22(1) of the CGST Act prescribes the persons who are liable for registration under GST as: "Every supplier shall be liable to be registered under this Act in the State or Union territory, other than special category States, from where he makes a taxable supply of goods or services or both, if his aggregate turnover in a financial year exceeds twenty lakh rupees: ........."

ECOs play a significant role in the digital economy's supply chain of goods and services. Under the GST regime, ECOs are required to adhere to specific registration requirements.

S. 24(ix) of the CGST Act describes the compulsory registration for persons if the supply of goods or services or both is through ECO. Every ECO who is required to collect tax at source ('TCS') under s. 52 of the CGST Act, as well as an ECO who is required to pay tax under s. 9(5) of the CGST Act are required to obtain registration compulsorily as per s. 24 of the CGST Act, irrespective of the quantum of the turnover. This requirement is mandated to ensure compliance and facilitate the collection and remittance of GST.

Further persons making supplies of goods through an ECO who is required to collect under s. 52 of the CGST Act are required to obtain registration mandatorily.

Any supplier making inter-state supplies through an e-commerce platform must register for GST, irrespective of their turnover. This is to ensure proper tax compliance and collection for inter-state transactions.

Thus, the ECOs, for the purpose of ss. 9 (5) and 52 of the CGST Act, are entities liable to collect and pay tax on the supplies made through them by other individual suppliers. Thus, ss. 9(5) and 52 of the CGST Act statutorily recognisethe ECO as a class distinct from the individual supplier registered with the ECO.

Suppliers of specified services such as transportation of passengers by radio-taxi, motorcab, maxicab, and motorcycle, as well as accommodation services, must register for GST irrespective of turnover if they provide these services through an e-commerce platform.

Threshold Limits

Unlikeregular suppliers of goods or services, ECOs are required to register under GST irrespective of their turnover. This mandatory registration applies to all ECOs without any threshold limit.

Suppliers of goods or services using e-commerce platforms must also register under GST if their turnover exceeds the specified threshold limits. The threshold limits for suppliers vary based on the type of supply and the state in which they operate.

|

Threshold limit |

Mandatory Registration in most States. |

Registration in Special Category States. |

|

In case of Goods |

Rs. 40 lakhs |

Rs. 20 lakhs |

|

In case of Services |

Rs. 20 lakhs. |

Rs. 10 lakhs. |

Invoicing and Documentation

-

ECOs must generate invoices for all supplies made through their platforms, adhering to GST rules.

-

Large ECOs (turnover above specified limits) are mandated to generate electronic invoices (e-invoices) as per GST rules.

-

Proper documentation includes capturing and maintaining accurate details of suppliers (includingGSTIN) and customers.

-

Seamless integrationwith the GSTN portal facilitates filing GST returns (like GSTR-1 and GSTR-3B) directly from e-commerce platforms.

Tax Collection at Source (TCS)

ECOs are required to collect TCS at a rate of 1% on the net value of the taxable supplies made through their platform. TCS must be collected from the supplier at the time of payment.

For example, ABC's e-commerce platform facilitates the sale of electronic gadgets. A seller, XYZ Electronics, sells a laptop worth Rs. 50,000 through the platform.

TCS calculation: ABC's e-commerce platform must collect 1% of the net value of the sale, i.e., 1% of Rs. 50,000 equals Rs. 500.

Exceptions

-

Non-taxablesupplies: TCS is not required to be collected on non-taxable supplies. If the supply made through the e-commerce platform is exempt from GST or falls under this category, TCS provisions do not apply.

-

Supplies by Unregistered Persons: TCS provisions do not apply to supplies made by unregistered persons through the e-commerce platform. Only supplies made by registered persons are subject to TCS collection.

-

ExemptSupplies: Certain services are specifically exempt from TCS under the CGST Act. For instance, if provided through an ECO, passenger transportation by radio taxi, motor cab, maxi cab, and motorcycle may not be subject to TCS.

Responsibilities of E-commerce Operators

-

ECOs must compulsorily register under GST, irrespective of their turnover. They act as intermediaries facilitating transactions between buyers and sellers.

-

ECOs are required to generate electronic invoices (e-invoices) in the prescribed format for transactions facilitated through their platforms.

-

ECOs must file GSTR-1 to report outward supplies made through their platforms by the 11th of the subsequent month.

-

Verify that suppliers registered under GST comply with their filing obligations to ensure eligibility for claiming ITC.

-

Educate sellers on GST compliance requirements, including registration thresholds, invoicing norms, and filing obligations.

Filing of Returns

-

ECOs must file a monthly TCS return (GSTR-8) by the 10th of the following month. This return includes details of the TCS collected and supplies made through the platform.

-

An annual statement (GSTR-9B) must be filed by the 31st of December following the end of the financial year.

-

Both e-commerce operators and suppliers using these platforms must comply with GST return filing requirements, including the filing of GSTR-1, GSTR-3B, and other applicable returns.

Due Dates of GST returns and deposit of TCS

-

Filing of GSTR-8 (Monthly TCS return) - Due date: 10thof the following month. This return includes the details of outward supplies of goods or services made through the ECO, the amount of TCS collected, and other relevant information.

-

Filing of Annual statement (GSTR-9B) - Due date: 31stDecember following the end of the financial year. The annual statement consolidates the details of the TCS collected during the financial year.

-

Depositof TCS: The TCScollected must be deposited with the government by the 10th of the following month.

Penalties for Non-compliance

-

Late filing of GSTR-8 - A late fee of Rs. 100 per day per Act (CGST and SGST), subject to a maximum of Rs. 5000 per Act. In addition to the late fee, the outstanding amount is subject to interest at 18% p.a.

-

Non-filing of GSTR-8 - If the ECO fails to file the GSTR-8 return beyond the due date, a penalty may be levied as per the provisions of the CGST Act. The above-mentioned late fee and interest would also apply.

-

Failure to collect TCS - An ECO that fails to collect TCS as required may be liable to pay a penalty equivalent to the amount of TCS that should have been collected. Interest may also be applicable on the TCS amount not collected or collected but not deposited.

-

Failure to Deposit TCS - If the collected TCS is not deposited within the prescribed time, the ECO is liable to pay interest at the rate of 18% per annum on the amount of TCS from the due date until the date of actual payment. It may also result in additional penalties, including a fine and prosecution under severe circumstances.

-

Incorrect or False information - Providing incorrect or false information in the TCS returns (GSTR-8) can result in penalties, including fines and prosecution, depending on the severity and intent of the misinformation.

-

General Penalties - - S. 122 of theCGST Act:Imposes penalties for various offences, including non-registration, non-payment of tax, and incorrect information. The penalty can be up to Rs. 10,000 or the amount of tax evaded, whichever is higher. - S. 125 of the CGST Act:A general penalty of up to ₹25,000 for any contravention of the provisions of the Act or rules for which no specific penalty is provided.

-

Prosecution for Serious Offences: S. 132 of the CGST Actstates thatin severe non-compliance or fraud (e.g., willful misstatement, suppression of facts), the ECO may face prosecution, which can result in imprisonment and fines.

Legal Issues and Challenges

Complexity in Compliance

-

ECOs often deal with interstate transactions, which require careful calculation and reporting of Integrated GST ('IGST'). Understanding the place of supply rules and correctly attributing transactions to the respective states is crucial yet complex.

-

Different states may have variations in tax rates, exemptions, and thresholds, complicating the process for ECOs operating across multiple states.

-

S. 52 of the CGST Act mandates ECOs collect TCS at 1% of the net value of taxable supplies. This adds a layer of compliance, as ECOs must accurately track and report TCS.

-

ECOs need to reconcile the TCS collected with the returns filed by suppliers, ensuring that the details match and are reported correctly in the GSTR-8 return.

-

ECOs need to ensure that consumers receive the benefits of reduced tax rates and ITC. Non-compliance can lead to investigations and penalties by the National Anti-Profiteering Authority (NAA).

Different Tax Rates on Various Goods and Services

-

Under GST, goods and services are taxed at different rates, ranging from 0% (exempt) to 28%. ECOs must manage this complexity in their billing and accounting systems.

-

It is crucial to accurately classify products and services according to the GST rate slabs. Misclassification can lead to penalties and compliance issues.

-

GST rates can be revised periodically. ECOs need to stay updated and promptly adjust their pricing and tax collection mechanisms.

-

Managing ITC with varying tax rates becomes complicated, requiring meticulous accounting to ensure correct credits are claimed.

Dispute Resolution Mechanisms

-

ECOs should have robust systems for handling GST disputes, including incorrect tax rates, refunds, and ITC.

-

Familiarity with the procedures for raising disputes with GST authorities and using the available legal channels is essential.

-

Consider using arbitration and mediation for quicker resolution of disputes without prolonged litigation.

-

Maintain comprehensive records to support claims and disputes, ensuring all necessary documentation is readily available.

Impact on Small and Medium Enterprises ('SMEs')

-

SMEs face higher compliance costs due to GST registration, regular filings, and maintaining detailed records.

-

The need to pay GST on sales while waiting for payments can strain cash flows, especially for SMEs.

-

GST compliance can be more burdensome for SMEs, potentially affecting their competitiveness against larger players with more resources.

-

SMEs may need to invest in accounting software and professional services to manage GST compliance effectively.

Recent Developments and Amendments

Recent GST Amendments Impacting E-commerce

-

Recent amendments have clarified that ECOs must register under GST irrespective of their turnover. This includes all operators, even those with a turnover below the previously stipulated threshold limits. This change ensures all e-commerce transactions are brought within the GST net, promoting greater tax compliance.

-

Amendments have fine-tuned the provisions related to TCS under s. 52 of the CGST Act. ECOs are required to collect TCS at 1% of the net value of taxable supplies made through their platform. ECOs must also comply with updated filing requirements, including the GSTR-8 return, which must be filed monthly.

-

The composition scheme has been extended to service providers, including those engaged in e-commerce, with a turnover of up to Rs. 50 lakhs. This scheme allows eligible taxpayers to pay a fixed percentage of their turnover as GST. This amendment simplifies GST compliance for small e-commerce service providers, reducing their tax and administrative burden.

-

Amendments have imposed restrictions on availing ITC in cases where suppliers have not furnished details in their GSTR-1. ECOs must ensure their suppliers comply with return filing requirements to claim ITC. Enhanced matching of ITC with supplier invoices ensures greater accuracy and reduces the risk of mismatched credits.

-

E-invoicing has been mandated for businesses with a turnover above a specified threshold, including many ECOs and their large suppliers. ECOs must ensure their systems are equipped to handle e-invoicing requirements, including generating and reporting electronic invoices.

-

Amendments have introduced stricter penalties for non-compliance, including higher fines and potential prosecution for fraudulent activities. E-commerce operators are now subject to increased scrutiny and must maintain detailed records of transactions to prevent evasion.

Technological Advancements in GST Compliance

-

E-commerce platforms have integrated automated systems that calculate GST in real time for every transaction, ensuring accurate tax computation based on the type of goods or services and applicable tax rates.

-

E-invoicing mandates have led to the adoption of standardised electronic invoicing formats.

-

ECOs generate and report invoices in real time, enhancing transparency and reducing errors. ECOs use advanced software that integrates with their sales and accounting systems to automate the preparation and filing of GST returns (GSTR-1, GSTR-3B, GSTR-8)

-

E-commerce platforms automatically calculate and collect TCS at the point of sale, ensuring timely and accurate collection.

-

AI and machine learning algorithms analyse transaction patterns to detect and prevent fraudulent activities, such as fake invoicing and tax evasion.

-

Blockchain technology ensures the creation of immutable records of transactions, enhancing the transparency and traceability of GST-related data.

-

Mobile apps enable ECOs and sellers to manage GST compliance on the go, including invoicing, return filing, and ITC claims.

-

Robotic Process Automation automates repetitive tasks such as data entry, invoice processing, and return filing, reducing manual errors and saving time.

GSTN Portal

-

ECOs register and enroll on the GSTN portal to obtain a GST identification number ('GSTIN'). This registration is mandatory for facilitating e-commerce transactions and ensuring compliance with GST laws.

-

The GSTN portal enables ECOs to comply with TCS provisions. ECOs collect TCS at the prescribed rates (usually 1%) from sellers making supplies through their platforms. This collected TCS is then reported and paid through the GSTN portal.

-

With the introduction of e-invoicing for specified taxpayers, including ECOs, the GSTN portal facilitates the generation and reporting of e-invoices in a standardised format. This enhances transparency and reduces invoice-level mismatches.

-

ECOs reconcile the ITC claimed with purchases and supplies reported by their sellers using the GSTN portal. This helps them claim legitimate ITC and maintain compliance with GST regulations.

-

The GSTNportal provides compliance tools and updates to ECOs regarding changes in GST laws, filing due dates, and compliance requirements. These tools help ECOs stay updated and avoid penalties for non-compliance.

-

ECOs access a dashboard on the GSTN portal that provides insights and analytics related to their GST compliance. This includes transaction summaries, compliance status, and alerts for discrepancies.

-

The GSTNportal offers a robust helpdesk and support system to assist e-commerce operators in resolving queries related to registration, filing returns, TCS compliance, and other GST-related matters. This support ensures smooth operations and compliance adherence.

-

The GSTNportal ensures stringent security measures to protect ECOs' sensitive GST data. Data privacy and confidentiality are maintained to prevent unauthorised access and breaches.

Conclusion

As integral players in the e-commerce ecosystem, ECOs must stay well-informed about GST regulations through workshops, webinars, and industry updates. Investing in advanced GST compliance solutions is crucial; these automate tax calculations, e-invoicing, and return filing, reducing errors and enhancing operational efficiency. Collaboration with sellers is essential to ensure they understand and adhere to GST norms, which helps maintain smooth compliance across platforms. ECOs must also proactively address compliance issues, rectify errors promptly, and keep detailed records to aid audits and inquiries by tax authorities.

Operating within India's complex GST framework, ECOs face key responsibilities, including mandatory registration, TCS, e-invoicing compliance, timely GST return filing, and adherence to ITC rules. Educating and supporting sellers on GST compliance, maintaining precise records, and cooperating with tax authorities during audits are fundamental duties that enhance transparency, build credibility, and reduce the risk of penalties.

Ultimately, adhering to GST regulations is not merely a legal requirement but a critical element for the seamless operation of e-commerce businesses. Keeping abreast of regulatory changes and maintaining GST compliance is essential for effectively navigating the evolving tax landscape, safeguarding business integrity, and ensuring a competitive edge in the market.

Footnote

1 2023 SCC OnLine Del 2216.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.