- within Tax topic(s)

- in United States

- in United States

- within Insolvency/Bankruptcy/Re-Structuring, Family and Matrimonial, Government and Public Sector topic(s)

- with readers working within the Utilities and Law Firm industries

I. Introduction

The Goods & Services Tax ('GST') was enacted in 2017. It was introduced with the objective of replacing the complex and fragmented erstwhile structure with a simple unified system that would reduce tax cascading and promote economic integration. GST is, by nature, a destination-based consumption tax, meaning that it is paid by all individuals across the supply chain based on the value they add to the eligible goods and/or services.

GST is governed through the Central Goods & Services Tax, 2017 ('CGST Act'), the State Goods & Services Tax, 2017 ('SGST Act'), the Integrated Goods & Services Tax, 2017 ('IGST Act'), along with the Central Goods and Services Rules, 2017 ('GST Rules'). Like the income tax regime, the GST regime also follows the procedure of 'self-assessment of tax,' whereby the assessee himself is tasked with first determining his tax liability and thereafter complying with the established procedure and rules thereof. The rationale behind adopting the self-assessment procedure under the GST regime was to optimize tax collections without having to incur exorbitant administrative costs, as in a 'self-accessed tax regime', the onus of examining financial statements and calculating the amount of tax payable shifts upon the taxpayers.1 Thus freeing the revenue department from the 'taxing' and tedious responsibility of ascertaining the tax liability of every assessee. However, to ensure compliance and prevent evasion of tax, the GST department maintains its own system of checks and balances to identify voluntary and involuntary tax evasion, conduct assessment(s) to correctly ascertain an assessee's tax liability, impose penalties and fines in case of default, and initiate tax recovery proceedings.

Assessment, as defined under s. 2(11) of CGST Act, means "determination of tax liability under this Act and includes self-assessment, re-assessment, provisional assessment, summary assessment and best judgment assessment;". However, the meaning and scope of assessment in tax proceedings are wide and include all proceedings, starting with the filing of the return or issue of notice and ending with the determination of tax payable by the assessee.2 Thus, assessment proceedings initiated by the GST department are undertaken by the department to ascertain (i) tax evasion, if any, (ii) amount of tax evaded, (iii) applicable interest and penalty, in case tax has been evaded, (iv) nature of the offence committed (whether cognizable/non-cognizable). The entire procedure of conducting an assessment under the GST law regime has been discussed through this insight.

II. What Precedes an Assessment under GST

Prior to an assessment being initiated under GST, the following process is undertaken:

- An assessee/registered person files his self-assessment tax returns under s. 39 CGST Act, including all relevant details of supply, GST, etc.

- The returns filed by the assessee are thereafter reviewed by the Proper Officer ('PO').

- The PO identifies discrepancies in returns filed by the assessee during the review, including, but not limited to, discrepancies regarding the applicable tax rate, calculation of tax, etc. If no discrepancy is noted, the return(s) filed by the assessee are approved.

- However, in a case wherein the PO is in the identification of a discrepancy, he is authorized to initiate an audit under s. 65 and 66 of the CGST Act or conduct an inspection under s. 67 of CGST Act.

- Upon completion of audit and/or inspection/search proceedings, if the PO is of the opinion that the assessee has evaded tax, she/he may issue a show cause notice(s) against the assessee under ss. 73 and 74 of the Act, thus raising a tax demand.

III. Types of Assessment under GST

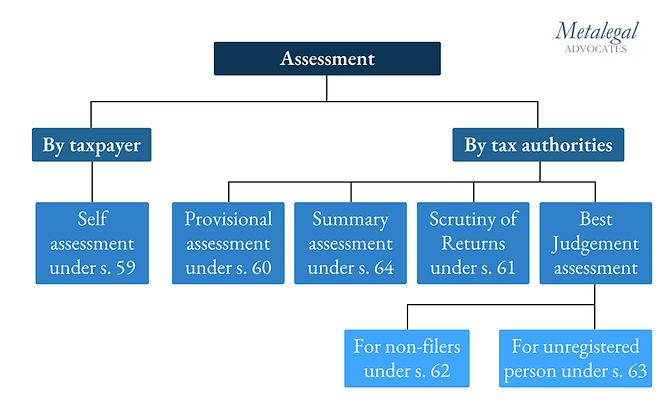

Under the GST law regime, assessment can be bifurcated into two tranches: (i) when the assessee undertakes the assessment and (ii) when the PO undertakes the assessment. In concurrence with its name, self-assessment is undertaken by the assessee himself. The revenue department undertakes all the other kinds of assessments mentioned below. The various kinds of assessments prescribed under the CGST Act are briefly explained here:

- Self-assessment: The assessee self-assesses his tax liability under s. 59 of the Act and furnishes his tax returns for each tax period under s. 39 of Act. Thus, the assessee makes the due payment of tax as per his own assessment.

- Provisional assessment: Where the assessee cannot determine the value of goods or services or both or the applicable tax rate, he may apply to the PO in writing requesting to pay tax on a provisional basis under s. 60 of the CGST Act. The PO is required to pass an order within 90 days, permitting provisional payment on a specified rate or value, and pass the final assessment within 6 months from communication of the aforementioned order.

- Scrutiny of returns: The PO may, under s. 61 of the Act scrutinizes the returns and other particulars furnished by the assessee to verify the correctness of the return and inform him of the discrepancies, if any. Thereafter, the assessee may furnish an explanation for the alleged discrepancy.

- Summary assessment: Under special circumstances, the PO may proceed to assess the tax liability of an assessee under s. 64. This assessment is done with the permission of the Additional Commissioner or Joint Commissioner of GST only when the PO has sufficient ground to believe that any delay in doing so may adversely affect the interest of revenue.

- Best Judgment assessment: In case of an unregistered person (s. 63 CGST Act), or if a registered person/assessee has not filed his tax returns (s. 62 CGST Act), the PO proceeds to assess the tax liability to the best of his judgment taking into account all the relevant material gathered by him. The PO can issue an assessment order within 5 years of filing the annual return.

IV. The Process of GST Assessment

The CGST Rules and the allied (ASMT and DRC) forms govern the process of undertaking an assessment under the CGST Act. However, considering that the CGST Act provides for five types of assessments, all of which are undertaken in varied instances, the process also tends to vary. Thus, in light of this, we shall look into the process of conducting the three most important kinds of assessments under the CGST Act.

1. Provisional assessment

The procedure for conducting provisional assessment is provided under r. 98 of the GST Rules, whereby:-

- The Assessee requests the PO to conduct a provisional assessment vide form ASMT-01.

- In furtherance of the aforementioned request, the PO sends a notice to the assessee vide form ASMT-02 seeking additional documents and information relevant to the assessment.

- The assessee provides to the PO the documents so sought by him vide form ASMT-03.

- The assessee can make provisional tax payment vide form ASMT-04.

- In furtherance of the aforementioned provisional payment, the assessee is liable to furnish a bond in the form of a bank guarantee vide form ASMT-05.

- The PO thereafter issues notice vide form ASMT-06, calling for information and record from the assessee.

- The PO passes the final assessment order vide form ASMT-07.

- The assessee can thereafter file an application vide form ASMT-08, seeking for the release of security furnished.

- The security furnished by the assessee is thereafter released vide form ASMT-09.

The PO is statutorily bound to pass an order allowing provisional payment of tax within 90 days from the date of request. Further, the PO should pass the final assessment order within 6 months (extendable up to 4 years) of communication of the abovementioned order.

2. Scrutiny assessment

The procedure for scrutiny is provided under s. 61 CGST Act read with r. 99 of GST Rules, whereby:

- Subsequent to the scrutiny of returns being filed by the assessee, the PO seeks an explanation by issuing a Notice for Discrepancies vide form ASMT-10. In certain scenarios, the PO, if possible, may also quantify the tax, interest and penalty, if any, liable to be paid by the assessee.

- The assessee is liable to furnish an explanation of the discrepancy so pointed out by the PO, vide form ASMT-11, within 30 days of the department's aforementioned notice being issued. Further, if the assessee accepts a discrepancy, he is liable to pay the due tax, interest, and penalty and inform the PO vide FORM ASMT-11.

- If the PO finds the explanation furnished by the assessee satisfactory, the scrutiny proceedings are dropped, and the assessee is intimated about it vide form ASMT-12.

However, in case the PO is unsatisfied with the response submitted by the assessee and/or the assessee fails to make the payment of tax, interest and penalty within the stipulated time period, s/he may initiate an audit/special audit proceedings/ inspection and search against the assessee, in furtherance of his intention to recover tax.

3. Best Judgment assessment

Best judgment assessment is a suo moto proceeding undertaken by PO under s. 62 of the Act in case of non-filers, and under s. 63 of the Act in case of unregistered persons. The procedure for conducting best judgement assessment is provided for under r. 68 and 100 of GST Rules, whereby:

In the case of non-filers, the PO may proceed to conduct a best judgment assessment if the assessee fails to furnish his periodic return under s. 39 or final return under s. 45 of the Act, subsequent upon the issuance of notice under s. 46 of the Act. The PO can only initiate best judgment assessment subsequent upon fulfilling the following predetermined conditions:

- Issuance of Notice: The PO must issue notice to the assessee in the form of GSTR-3A, formally reminding the assessee of his liability to furnish his periodic returns within 15 days of the issuance of the aforementioned form.

- Failure to file returns: if the assessee does not file his returns within the above-mentioned time frame, the PO can conduct a best judgment assessment and pass an assessment order vide FORM ASMT-13.

- After the aforementioned assessment order is passed, a summary is uploaded on the website in Form DRC-07 to apprise the taxpayer of the order passed in his case.

- However, upon passing the assessment order, if the assessee furnishes his return within 30 days, the assessment order passed previously stands withdrawn.

In the case of an unregistered person –the PO is empowered to make the best judgment assessment in cases wherein there is an accruing tax liability for unregistered persons or persons/entities whose GST registration has been cancelled. The conditions precedent for initiation of best judgment assessment is under s. 63 of the Act are as follows:

- Issuance of Notice: The PO shall issue a notice to the assessee vide FORM ASMT-14 detailing the grounds for assessment by best judgment and additionally serve a summary video FORM DRC-01. The unregistered person is provided 15 days to reply to the aforementioned notice and is also provided with an opportunity to be heard.

- Passing of the assessment order: After the aforementioned time has lapsed, the PO shall pass an assessment order vide FORM ASMT-15.

- After the aforementioned assessment order is passed, a summary in the form of FORM DRC-07 is uploaded on the website to apprise the taxpayer of the order passed in his case.

Best Judgment assessment is considered a safe route for the assessee to submit tax under protest in case of any dispute in assessment amount.

V. Does assessment necessarily lead to prosecution under GST law

The scheme of the CGST Act permits parallel proceedings against an assessee in cases of tax evasion. Upon establishing that tax has been evaded, the assessee is subjected to (i) adjudication proceedings for assessment/determination of tax liability and (ii) prosecution to penalize the assessee for violating the law.

Proceedings initiated under s. 73 of the Act, wherein the non-payment/short payment of tax by the assessee is involuntary, does not lead to the initiation of criminal prosecution. However, proceedings initiated under s. 74 of the Act, wherein tax evasion is voluntary on the part of the assessee she/he is subjected to trial.

The issue of whether criminal prosecution can be initiated without assessment proceedings under GST has been dealt with differently by various High Courts. In Jayachandran Alloys Pvt. Ltd. v. Superintendent of GST and Central Excise3, Madras High Court has observed that prosecution proceedings under s. 132 CGST Act can be initiated only after the tax liability is quantified upon due assessment. On the other hand, in P.V. Ramana Reddy v. Union of India4, the Telangana High Court has held that coercive steps of arrest and prosecution under s. 132 of the CGST Act can be launched even before the completion of the assessment. This question is pending consideration before the Hon'ble Supreme Court in Union of India v. Sapna Jain5.

However, the prosecution proceedings, even if simultaneously initiated with assessment proceedings, cannot be concluded prior to the adjudication being concluded, as the actual and true amount of tax evaded will and can only be determined through adjudication. Only once the tax evaded has rightly been ascertained can an assessee be prosecuted for tax evasion. Criminal prosecution is largely dependent upon the amount of tax evaded. Up until a certain amount, tax evasion is a bailable and non-cognizable offence under the GST law regime. More serious consequences, such as arrest, shall concur only when such a threshold is breached. Thus, prosecution and assessment may move parallel; however, in no instance can the prosecution be concluded prior to the passing of the final assessment order.

VI. How to deal with the Aftermath of an Assessment

More often than not, GST assessment proceedings shock the assessee, and there is no definite time limit for initiating scrutiny of returns under s. 61 CGST Act or to conduct inspection, search, or seizure under s. 67 CGST Act. However, once the assessment/adjudication proceedings commence, there is a maximum time limit for concluding proceedings by issuing a Demand order within 3 years from the due date of the annual return in case of proceedings under s. 73 CGST Act and within 5 years from the due date of annual return in case of proceedings under s. 74 CGST Act. Upon passing the Demand order by the Adjudicating Authority, the assessee may choose to approach the Appellate Authority(s) against the order passed by the Adjudicating Authority, under s. 107 CGST Act, which may take further time as the appeals are currently heard by the High Court, which has the territorial jurisdiction to do so, further delays the appeal proceedings. The recent operationalisation of the GST Appellate Tribunal is expected to reduce the timeline for appeal proceedings and ensure faster resolution of disputes.

The following table summarizes the timeline for proceedings under s. 73 and s. 74 CGST Act:

| Stage/Proceeding | Proceeding u/s 73 | Proceedings u/s 74 |

|---|---|---|

|

SCN stage |

2 years and 9 months from the due date of filing the annual return |

4 years and 6 months from the due date of filing the annual return |

|

Issuing Demand Order |

3 years from the due date of filing the annual return |

5 years from the due date of filing the annual return |

|

Maximum time of proceedings |

3 years |

5 years |

|

The limitation period for filing an appeal by an aggrieved assessee against a Demand order |

(3+1) months from communication of order |

(3+1) months from communication of order |

In case assessment proceedings are initiated against an assessee,

she/he needs to adhere to stipulated timelines for submitting an

explanation, reply to SCN and appeal proceedings. Litigation in

case of appeal is prolonged and protracted. Therefore, it is

advisable that an assessee can seek for compounding of proceedings

in case of apparent error on his part. The assessee may

alternatively submit the demand amount as per Summary SCN as

payment under protest and continue to contest the proceedings. This

will ensure that further interest and penalty are not levied upon

the tax amount due to delay.

VII. Analysis and Conclusions

The assessment procedure undertaken by GST authorities is, thus, an effective tool to ensure that an assessee complies with the provisions of the GST Act. The Act is intended to act as a deterrent for assessees in cases of GST evasion and, therefore, makes provision for penalty and punitive proceedings against the assessee. However, the nature of assessment proceedings under GST is long and protracted. This is because the assessment procedure often involves analysis and verification of large, cumbersome documents, multiple rounds of investigation and questioning with the assessee, and long statutory time limits, which the Act provides for compliance purposes. Additionally, the timeline of proceedings and the adjudication of penalty and offence hinges upon the GST department, sans judicial oversight. Hence, the possibility of unwanted latches and delays in assessment proceedings cannot be ruled out. In light of tediously long assessment proceedings, it is in favour of both revenue and assessee to settle the matter before the issue of SCN through pre-notice consultation. Furthermore, a more user-friendly system can be introduced for assessment proceedings to help resolve GST assessment disputes swiftly and without undue delays.

Footnotes

1. Okello, A. (2014) 'Managing income tax compliance through self-assessment', IMF Working Papers, 14(41), p. 4. doi:10.5089/9781475515237.001.

2. S Sankappa & Ors. v. Income-tax Officer, Central Circle II, Bangalore, 1967 (12) TMI 2 – Supreme Court.

3. 2019 SCC OnLine Mad 31224.

4. 2019 SCC OnLine TS 3332.

5. 2019 SCC OnLine SC 1939.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.