Exports are zero-rated under the Goods and Service Tax ('GST') regime, and Input Tax Credit ('ITC') can be availed on the supply of goods and services outside the territory of India, which reduces the overall prices of goods and services during export. This mechanism benefits the country's economy by fostering competition and increasing the volume of exports.

GST is a destination-based tax levied on the value added during the stages of the production or sales cycle of goods. In some countries, it is referred to as Value Added Tax ('VAT'), while in others, it is referred to as GST. In India, it is called GST. When the tax rate applied to a supply is zero, it is known as zero-rating. The concept of zero-rating ensures that goods are supplied without VAT or GST.

The Netherlands was one of the first countries to implement comprehensive VAT policies that included zero-rating, allowing the entire tax paid on inputs for exported goods to be credited. Canada, the first country to introduce GST, incorporated zero-rating for the export of goods and services. Since then, regions and countries, including the European Union, Australia, China, Singapore, and India, have adopted zero-rating of GST on exports, creating a global network of economic growth.

In India, the first discussion paper on GST in 2009 proposed zero-rating for exports of goods or services and supplies to special economic zones ('SEZs'). This concept was later incorporated into the GST Act of 2017. Similarly, under the GST regime in India, the supply of services to locations outside the territory of India also enjoys a zero per cent tax rate.

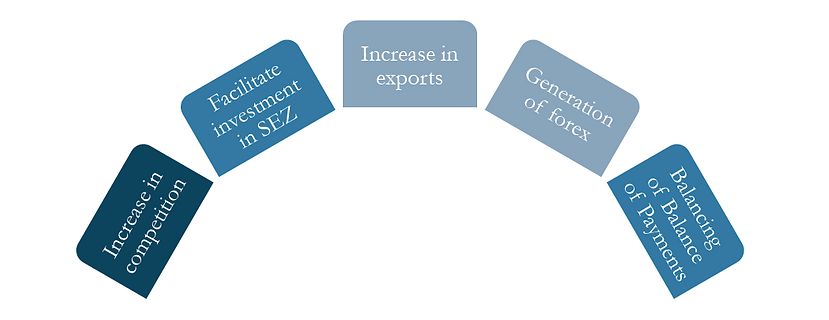

Benefits of Zero-Rating

The concept of zero-rating has been incorporated into the VAT/GST regime of various countries due to the following benefits:

- Increase in competition – Zero-rating of exports not only benefits traders but also fosters a spirit of healthy competition. This practice allows traders to explore and penetrate new markets, thereby increasing competition in the international market and inspiring growth and innovation.

- Facilitate investment in SEZ – With zero-rating of supplies to the SEZ, the investment has increased in SEZs.

- Increase in exports – The zero-rating of exports benefits the exporters, which has led to an increase in exports.

- Generation of Forex – With the increase in exports, there is a higher influx of forex, which can put the country in a better position.

- Balancing of Balance of Payments – A country's balance of payments account records transactions made by residents in both credits and debits. Zero-rating helps increase exports and forex generation, potentially reducing deficits in the balance of payments and thereby improving the national economy.

Zero-Rating of Exports – Under Indian Law

Integrated Goods and Services Act, 2017 ('IGST') is the applicable legislation on the inter-state supply of goods or services. S. 17 of the IGST Act provides that the export of goods or services and supply of goods and services to SEZ qualify as zero-rated supplies; it further states that ITC may be availed on such supplies.

Export of Supply – Meaning

As stated above, zero-rating of supplies applies to exports of services. Therefore, it is important to analyse the requirements stipulated under the statute that qualify a supply as an export.

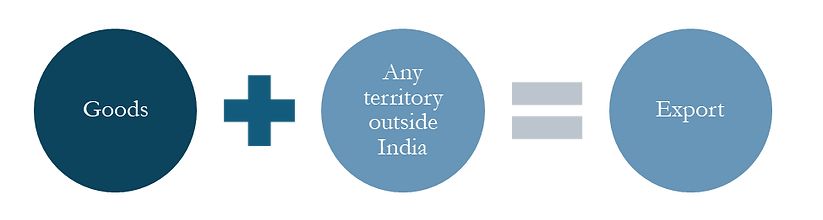

Export of goods

Export of goods1 has been defined as taking goods out of India to a place outside India. Which may be summarised with the help of the following diagram:

Export of Services

For the supply of services to qualify as an export of services,2 the following criteria are required to be fulfilled:

- The supplier should be located in India—S. 2(6) of the IGST Act states that the supplier of services must be situated in India to qualify as an export of services. The location of the supplier is determined3 by their place of business or fixed establishment or, if these cannot be determined or are unavailable, their usual place of residence. Therefore, if the supply is made from a place of business or a fixed establishment located in India, this condition can be fulfilled.

- The recipient should be located outside India – S. 2(6) of the IGST Act states that the location of the recipient of services must be outside India for it to qualify as an export of service. The location of the recipient depends on their place of business or fixed establishment, or, if these cannot be determined or are unavailable, their usual place of residence. Therefore, if the supply is received at a place of business or fixed establishment located outside India, this condition can be fulfilled.

- The Place of Supply should be outside India – S. 11 of the IGST Act states that the place of supply in case of goods exported from India is the location outside India. S. 13 of the IGST describes the place of supply in the case of services; it states that the place of supply of services shall be the location of the recipient of services. Therefore, this condition can be fulfilled if the abovementioned condition is fulfilled, i.e., the recipient should be outside India.

- The Payment of Services should be received in convertible foreign exchange – Convertible foreign exchange is the foreign currency received by the Indian supplier for the export of services. If the payment of such services has been received in foreign exchange, then this condition can be fulfilled.

- The supplier of service and the recipient should not be mere establishments of a distinct person – Exp. 1 to s. 8 of the IGST Act explains the concept of establishments of distinct persons. Suppose a person has an establishment in India and any other establishment outside India, and the two establishments are engaging with each other. In that case, the transaction will not qualify as an export of service. It will be considered as an internal supply to the same legal entity rather than an export of service. Therefore, If the supplier and the recipient qualify as mere establishment of the same person, this condition would not be fulfilled. It is noteworthy that the subsidiary and holding company qualify as distinct persons. Any transaction between the two will qualify as an export if the other four conditions are also fulfilled.

ITC on Zero-Rated Exports

S. 2(62) of the Central Goods and Services Act, 2017 ('CGST Act') states that the input tax includes the central tax, state tax, integrated tax, or IGST charged on the import of goods to a registered person on the supply of goods or services made by him. ITC has been defined as the credit of input tax under s. 2(63) of the CGST. In simple words, it is a credit of taxes paid on inputs used in the value addition process so that the final burden of tax is on the recipient and not the seller.

Every registered person can avail ITC charged to him on any supply of goods or services that are used in the course of furtherance of business, i.e., the goods or services that may be used as an input in the production cycle or for rendering the service,4 subject to the following conditions:

- The registered person is in possession of a debit or credit note issued by the supplier of such goods.

- The registered person has received the goods or services or both, and the ITC with respect to such supply shall be communicated and should not be restricted.

- The tax charged with respect to such supply has been paid to the government.

- The registered person has furnished a return under s. 39 of the CGST.

Utilisation of ITC

Under the provisions of s. 49A of the CGST, the ITC can be used to pay integrated, central, state, or union territory tax. S. 49B of the CGST provides the order of utilisation of ITC on account of integrated tax, central tax, state tax, or union territory tax, as the case may be.

Refund of Tax

S. 54 of the CGST provides for the circumstances under which the registered person may claim a refund of tax or ITC. It expressly provides that a refund can be claimed if zero-rated supplies are made without tax payment. However, such a refund is not allowed where the exported goods attract export duty, i.e., the government may discourage their exports.

Thus, upon a conjoint reading of ss 16, 49A, 49B and 54 of the CGST, it can be concluded that the exporter of goods may utilise the ITC towards payment of tax or claim the refund of the ITC on the zero-rated supplies made by him.

Imports Under GST

Imports under the GST regime do not qualify as exempt from zero-rated supply. Therefore, they are taxable under the provisions of the CGST Act. Imports, unlike exports, are chargeable under the provisions of the GST Act. While the zero-rating on exports has led to an increase in the quantum of exports, the imposition of GST on exports can lead to a decrease in the quantity of imports due to the increase in prices of imported goods.

Taxability of Imports – under GST

The supply of services imported into the territory of India is to be treated as a supply of services during Inter-state trade and commerce and, thus, subject to the provisions of the IGST Act. The central government has been empowered5 to subject any class of registered persons to reverse charge through a notification6. It has specified that the reverse charge is applicable on any service supplied by any person who is in non-taxable territory to any person located in the taxable territory, i.e., on the import of services in India.

Reverse Charge Mechanism ('RCM')

RCM is defined under s. 2(98) of the CGST Act as an event when the burden and incidence of tax are on the same person, i.e., the recipient of the goods or services is liable to discharge the tax liability instead of the seller. It is an exception to the general rule followed under the indirect tax regime, wherein the burden and incidence of tax are on two different persons.

Availment of ITC

To avail ITC, the registered person is to issue the invoice as per the provisions of s. 31(3)(f) of the CGST. S. 16(2)(a) of the CGST Act and r. 36(1)(b) of the CGST Rules, 2017 states that the registered person shall only be entitled to the credit of ITC if he is in possession of the tax invoice or debit note and the ITC can be claimed on the basis of the invoice issued under s. 31(3)(f) of the CGST. Therefore, the registered person has to issue the invoice to avail GST under the RCM mechanism and produce the same to avail the ITC.

Conclusion

Exports and imports are treated as inter-state supplies under the IGST Act, thereby falling within the purview of IGST. While both share a similar nature as inter-state supplies, their treatment under the GST regime differs significantly; exports are zero-rated, facilitating competitive pricing and market expansion, whereas imports are subject to tax under the RCM. This strategic differentiation allows suppliers to claim ITC for both, which helps reduce the cost of exported goods and services, leading to an increase in export volume and heightened market competition.

Furthermore, zero-rating exports yield substantial economic benefits, such as fostering investment in SEZs and bolstering competition in the international arena. Ideally, by increasing exports and curbing imports, a country can improve its current account balance within the balance of payments framework, potentially decreasing the national deficit and reducing reliance on foreign borrowing. This strategic fiscal approach aims to enhance overall economic stability and growth.

Footnotes

1. S.2(5) of IGST Act, 2017

2. S.2(6) of IGST Act,2017

3. S.2(15) of the IGST Act, 2017

4. S.16 of CGST Act, 2017

5. S. 5(4) of the IGST Act

6. Notification No. 10/2017- Integrated Tax (Rate)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.