Background

In recent times, corporate entities aiming to elevate their global market position are restructuring their operations. One prevalent method is through mergers and acquisitions ('M&A'). Whenever a company considers an M&A, it must cover all bases and risks. This thorough risk assessment process is known as due diligence ('DD'). DD is a form of research conducted by investors to identify potential risks involved in an M&A. It is crucial for mitigating the possibility of failures in M&A transactions. DD is a step-by-step process that examines risks and formulates strategies to address them. The DD process includes accounting and tax due diligence ('TDD'), commercial and operational, and regulatory and legal due diligence. This article focuses on the scope and extent of TDD, the issues arising in TDD, and a sample checklist.

Introduction

Before delving into TDD, a realistic example underscores TDD's necessity. In 2006, GSK acquired SB Pharmaco, a Puerto Rico-based company holding patents for several GSK drugs. Subsequently, the US tax authorities investigated the deal, alleging that GSK had overpaid for the patents, transferring profits to the Puerto Rican entity. The Internal Revenue Service challenged the transaction under transfer pricing ('TP') regulations, and the case ended in a $3.4 billion settlement between GSK and US authorities. This deal emphasizes the need for TDD among companies.1

Taxation is unavoidable, but comprehensive tax planning can minimise the extent of tax liabilities. In India, the tax system is complex and continually evolving through amendments under the Income-tax Act, 1961 ('Act') and circulars issued by the Central Board of Direct Taxes ('CBDT'). Due to globalisation and modern society, another concept, the 'risk society,' has emerged. From a taxation perspective, this concept relates to uncertainty in the global market, creating insecurity and confusion in meeting tax obligations. The term 'risk' is derived from a Latin phrase meaning 'to dare,' indicating an uncertain future event that is likely to occur. To address tax risks, company management must study the company's tax philosophy, strategy, internal policies, and procedures under the Act and Income-tax Rules, 1962 ('IT rules'). This alignment ensures better tax alternatives that enhance business value.

Therefore, TDD plays a pivotal role in M&A decision-making, providing a framework and support for tax-efficient structuring and funding of the transaction, addressing the tax aspects of the share or asset purchase agreement (including warranties and indemnities), and validating the purchaser's valuation model or hypothesis. The overall objective of TDD is to receive careful attention at the planning stage, ensuring it is thoroughly exploited and its total value realised.

Types of TDD

To understand the extent and scope of TDD, it is essential to note that TDD is broadly classified into two categories:

a. Buyer's Side (Target Due Diligence): This type is conducted by the buyer on the target company they are interested in purchasing or investing in. The buyer primarily focuses on evaluating a tax-friendly structure to minimise tax liabilities.

b. Seller's Side (Vendor Due Diligence, VDD): It is crucial to conduct TDD from the seller's perspective to prepare for any surprise tax liabilities before entering the market, maximising the value of their business.

Scope of TDD

The scope of TDD includes all aspects of direct taxes ('DT') and indirect taxes ('IDT'). DT encompass the Act and related obligations such as withholding taxes, deferred taxes, TP, and international taxation coupled with double tax avoidance agreements ('DTAA'). IDT include customs duties, excise duties, goods and services tax ('GST'), and value-added tax ('VAT').

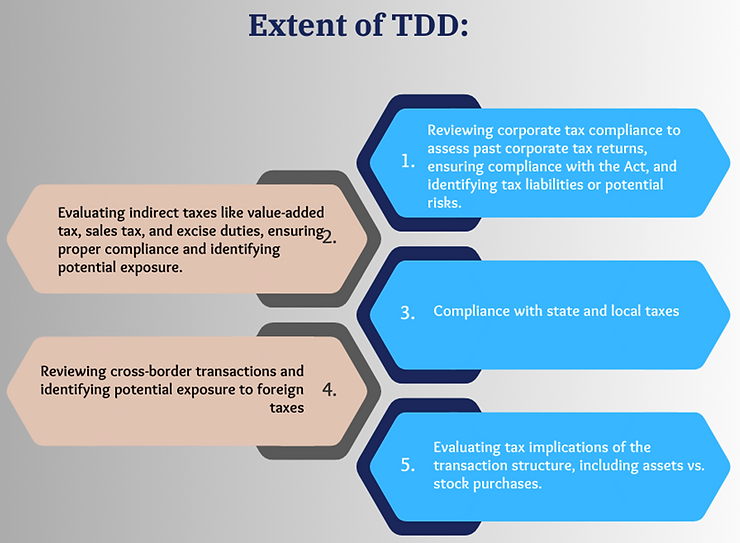

Extent of TDD

Consultants conducting TDD must diligently prepare a report based on the company's goals and the transaction size. Key areas include:

The extent of the TDD process depends on specific circumstances and company goals. Its objective is to uncover potential tax risks and liabilities and provide a sustainable tax structure.

Key issues identified while performing TDD

Several nuances are emphasised while performing TDD, including the following:

a. TaxWithholding: Under the IT Act, withholding tax/TDS must be applied to most payments to residents and non-residents. For instance, a global multinational company ('MNC') should ensure it has deducted TDS and complied with tax withholding obligations on foreign and domestic transactions. Non-compliance can result in penalties. Additionally, domestic transactions, such as providing benefits or free samples, can lead to non-deduction of TDS under the Act, leading to litigation.2

It is also pertinent to note that any advancement of a loan by the closely held company to its shareholders or allied entities may be termed as a 'deemed dividend' in the hands of the recipient, triggering withholding tax liability on the target company.

b. TP obligations: While conducting TDD, it is essential to assess whether the target company has properly prepared and maintained its TP documentation for related-party transactions. Non-adherence to TP regulations can lead to extensive litigation, as India has stringent TP regulations and is notorious for TP controversies.

c. Recapture of shareholding losses and distressed buyouts- A company with majority shareholders holding more than 49% of shares may face limitations in carrying forward unabsorbed tax losses (excluding depreciation), which are otherwise eligible to be carried forward for eight years. During TDD, assessing whether changes in the target's shareholding pattern could affect its ability to carry forward unabsorbed losses is important. Past claims may be wiped out in distressed buyouts under the corporate insolvency resolution process ('CIRP') of the Insolvency and Bankruptcy Act, 2016 ('IBC'). A thorough TDD should ensure that new shareholders are not burdened with past claims and that the resolution plan includes provisions for relief from past tax claims.3

d. TDD issues surrounding Start-ups: Various issues arise during TDD for start-ups, primarily related to valuation. Share acquisitions and business acquisitions must comply with valuation norms under the IT Act and IT Rules. Acquisitions at inflated or deflated valuations can lead to adverse consequences and litigation.

e. Claim of Tax Holiday/incentives - Under the IT regime, tax holidays and incentives can be availed for a specified period, subject to the fulfilment of certain conditions. It is necessary to assess whether the conditions for availing of tax holidays have been met.

f. TDS of certain expenses w.r.t to employees: Another issue during TDD is the intricacies of TDS on certain expenses, such as leave encashment and bonuses, in accordance with the IT Act. It is also important to assess whether expenses like interest paid on late advance tax payments are claimed correctly under the IT Act.

g. TDD issues w.r.t IDT: Under the Indian IDT regime, laws include GST, the Customs Act, VAT, and excise duty. IDTs vary by industry; for example, the manufacturing industry attracts excise duty, and imports/exports attract customs duty, affecting the final cost to the customer. TDD can uncover issues like the misclassification of goods under the Customs Act. Under GST, input tax credits on goods/services are allowed against output tax, but credits for goods/services used for exempt goods/services are not. TDD helps ensure correct classification, accurate customs duty assessment, and eligibility of input credits for payment of output tax liability, highlighting potential exposure from ineligible services.

Change in law as an impediment while conducting TDD

Unlike other legislation, the Indian taxation system, particularly various tax enactments, evolves frequently due to amendments and circulars issued by the CBDT or the Central Board of Indirect Taxes and Customs ('CBIC'). This constant evolution poses significant challenges during TDD. Some of these challenges include:

|

Change in Law |

Judicial Decisions |

Circulars Issued by CBDT and CBIC |

|

One of the primary issues that can impede TDD is the re-evaluation necessitated by changes in law. This involves determining whether the new provisions are retrospective or prospective. To address this, it is imperative to reassess the history of the provisions in light of the new laws. This helps in determining whether previous filings are now at risk of non-compliance and whether the proposed amendments could lead to future tax liabilities. |

Judicial decisions can cause impediments while performing TDD as they often stare decisis on several key issues. This often leads to certain disputes and subsequent litigations between corporations and Income-tax authorities. |

Circulars issued by the CBDT and CBIC are often directive in nature towards citizens. In the Indian Taxation system, these circulars are binding on both the authorities and the citizens, further complicating the TDD process. |

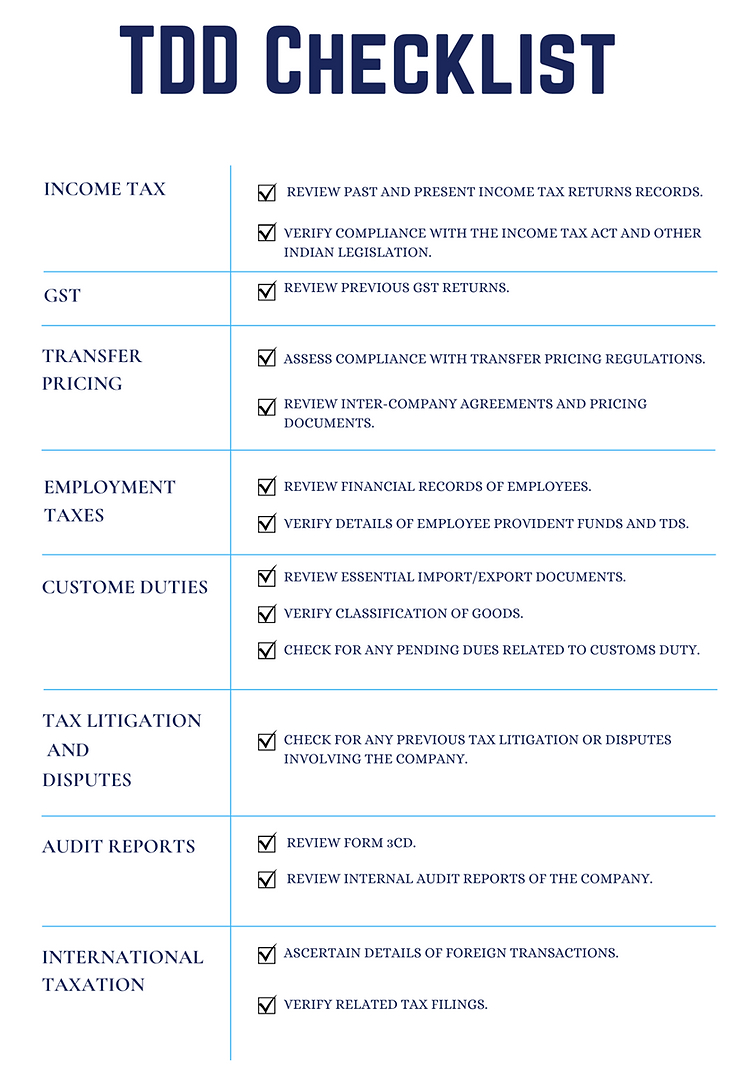

Sample Checklist of TDD

Consultants often prepare a checklist when performing TDD to maximise efficiency and minimise tax liability. The checklist can include the following items:

Conclusion

Tax plays a vital role during the M&A process and often becomes a deal-breaker. Hence, TDD plays a pivotal role in investment decisions. TDD involves a comprehensive investigation and analysis of the company's procedures, practices, and strategies under examination, depending on the scope and objectives of the work TDD. It addresses whether the seller/target company has paid all its tax dues. There is a trend among companies to carry forward net operating losses. TDD evaluates the carrying forward of losses and assesses the seller's tax liabilities. Thus, TDD, if done meticulously with extensive tax planning, can help the company mitigate tax liabilities and capture the maximum value of the deal.

Footnotes

2 [2017] 77 taxmann.com 188 (Article)

3 supra

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.