Introduction

In India, economic offences lack a precise legislative or judicial definition. The Hon'ble Supreme Court ('SC') has observed1 that economic offences have a very grave and serious impact on the economic status and mental health of the people at large. Time and again, the SC has also observed2 that economic offences need to be dealt with very strictly. These legal principles underscore the significance of economic offences and their potential impact on the nation. In response to such issues, the Parliament has enacted various statutes, rules, and regulations, one of which is the Foreign Exchange Management Act, 1999 ('FEMA'). FEMA regulates transactions of an economic nature. Central to the FEMA is s. 13, which mandates penalties for contraventions of its provisions, ensuring legal repercussions for violations.

From FERA to FEMA: Tracing the Transition Period

The Foreign Exchange Regulation Act ('FERA') was introduced in 1947 to address India's adverse balance of payments by strictly regulating foreign exchange ('forex') and securities transactions. As India's forex reserves grew with the economic liberalisation in 1991, FERA's stringent provisions became misaligned with the liberalising economy. Consequently, FERA was replaced by FEMA.

This shift from FERA to FEMA marked a significant change in India's approach to forex, from stringent control to effective management. FEMA aims to simplify and liberalise forex transactions, promoting orderly management, facilitating external trade, and regulating foreign payments. Unlike FERA, violations under FEMA are not criminal offences, which encourages the free flow of trade. FEMA focuses on specific transactions, introduces current and capital account transactions, reduces penalties, and ensures legal assistance for the accused.3 It applies to the entire country and has extra-territorial jurisdiction, ensuring comprehensive regulatory oversight for all forex transactions involving residents of India.4

In the case of Standard Chartered Bank v. ED5, the SC observed that FEMA/FERA aims to protect the country's economic interests by addressing violations that cause economic loss, ensuring the conservation and proper utilisation of forex resources for economic development. The legislative intent behind the 1973 Act, which replaced the 1947 Act and was included in the Ninth Schedule of the Constitution, is to treat any contravention seriously and hold those responsible accountable. Further, the Act serves a dual purpose: preventing economic loss through penalties after adjudication and deterring violations by imposing punishments after prosecution. The absence of a requirement for adjudication to precede prosecution indicates that the legislature intended these proceedings to be independent.

Thus, although this insight focuses primarily on the imposition of penalties, it is important to remember that an individual can simultaneously face both adjudication proceedings (which can result in penalties) and prosecution proceedings (which can lead to imprisonment).

Procedural Requirements under FEMA: Non-compliance Leading to Violations

Before moving forward, the Reserve Bank of India ('RBI') plays a crucial role as the principal regulator under FEMA, ensuring compliance and facilitating the act's objectives. It is empowered by s. 3 of the FEMA, the RBI regulates forex transactions, requiring permissions for dealings not covered by FEMA. The RBI also has regulation-making powers for various purposes, including defining permissible capital account transactions involving debt instruments, setting limits and regulations on forex transactions, prescribing declaration forms and repatriation procedures, setting possession limits for foreign currency and coins, determining limits and classes for holding foreign currency accounts, exempting and retaining acquired forex, managing currency import/export, and addressing other specified matters.6

A contravention under FEMA refers to any act of commission or omission that violates the provisions of the Act, rules, regulations, notifications, direction, or orders issued thereunder. FEMA mandates adherence to various critical compliances before, during, and after executing forex transactions. For instance, certain transactions necessitate obtaining approvals from the government or other authorities before the transaction is undertaken, such as when investments exceed the sectoral cap allowed by the RBI. Conducting due diligence and ensuring compliance with know your customer ('KYC') norms before making such transactions is also essential.

Adherence to prescribed limits and conditions under FEMA is crucial during the transaction. Transactions should be conducted through Authorised Dealer banks ('AD banks') recognised by the RBI to ensure proper recording and reporting. Maintaining accurate and complete documentation, including contracts, invoices, and bank statements, is vital to demonstrate compliance and facilitate any required communications with regulatory authorities.

After the transaction, entities must fulfil reporting requirements, such as submitting necessary reports to the RBI, including the Foreign Currency-Gross Provisional Return ('FC-GPR') within 30 days of allotment, filing Foreign Currency Transfers ('FCTRS') with AD banks within two months of the transfer of shares, and submitting the annual return on Foreign Liabilities and Assets ('FLA'). Post-transaction obligations are essential, such as regular reporting and maintaining documentation for potential audits. Ensuring that the remittance of funds complies with FEMA regulations and adhering to applicable tax laws in India are critical to avoiding legal issues and penalties. By following these steps, entities and individuals ensure their forex transactions are legally compliant and efficiently managed.

However, if any of such compliances are not followed, under s. 13 of the FEMA, the alleged contravention shall be subjected to the imposition of penalties. It provides that any person contravening the provisions of FEMA is liable, upon adjudication, to a penalty of up to three times the sum involved in the contravention if the amount is quantifiable or up to Rs. 2 lakhs if the amount is not directly quantifiable. Additionally, there is a further penalty of up to Rs. 5 thousand per day for continuing contraventions after the first day.

Commencement of Penalty Proceedings: Ensuring Procedural Fairness & Documentation in FEMA Adjudication

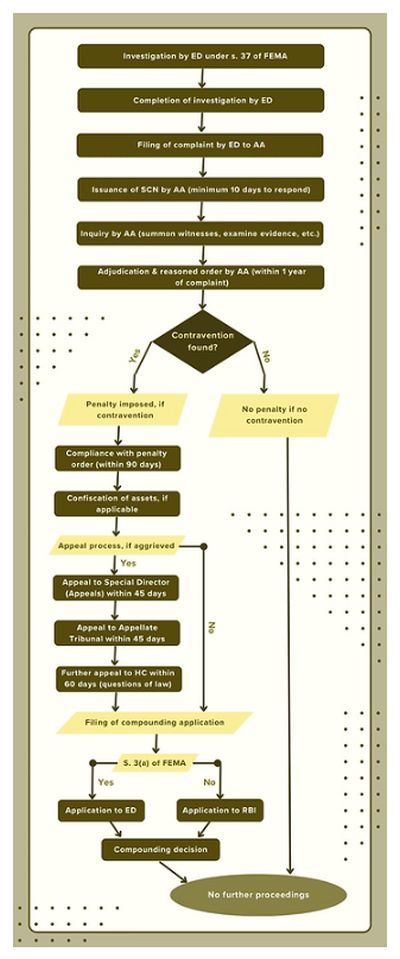

The adjudication process under FEMA involves the appointment of an Adjudicating Authority ('AA') tasked with conducting inquiries into contraventions. Governed by the FEM (Adjudication Proceedings and Appeal) Rules, 2000 ('Adjudicating Rules'), the AA initiates proceedings upon receipt of a complaint from the Directorate of Enforcement ('ED') following an investigation into alleged contraventions.

Under s. 37 of the FEMA, the ED, led by officers not below the rank of Assistant Director, undertakes investigations into contraventions specified under s. 13 of FEMA. These investigations are empowered with provisions analogous to those under the Income-tax Act, 1961 ('IT Act'), including the authority to conduct searches, seize assets, and summon individuals for statements.

Once the ED completes its investigation and gathers sufficient evidence, it files a written complaint to the AA.7 This complaint outlines the nature of the contravention and presents the findings and evidence collected during the investigation, prompting the AA to initiate adjudication proceedings. However, it is pertinent to note that the ED's complaint must be based on valid grounds; otherwise, no penalty shall be sustained. For instance, in Arun K. Maitra & Ors v. ED8, the petitioners argued that the ED's complaint misrepresented compliance responsibilities for payments over 5000 USD and contradicted a Central Bureau Investigation ('CBI') report. They sought dismissal on grounds of concealed facts and lack of linkage between allegations and findings. The Court dismissed the complaints, ruling that the ED had deliberately ignored the CBI's investigation, wherein no such contraventions were found.

Upon receiving the complaint, the AA issues a show-cause notice ('SCN') to the accused party, providing a minimum notice period of ten days to respond. The notice details the alleged contravention and allows the accused to present their case personally or through legal representation. During the inquiry, the AA may summon witnesses, call for evidence, and examine relevant documents to ascertain the facts of the case.9 The AA must dispose of the complaint within one year from the date of receipt of the complaint.10

In Natwar Singh v. ED & Anr.11, the SC addressed whether, in the absence of a specific mandate in the Adjudicating Rules regarding the supply of documents with the SCN, the AA is required to provide a list and copies of the documents relied upon to issue notice. It was held that fairness and the principles of natural justice necessitate the AA to furnish these documents to the noticee. This enables the noticee to properly defend themselves and present reasons why an inquiry under s. 16 of the FEMA should not be initiated. The SC emphasised that such a requirement is inherent in the Adjudicating Rules, ensuring a fair procedure without contradicting statutory provisions.

Adjudication & Penalty Imposition under FEMA: Proportionality, Enforcement & Appellate Remedies

If, upon review of the evidence and after considering the defence presented by the accused, the AA determines that a contravention under s. 13 of the FEMA has occurred, it issues a reasoned order imposing a penalty. The penalty amount varies based on factors such as the nature and gravity of the contravention, the duration of non-compliance, financial implications, and any mitigating or aggravating circumstances.

Paragraph 7.4 of the Master Direction12 on compounding of contraventions under FEMA provides a guidance note on the penalty computation matrix. These guidelines ensure a proportionate and fair approach to penalty imposition, aligning with the judicial principles of proportionality and fairness outlined in relevant legal precedents.

In Jaipur IPL Cricket Pvt. Ltd. & Ors v. The Special Director, ED Mumbai13, the Appellate Tribunal observed that the principle of proportionality must guide penalties. For instance, penalties for procedural violations are typically less severe compared to violations involving mens rea. In this case, the Tribunal reduced initially imposed penalties, highlighting certain individuals' lack of direct involvement in the contraventions, absence of loss to the exchequer, and intended use of funds in India. It applied the principle of proportionality and settled on a penalty of Rs. 15 crores, 50% of the remitted amounts. The Bombay High Court ('BHC') upheld this decision.14

Additionally, in Excel Crop Care Limited v. Competition Commission of India & Ors.15, the SC provided a two-step formula for determining the quantum of penalties imposed by authorities: considering relevant turnover and aggravating/mitigating circumstances. In Suborno Bose v. ED16, the SC clarified that contraventions under s. 10(6) of FEMA as a managing director are continuous actionable violations, implying ongoing non-compliance until corrective measures are taken. Penalties for such contraventions aim to remedy revenue loss and are civil obligations distinct from criminal offences. Therefore, mens rea or criminal intent is not essential for imposing penalties under FEMA's civil obligations.

In Union of India v. Kaluram B.17, the Appellate Tribunal addressed an appeal against a FEMA penalty for outward remittances without corresponding imports. Despite upholding the contravention charges, the Tribunal emphasised that s. 13 of FEMA allows the AA discretion to impose penalties judiciously based on the circumstances of each case. This discretion includes the authority's ability to levy penalties below the maximum prescribed limit, ensuring flexibility in penalty imposition under FEMA.

While s. 13 of the FEMA stipulates penalties on individuals, s. 42 of the FEMA extends liability for contraventions to directors and functionaries of companies. They are categorised as either vicarious or original—vicarious if they were in charge during the contravention and original if based on their acts, consent, or neglect. These provisions ensure that companies, directors, and officers are held accountable for FEMA compliance.

Upon issuance of a penalty order, the accused must comply with payment within 90 days. Failure to do so may result in civil imprisonment.18 Additionally, the AA may order the confiscation of currency, securities, or other assets involved in the contravention and direct repatriation or retention of forex holdings as per regulatory directives.19 Parties aggrieved by the AA's final order can appeal within 45 days to the Special Director (Appeals) if the authority is of Assistant Director or Deputy Director rank.20 Appeals from higher-ranking authorities go to the Appellate Tribunal,21 with further appeals on questions of law to the High Court within 60 days of receiving the order.22

Compounding Rules under FEMA: RBI's Regulatory Framework & Implementation

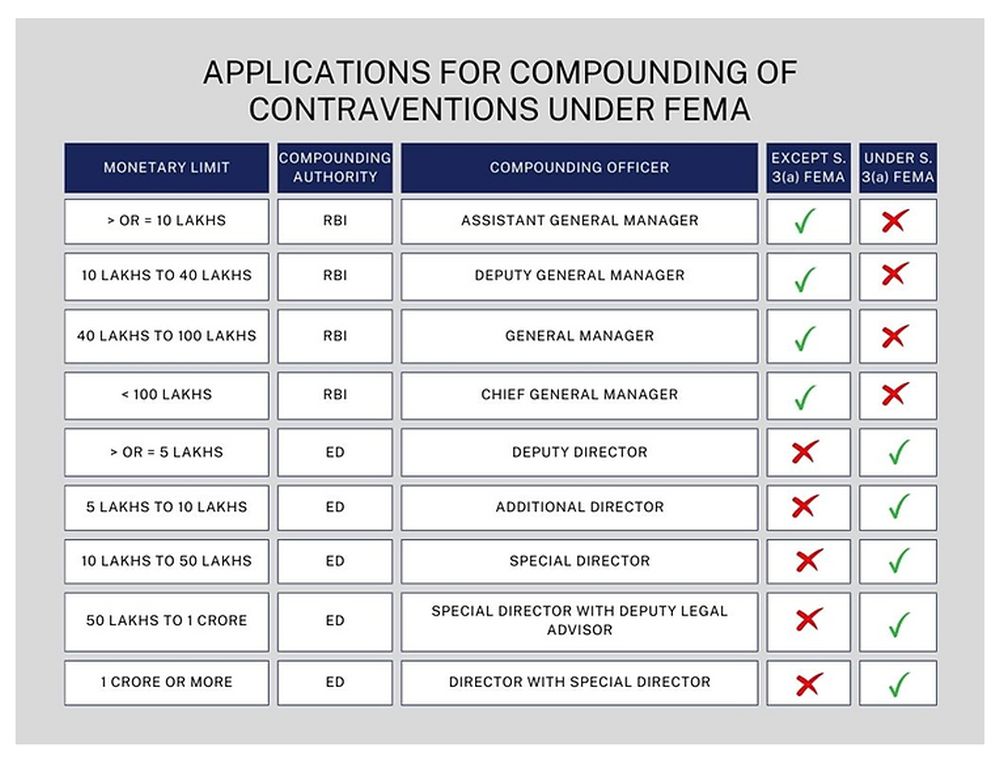

S. 15 of the FEMA empowers the ED or authorised officers to compound contraventions, resolving cases through monetary fines without further proceedings. The Forex (Compounding Proceedings) Rules, 2000 ('Compounding Rules') explain the compounding process, categorising monetary limits for different authorities based on contravention severity.

Under r. 4 of the Compounding Rules, applications for contraventions excluding those under s. 3(a) of the FEMA must be made to the RBI. The application is processed by different RBI authorities depending on the monetary amount involved, while R. 5 of the Compounding Rules covers contraventions under s. 3(a) of the FEMA, requiring applications to be made to ED officers, with similar categorisation based on monetary limits.

Applications under these rules must include a fee and relevant documents, with decisions expected within 180 days.23 Serious contraventions like money laundering, terror financing, or those affecting national security, sovereignty, and integrity cannot be compounded and are remanded back for adjudication. However, communication from the ED to the RBI must be clear rather than vague and ambiguous in addition to being supported by authentic materials. In NDTV v. RBI24, the BHC rejected the ED's request to stop compounding proceedings against NDTV due to the lack of authentic material. The Court emphasised the necessity for clear and substantiated communication from the ED to the RBI.

Furthermore, in Brentfield Travels Co. Pvt. Ltd v. RBI & Anr.25, the BHC held as follows: "The power to compound has to be exercised judiciously, considering the factors outlined in the statute and the circular issued by the Reserve Bank of India. There is no absolute right to claim a compounding of contraventions. It is for the Competent Authority to decide whether the contravention is of a technical nature or involves broader issues such as national security, money laundering, or serious infringements, in which case compounding cannot be allowed."

Contraventions under FEMA are classified into three categories:

- Sensitive contraventions: Involves suspected money laundering, terror financing, or actions affecting national sovereignty.

- Substantive contraventions: Significant violations requiring compounding procedures as per regulations.

- Technical contraventions: Less severe violations are typically identified by the RBI or brought to its attention by the involved entity, often through means other than the prescribed compounding application.

In November 202026, the RBI made a pivotal regulatory change regarding compounding by abolishing the differentiation between substantive and technical contraventions under FEMA. The circular stated that the RBI would no longer classify contraventions under FEMA as 'technical.' Instead of handling these through administrative or cautionary advice, the RBI will now impose a minimal compounding amount based on the guidelines in the Master Direction (supra) on compounding of contraventions. This strategic decision aimed to instil uniformity in managing contraventions, ensuring that all breaches are subject to consistent scrutiny and enforcement measures. By eliminating this distinction, the RBI sought to minimise ambiguity and ensure a streamlined approach to handling contraventions, thereby enhancing the overall regulatory framework. However, despite this circular, the distinction between substantive and technical contraventions still persists in practice.

Conclusion

The penalty framework under FEMA is meticulously designed to regulate and enforce forex transactions in India. Transitioning from the earlier FERA to the current FEMA, India has shifted from strict controls to a more liberalised approach, aligning with global economic trends while safeguarding national interests. The adjudication process, overseen by the AA with support from the ED, prioritises transparency and accountability, ensuring fair inquiry and penalty imposition, which is crucial for upholding regulatory effectiveness and public trust.

Furthermore, the compounding of contraventions under FEMA provides a structured mechanism for efficiently resolving cases, encouraging compliance through monetary fines and corrective actions. As the primary regulatory authority, the RBI plays a pivotal role in facilitating forex transactions while maintaining economic stability. Simultaneously, the ED focuses on enforcing compliance, particularly in cases involving serious contraventions like money laundering and terror financing. This collaborative approach between regulatory oversight and enforcement ensures a balanced regulatory environment, supporting economic growth while deterring illicit financial activities.

In essence, FEMA's penalty proceedings underscore India's commitment to fostering a conducive environment for forex transactions amid global integration. The legal framework, bolstered by clear regulations and procedural integrity, enables FEMA to adapt to evolving economic challenges while maintaining stringent oversight to safeguard national interests. As India continues its journey in the global economy, FEMA remains pivotal in regulating forex transactions with principles of fairness, proportionality, and effective enforcement at its core.

Footnotes

1. Suresh Thimiri v. The State of Maharashtra, (2016) SCC OnLine (Bom.) 2602.

2. P Chidambaram v. ED, (2019) 9 SCC 24.

3. S. 13, FEMA; s. 56 FERA.

4. Preamble, FEMA; s. 1, FEMA.

5. (2006) 4 SCC 278.

6. S. 46, FEMA.

7. S. 16, FEMA.

8. CRL.M.C. 3003/2002 (Delhi High Court, 09.03.2016)

9. R. 4, Adjudication Rules.

10. S. 16(6), FEMA.

11. (2010) 13 SCC 255

12. RBI/FED/2015-16/1; FED Master Direction No. 4/2015-16, dated: 01.01.2016.

13. MP-FE-327/MUM/2018 (Stay) In FPA-FE-9/MUM/2013.

14. [2023] 157 taxmann.com 283 (Bombay).

15. (2017) 8 SCC 47.

16. (2020) 14 SCC 241.

17. [2023] 152 taxmann.com 144 (FEMA-AT, New Delhi).

18. S. 14(1), FEMA.

19. S. 13(2), FEMA.

20. S. 17, FEMA.

21. S. 19, FEMA.

22. S. 35, FEMA.

23. R. 8, Compounding Rules.

24. 2018 SCC OnLine Bom 1309.

25. Writ Petition No. 1777 of 2011(BHC - 23.09.2011).

26. RBI/2020-21/67 A.P. (DIR Series), Circular No. 06, dated: 17.11.2020.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.