Due diligence ('DD') is a multifaceted process that requires a methodological approach, essential for Mergers & Acquisitions ('M&A') to make informed decisions. It involves in-depth analysis of the financial and legal documents of the target entity, involving substantial sums of money and significant man-hours.

It is imperative that this procedure is completed within a specified time frame, as any delay can hinder the timely conclusion of the transaction. However, a promising solution on the horizon – the automation of the DD - will ensue before any M&A transaction reaches finality. Artificial intelligence ('AI') has the potential to revolutionize the world and can be harnessed to analyze documents and assist in the DD process. It has already streamlined the DD process and has facilitated M&A transactions all over the world. This article provides insight into the necessity of automation of DD and the transformative role AI can play in this process.

Introduction To DD

DD is a crucial step in any M&A transaction, with the potential to make or break the deal. While it may be referred to as a single step in the realm of M&A, in reality, it encompasses multiple types and stages, culminating in a conclusive report that plays a pivotal role in facilitating investment decisions. This conclusive report, often known as a DD report, includes an in-depth analysis of the documents and financial position of the target company. It forms the basis for future negotiations, underlining the significance of your role in the process.

DD requires the meticulous analysis of data, encompassing financial and legal documents, from the business plan to the regulatory checklist of a company. Consequently, the volume of data that needs to be scrutinized is generally substantial. Every document must be examined with great diligence; otherwise, the entire exercise may fail to achieve the desired outcome, which is a clear and comprehensive understanding of the affairs of the target company. It is imperative that the DD exercise is concluded within a specific time frame; otherwise, it can hinder the decision-making process, emphasizing the importance of your diligence in the process.

The voluminous nature of the data and the need for great diligence make DD a very time-consuming and costly affair for the investing company. However, missing any document in the process may defeat the whole purpose of this exercise, making automation of DD a crucial requirement.

Automation Of DD

With the advent of information technology, corporations increasingly rely on various technological tools to address their challenges. Data requiring a substantial number of man hours can be analysed within a short span of time, provided the correct tools or operations are utilised. DD's automation encompasses applying appropriate tools or operations and utilising AI and other ancillary software. This advanced approach enables autonomous data analysis with minimal human intervention.

Benefits Of Automation

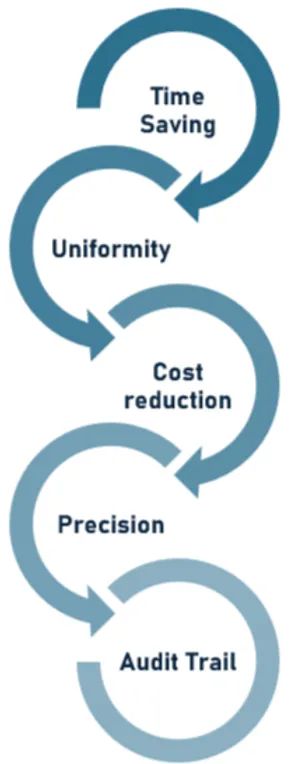

Automation of DD can benefit the investor and facilitate the investment decision in the following ways:

- Time-Saving: Automation of DD significantly reduces the time required to conclude the process. Automated operations and tools can expedite decision-making and thus save valuable time.

- Uniformity: By employing standard procedures and algorithms, every aspect of the evaluation can be treated equally. Consequently, automation can bring consistency and uniformity to the DD process.

- Cost Reduction: Automation leads to substantial cost savings by cutting down the time required to analyse the various aspects of an investment decision, thereby reducing the man-hours required to conclude the process.

- Precision: With Automation, a large volume of data can be easily analysed without any chances of human errors. This enhances the reliability of the DD report by ensuring that all relevant information is thoroughly examined.

- Audit Trail: The software or system employed to automate the DD procedure can maintain a trail of actions undertaken during the DD process, making it easier to trace the origin of errors or discrepancies. Consequently, this facilitates the corrective actions required to rectify such errors.

AI

AI 'is the science and engineering of making intelligent machines, especially intelligent computer programs,' with 'intelligence' being 'the computational part of the ability to achieve goals in the world.1' If used correctly, AI has the capability to revolutionise the world. The application of AI in individuals' daily lives has proliferated in recent years. For instance, we rely on GPS guidance for our daily commute.

The AI model comprises of three components – the model, the input data which is required for the learning process and the software on which it is programmed.

Niti Aayog, in its report2, has discussed the impact and future of AI in the Indian economy. However, legal jurisprudence in relation to AI and its implications is still in its nascent stages, and no laws have been passed to recognise or regulate the use of AI.

Branches Of AI

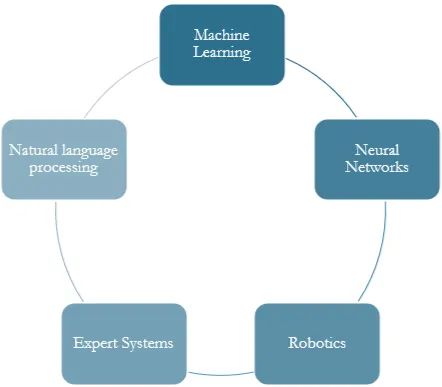

AI has various branches, which include the following:

- Machine Learning ('ML'): It has been defined as the - 'field of study that gives computers the ability to learn without being explicitly programmed3.' ML involves learning and processing data to enhance user experience. The application of ML can be observed in chatbot robots and predictive texts.

- Neural Networks/Deep Learning ('DL'): It is a branch of AI that is inspired by neuroscience; it mimics the neural networks of the brains and strives to achieve similar results. The function of DL is similar to ML, with a difference in the learning process. DL requires lesser human intervention and large volumes of data.

- Natural Language Processing ('NLP'): The computers can process the written or spoken words and process the same for an outcome. It combines linguistics with AI, processes the data input by the user, and presents the outcome in the form of an answer or action. For example, Alexa can process the words the user speaks and may play a song as an outcome. Large Language Models ('LLM') are a subset of NLP, which are trained to process large amounts of data.

- Robotics: It is a science wherein machines are preprogrammed to act in a certain way and fetch specific results for the user as the humanoid robots in Japan, with the help of AI, can process the data input by the user and answer the questions asked to it or perform the task according to the instructions.

- Expert Systems: It is a branch of AI that learns through the input of knowledge of human experts, which then processes any data input on the basis of such expert knowledge.

AI & DD – Can AI Assist With DD?

The outcome received by the user is contingent upon the relevance and veracity of data provided to the AI tool. The AI tool processes the data in accordance with the algorithms and presents an outcome to the user. The DD exercise aims to analyse large volumes of data and present a detailed DD report to the investing company for further analysis. As stated above, automation can analyse the data speedily and precisely.

Computer systems can learn and process input data, thereby assisting with DD. Through the application of ML, DL and expert systems, the AI tool may be able to enhance and automate various aspects of legal DD.

- When applying expert systems in DD, the AI tool can be trained to function similarly to a human expert by learning from the expert's knowledge. The tool can then analyse the documents and prepare conclusions on the basis of such knowledge.

- In the Application of ML/DL, the AI tool learns from user-input data and analyses it according to the set algorithms and functions. The AI tool can then prepare detailed analyses or forecasts on the basis of such data.

- In applying NLP & LLM, the AI tool can extract valuable information from financial or legal documents for further analysis, such as contractual agreements with third parties. The application of NLP & LLM can extend to report writing in DD.

Existing Software

It has been observed that AI tools are currently being used by law firms/organisations worldwide to automate the DD process. The following is a brief illustration of how such software has assisted in the automation of the DD process:

- Kira: It is a Canada-based company. With the application of ML, its AI tool can extract and analyse relevant information from legal or financial documents, which are widely used in M&A transactions.

- Xapien: It is a UK-based company that has streamlined the application of AI in the legal field. Its AI tool covers initial and in-depth DD, efficiently identifying low- or high-risk documents in shorter timeframes. This capability significantly reduces the man-hours and costs traditionally associated with the DD process.

- Harvey AI: It is a legal AI platform based in the US. It analyses documents, aids in legal research, answers questions and drafts legal documents. Harvey aims to streamline and enhance various aspects of legal practice through its versatile AI capabilities.

- Mindbridge.ai: It is an Indian Company; its AI tool can analyse financial documents to detect anomalies. It may not entirely automate the process; however, it can assist in the process.

Conclusion

DD requires the analysis of voluminous data, which can be streamlined with the help of AI tools. It has been observed that AI tools such as Kira, Xapien, and Harvey have been employed globally and have successfully automated the DD process. Thus, the question of whether the automation of DD in M&A transactions is possible can be answered in the affirmative.

However, the legal jurisprudence on the application of AI is still in its nascent stages, and it remains unclear whether the advice rendered by AI can form the basis of legal advice. It is essential that AI tools are equipped with the requisite knowledge and that legal and financial experts oversee the process. This ensures that the automated insights are appropriately interpreted and applied within the legal framework.

Footnotes

1. Report of The Artificial Intelligence Task Force.

2. National Strategy for Artificial Intelligence Report 2018.

3. Arthur Samuel in 1959.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.