The Central Board of Indirect Taxes and Customs (CBIC) issued various circulars to clarify the recommendations made in 53rd GST Council meeting. Please find below a summary of the important clarifications issued vide such circulars:

A) Circular No. 207/1/2024-GST

In line with the objectives of the National Litigation Policy to optimize the utilization of judicial resources, the following monetary limits have now been set for filing appeals/applications/SLPs by the GST department before the GST Appellate Tribunal (GSTAT), High Courts and Supreme Court:

The Circular also attempts to discourage the filing of such appeals, considering these are merely filed because the disputed amount involved in the matter breaches the above threshold.

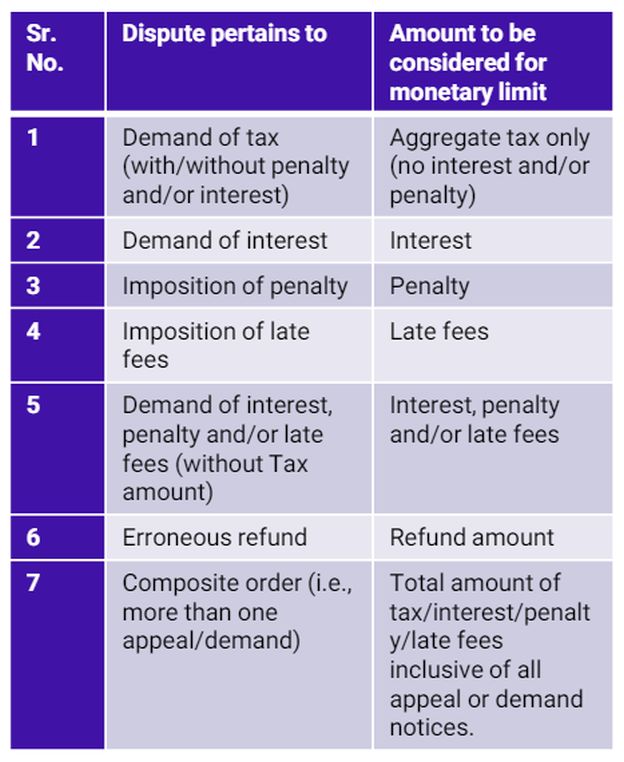

For the purpose of determining the monetary limit, whether a case falls within the above monetary limits or not, the following principles are to be considered:

As an exception, tax authorities may still file an appeal/application/SLP disregarding the monetary limits in the following cases:

- Where any provisions of the GST Act are held to be ultra vires to the Constitution of India, or any Rules, Regulations, Order, Notification, Instruction, or Circular under the GST Act are held to be ultra vires the parent Act;

- Matters pertaining to valuation, classification, place of supply, refunds, or topics of recurring nature;

- Where the Government/Department or their officers have either been criticized and/or cost has been imposed against them;

- Any other case(s) that CBIC may deem necessary to contest in the interest of justice or revenue.

The Circular further clarifies that non-filing of appeal/application/SLP due to the given threshold of amounts should not restrict the department from filing appeals in other cases where the amounts breach the given threshold.

Our Comments

The aforesaid clarifications bring a sigh of relief to taxpayers who can now be assured that unless there is a breach of the given thresholds, the chances of authorities appealing against a favorable order will be relatively less. This will also help reduce the burden on appellate authorities and courts, thereby further helping smoothen the GST litigation process. Certainly, the exception criteria come to aid tax authorities and may slightly pose worry for taxpayers if used with a prejudicial mindset.

In addition, the current limits closely align with those from the pre-GST era (except at Tribunal level where the limits are further reduced instead of increasing), which are now seven years old. Given the passage of time, it would have been beneficial to raise these limits further, ultimately aiding in the goal of minimizing legal disputes and optimizing resource utilization.

B) Circular No. 208/2/2024-GST

A special procedure was notified vide a Notification No. 30/2023 – Central Tax dated 31 July 2023 in case of registered persons engaged in the manufacturing of goods notified in the schedule thereto. The said Notification was subsequently repealed in January 2024 and a revised procedure was subsequently introduced vide Notification No.04/2024- Central Tax.

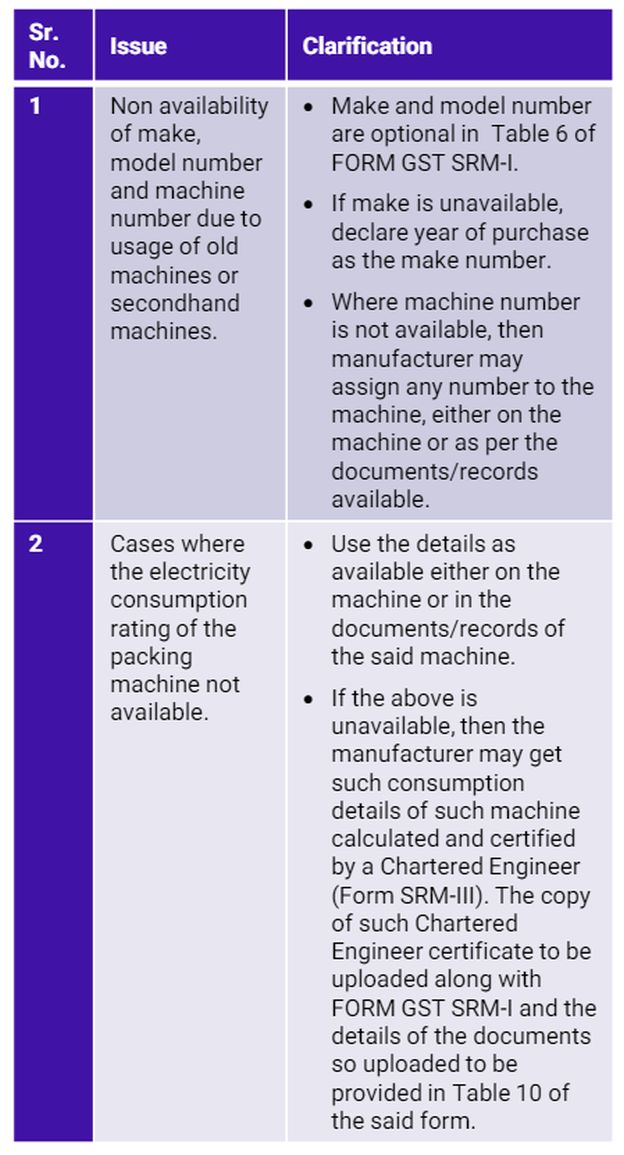

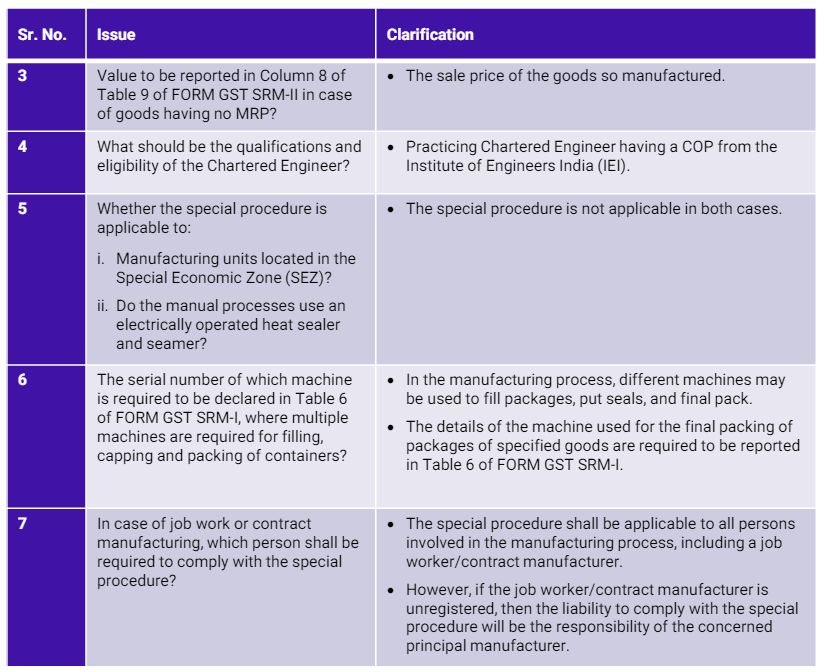

This Circular clarifies various queries raised by trade associations as follows:

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.