The ESAs call for a coherent sustainable finance framework which caters for green transition and investor protection, while addressing identified SFDR shortcomings. Recommendations include a categorisation system and/or sustainability indicator to enhance the transparency and clarity of sustainable products and related disclosures.

Context

On 18 June 2024, the three European Supervisory Authorities (EBA, EIOPA and ESMA, together the ESAs), acting on their own initiative, published Joint Opinion on the assessment of the Sustainable Finance Disclosure Regulation (SFDR) (Joint Opinion). It follows the public and targeted consultations launched by the EU Commission in September 2023 with the objective of gathering input on the issues around the implementation and functioning of the SFDR.

As the market waits for the endorsement of the ESAs' Final Report on the review of the SFDR Delegated Regulation the Joint Opinion appears amid a broader evaluation of the EU's sustainable finance framework.

Key points

The Joint Opinion provides policy recommendations to eliminate the risk of misuse of the SFDR. Its main focus points are (i) introduction of a categorisation system and/or an indicator of sustainability, (ii) review of the key parameters underlying the definition of 'sustainable investment' under Article 2(17) of the SFDR, (iii) expansion of the SFDR's scope to include additional financial products, (iv) simplification of product pre-contractual disclosures, and (v) improvements to the principal adverse impacts disclosure framework. In addition, the ESAs suggest a number of technical changes. Throughout their recommendations, they strongly urge the EU Commission to undertake consumer testing when developing policy options.

The ESAs' main recommendations include:

- A product classification system based on

regulatory categories and/or a sustainability

indicator, to assist consumers in navigating the wide

array of sustainable products:

- The categories should be straightforward with

clear objective criteria or

thresholds to determine the appropriate category for each

product. The ESAs suggest, as a baseline, two categories:

"sustainable" and

"transition".

For products that do not qualify for these categories, the ESAs suggest dividing them into (i) financial products that have certain sustainability features and (ii) those that do not have any sustainability features. - Instead or on top of a categorisation system, a sustainability indicator could signify a certain level of environmental sustainability, social sustainability or both, providing investors with a scaled representation of a product's sustainability features (similar to the Nutri-Score system for food products).

- The categories should be straightforward with

clear objective criteria or

thresholds to determine the appropriate category for each

product. The ESAs suggest, as a baseline, two categories:

"sustainable" and

"transition".

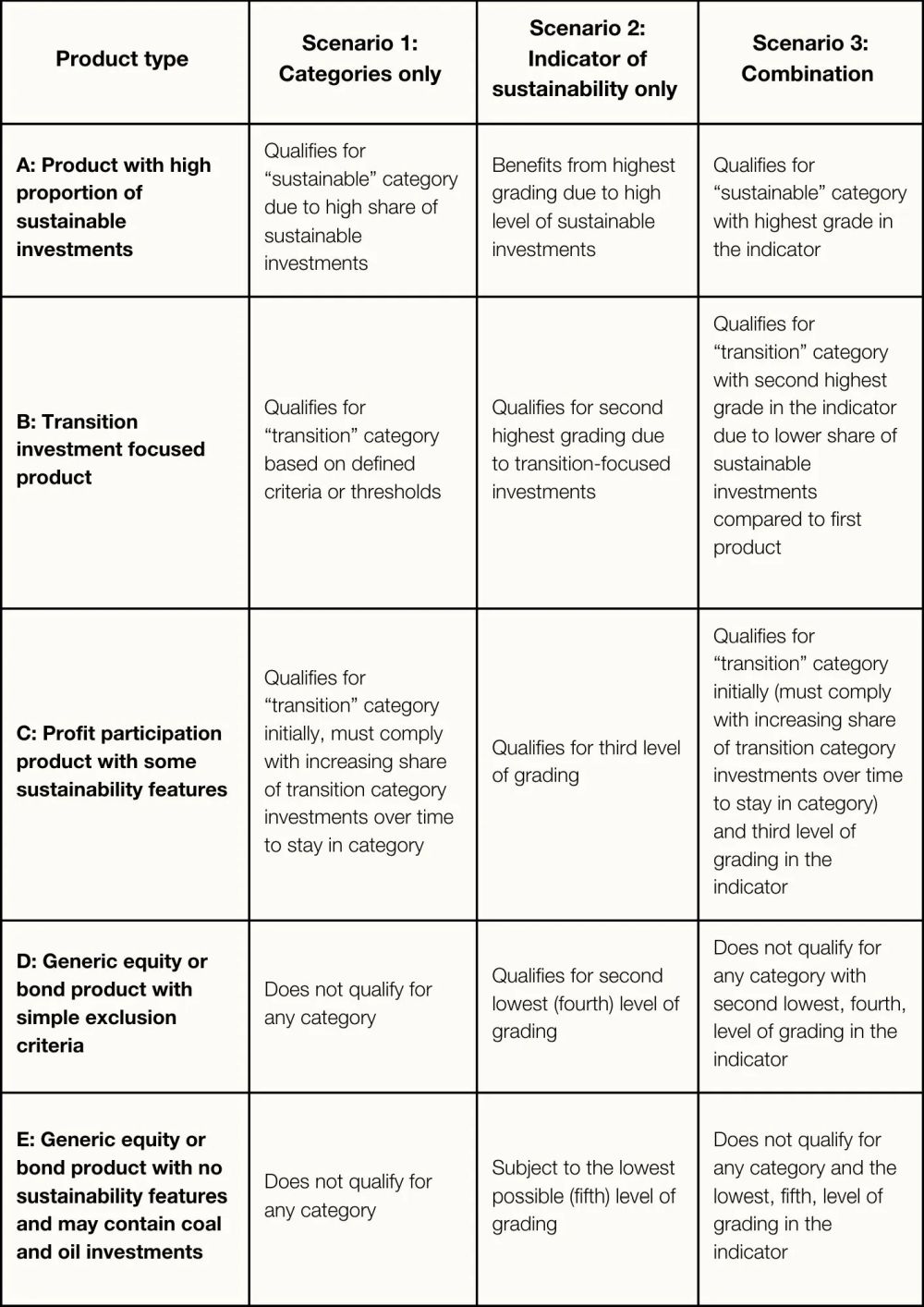

Integrating the above points, the ESAs outline the potential treatment of different types of hypothetical financial products under three scenarios:

The ESAs also suggest that the EU Commission take the following actions:

- Consider making the key parameters underpinning the definition of "sustainable investment" under Article 2(17) of the SFDR more prescriptive, to ensure a uniform application of the concept of "sustainable investment" across the market.

- Reflect on the coexistence of the two parallel concepts of "sustainable investment" as defined in the SFDR and the EU Taxonomy and clarify the relationship between the two definitions. According to the ESAs, the EU Commission should focus on completing the EU Taxonomy and expanding it to include social sustainability.

- Ensure that sustainability disclosures meet the diverse needs of investors, with simplified disclosures for retail investors and more complex information for sophisticated investors. The format of these disclosures should be adapted to the increased digital consumption of the information.

- Consider expanding the SFDR's scope to include additional products currently exempted from the regulation, to ensure harmonised and comparable sustainability-related disclosures.

- Clarify the disclosure requirements for principal adverse impacts (PAIs).The consideration of all or a portion of the PAIs in Annex I SFDR RTS could be made mandatory for financial products qualifying for the sustainable or transition product category, while other financial products would be subject to minimal disclosures about key PAIs, based on a cost-benefit analysis justifying such a requirement.

- Evaluate introducing a framework to assess the sustainability features of government bonds, taking into account the specific characteristics of that asset class.

In addition to the above policy considerations, the ESAs suggest a number of technical amendments for the EU Commission to take into account when revising the SFDR. Among others, these relate to the interaction between entity-level disclosure requirements under the SFDR and CSRD and the harmonisation of the content and presentation of website disclosures pursuant to Article 10 of the SFDR. The full list of suggestions is in Annex I of the Joint Opinion.

Access the ESMA press release here

Make sure you are one step ahead of the game and get in touch with your usual Arendt contact person for help and advice on how to tackle the implications of these changes for your sustainability-related reporting, operations and strategy.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.