1. Executive Summary

This legal and regulatory study was commissioned by the International Sustainable Finance Centre of Excellence ("ISFCOE") to assist in the update of the National Sustainable Finance Roadmap (the "Roadmap") in 2023. The content of this study was a critical input in the updated Roadmap. This study is an update and progress report on the report titled "Ireland as a Global Centre of Excellence for Sustainable Finance – Legal and Regulatory Report" produced in 2021 (the "2021 Report").1

We provide an overview of the global legal and regulatory landscape (Section 3), an update on European and Irish legal and regulatory developments since the 2021 Report (Sections 4 and 5 respectively) and outline pending and possible future developments with respect to sustainable finance (Section 6). Sections 7 and 8 examine the opportunities and challenges for Ireland as a centre of excellence for sustainable finance. In Section 9, we comment on the progress made with respect to the recommendations made in the 2021 Report and we identify next steps and further implementation efforts to advance the progress made in building Ireland's reputation as a leader in sustainable finance.

The sustainable finance legal and regulatory framework is evolving at pace, with all stakeholders being required to adapt quickly to new rules, often in the absence of finalised legal requirements and regulatory guidance at European Union ("EU") or national level to assist with compliance. The EU's highly ambitious legislative programme in this area, combined with delays in the legislative process, has presented challenges to stakeholders, who must contend with a complicated matrix of requirements. There is an ongoing lack of clarity in relation to key concepts such as the definition of "sustainable investments". Many of the interpretation issues arise at EU level, making engagement at EU level essential to ensure that the issues are identified and adequately addressed. There may also be scope for further guidance and clarity from the Central Bank of Ireland ("Central Bank") relating to its expectations on implementing the various legislative requirements. It is necessary to understand the overall legal and regulatory context and the challenges facing market participants in order to identify measures that can be taken to maintain Ireland's position as a centre of excellence for sustainable finance.

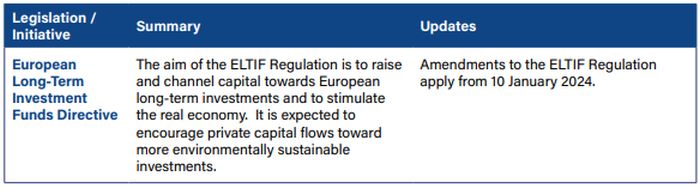

Underlining the constantly evolving nature of the sustainable finance framework, we have outlined in the table in Figure 1 some key upcoming legal and regulatory developments. These developments are examined in further detail in section 6 (Horizon Scanning).

Figure 1 Summary of upcoming legislative and regulatory developments

The inter-relationship between the various legislative initiatives must also be understood, as the disclosure requirements applicable to many financial market participants, for example, cannot be viewed in isolation from the reporting requirements of their underlying investee companies. The misalignment between the timing of the application of disclosure and reporting requirements, as well as a lack of consistency and coherency between third-party data providers, has led to significant data gaps and data challenges for market participants.

Continued government impetus to build on the outstanding success of financial services in Ireland to date has sustained the focus on innovation in the international financial services sector, backed by sound and prudent regulation. Ireland's coherent, consistent and reliable policy and regulatory framework means that Ireland is well-positioned to take advantage of opportunities presented by sustainable finance and to maintain and develop its reputation as a location of choice for domiciling and distributing sustainable financial products that meet growing investor demand for sustainable solutions. Ireland is internationally recognised as one of the world's most advantageous jurisdictions in which to establish international investment funds and is the jurisdiction of choice for the establishment of special purpose vehicles for a variety of debt issuance transactions.

In light of the inter-relationship between sustainable finance legislative initiatives and the impact of the sustainable finance agenda across various government departments, a holistic, multi-disciplinary, cross-governmental approach best utilises the opportunities and addresses the challenges presented by the sustainable finance agenda. Ensuring that our regulators and representatives have a prominent place in international fora discussing sustainable finance matters will afford an opportunity to input on and shape the agenda and ensure that Ireland has a leadership role in the development of legal and policy initiatives.

Ongoing constructive engagement with stakeholders' systemic knowledge development and addressing the evolving competencies required of regulators, senior managers, those making investment decisions and giving financial advice and service providers, including legal professionals, will also play a role in developing Ireland's leadership status in relation to sustainable finance.

2. Introduction

This study is one of a number of studies commissioned by the ISFCOE to assist in the update of the Roadmap. The Roadmap, first published in October 20212 sets out targeted measures with a view to Ireland being a leading sustainable finance centre, informed by extensive research and stakeholder engagement. The 2021 Roadmap outlined how public-private sector collaboration can develop talent, prepare industry, leverage digital solutions, enhance the enabling environment, and promote and communicate Ireland's sustainable finance priorities and capabilities.

We will examine the legal and regulatory landscape, opportunities and challenges in sustainable finance and how Irish laws, regulations, guidance and policies might exploit those opportunities and address those challenges and successfully and efficiently implement EU level initiatives. This study builds upon the 2021 Report. An overview of the legislative and regulatory changes since the publication of the 2021 Report is included in Section 4 (Update on European Developments).

Impetus for financial services markets to help combat climate change has come from a series of global and EU initiatives derived principally from the United Nations Sustainable Development Goals ("SDGs")3 and the 2015 Paris Agreement (the "Paris Agreement")4 which indicated that the ability to meet the targets set out in those initiatives was dependent on "making finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development".

The EU has outlined that it will need additional investments of around €700 billion every year to meet the objectives of the European Green Deal. The objective of the European Green Deal is to transform the EU into a modern, resourceefficient and competitive economy, ensuring no net emissions of greenhouse gases by 2050, economic growth decoupled from resource use and no person and no place left behind. The bulk of the required investment will have to come from private funding.5 Sustainable development is a core principle of the Treaty of the European Union and a priority objective for the EU's internal and external policies.

In light of these objectives and the EU's international commitments, the EU published a Sustainable Finance Action Plan in March 20186 and a Renewed Sustainable Finance Action Plan in 20217 (the "Action Plan") with a view to reorienting capital flows towards a more sustainable economy. Various legislative initiatives have been adopted under the Action Plan, including the SFDR,8 the EU Taxonomy9 Regulation and the EU Green Bond Standard ("EUGBS").10

Investor preferences are also changing in line with increased public awareness of the climate crisis. Morgan Stanley's 2020 Sustainable Signals survey11 found that around 95% of institutional asset owners are integrating or considering integrating sustainable and impact investing in all or part of their portfolios. Indeed, many customers of corporates and financial institutions are demanding that they establish and pursue binding sustainability targets.

Market indications are that sustainability will feature heavily in the recovery from the COVID-19 pandemic. The Commission has attached "green strings" to the agreed "Next Generation EU" €750 billion post-pandemic recovery plan.

Very detailed and ambitious legislative requirements have therefore been set out in EU law, many of which take the form of EU regulations which have direct effect in Ireland and are not required to be transposed into Irish law. There is therefore limited scope, from a legal and regulatory point of view, for Ireland to devise a framework that differs to other EU member states and that would render Ireland a more attractive centre for sustainable investment products. Goldplating, ie, imposing additional legal requirements to supplement the framework established at EU level, would present challenges to financial market participants ("FMPs")12 who operate on a cross-border basis. Divergences in approach at national level create operational and compliance challenges for these FMPs.

Due to the fact that many aspects of the sustainable finance agenda are dictated by EU law, together with the Commission harmonisation objective and aim of achieving a "level playing field", the opportunities for individual member states to differentiate themselves are limited from a legal point of view, but significant opportunities lie in areas where Ireland has already established a strong reputation eg, a knowledgeable and prudent financial regulator and a skilled, highlyeducated talent pool supported by a wellestablished financial services infrastructure.

Ireland's coherent, consistent and reliable policy and regulatory framework means that Ireland is well positioned to take advantage of opportunities presented by sustainable finance and to maintain and develop its reputation as a location of choice for domiciling and distributing sustainable financial products that meet growing investor demand for sustainable solutions. Consideration must also be given to how the legal and regulatory environment can operate to incentivise and promote sustainable investment in Ireland so that sustainable projects such as renewable energy infrastructure can be financed to facilitate the transition to net zero.

To ensure that Ireland can maintain and develop its reputation as a centre of excellence for sustainable finance, a holistic, multi-disciplinary, cross-governmental approach best utilises the opportunities and addresses the challenges presented by the sustainable finance agenda. Ireland, as a small, open economy has the benefit of being capable of a nimble, flexible approach, drawing on input across the many governmental departments and economic sectors impacted by sustainable finance.

Ensuring that our regulators and representatives have a prominent place in international fora discussing sustainable finance matters affords an opportunity to input on and shape the agenda and positions Ireland to take a leadership role in the development of legal and policy initiatives.

Furthermore, our continued focus on systemic knowledge development and addressing the evolving competencies required of regulators, senior managers, those making investment decisions and giving financial advice and service providers, including legal professionals, contributes towards building Ireland's reputation as a centre of excellence for sustainable finance.

Ireland's coherent, consistent and reliable policy and regulatory framework means that Ireland is well positioned to take advantage of opportunities presented by sustainable finance and to maintain and develop its reputation as a location of choice for domiciling and distributing sustainable financial products that meet growing investor demand for sustainable solutions.

3. Overview of Global Legal and Regulatory Landscape

As more data has become available on the financial impacts of climate change, international regulators and supervisors have increasingly focused on how the legislative and regulatory framework can be adapted to respond to those impacts and make a positive contribution in the transition to net zero. The EU has sought to be a global leader in this regard and to put in place a legislative framework to further global initiatives such as the SDGs and the Paris Agreement. The ambitious nature of the EU measures and the pace at which they have been adopted has presented significant implementation challenges, including challenges arising from the misalignment in the timing of the introduction of obligations. For example, the EU has sought to impose detailed disclosure requirements on FMPs under the SFDR at a time when there are no corresponding reporting obligations on investee companies, creating significant data gaps and resulting in less comparable, comprehensible disclosures for investors, undermining the purpose of the EU disclosure regime. The pace of change also presents challenges, with disclosure requirements introduced in 2021 (SFDR Level 1) and early 2023 (SFDR Level 2) already under review by the Commission, leaving little time for market participants to become familiar with the requirements and for the framework to bed in.

The tables below provide an at-a-glance overview of the various initiatives adopted at global13 and European level in relation to sustainable finance. National measures have not been set out in this section, as the legislative landscape in Ireland is dictated by European developments, many of which are of direct effect and allow for no member state discretion in their implementation. Ireland's response to the evolving sustainable finance framework is, however, addressed in Section 5 (Update on Irish Developments). The European initiatives referred to in the table below are addressed in more detail in Section 4 (Update on European Developments) and a more complete list of relevant European legislation is set out in the appendix to this report.

To view the full article click here

Footnotes

1. Available at https://sfskillnet.sustainablefinance.ie/wp-content/uploads/2022/11/Regulatory-Study_Final.pdf

2. Ireland's Sustainable Finance Roadmap October 2021. Available at https://www.skillnetireland.ie/ wp-content/uploads/2021/10/Irelands-Sustainable-Finance-Roadmap-October-2021.pdf

3 Available at: https://sdgs.un.org/goals

4 The United Nations webpage on the Paris Agreement is available here: https://unfccc.int/ process-and-meetings/the-paris-agreement

5. European Commission Questions and Answers on Sustainable Finance package 13 June 2023. Available at https://ec.europa.eu/commission/presscorner/detail/en/QANDA-23-3194

6. Communication from the Commission to the European Parliament, the European Council, the Council, the European Central Bank, the European Economic and Social Committee and the Committee of the Regions Action Plan: Financing Sustainable Growth COM/2018/097 final. Available at https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52018DC0097

7. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions Strategy for Financing the Transition to a Sustainable Economy Com/2021/390 Final. Available at https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52021DC0390

8. Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector

9. Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investment, and amending Regulation (EU) 2019/2088

10. An earlier Legal and Regulatory Report commissioned by Sustainable Finance Ireland provided a full overview of the action plan, which is not addressed in detail in this study. Sustainable Finance Ireland Legal and Regulatory Report 28 May 2021 available at https://sfskillnet. sustainablefinance.ie/wp-content/uploads/2022/11/Regulatory-Study-Final.pdf

11. Available at https://www.morganstanley.com/content/dam/msdotcom/ sustainability/20-05-22-3094389%20Sustainable%20Signals%20Asset%20Owners-FINAL.pdf

12. Financial market participants are defined in Article 2 of the SFDR to include an insurance undertaking which makes available an insurance-based investment product (IBIP); an investment firm which provides portfolio management; an institution for occupational retirement provision (IORP); a manufacturer of a pension product; an alternative investment fund manager (AIFM); a pan-European personal pension product (PEPP) provider; a manager of a qualifying venture capital fund registered in accordance with Article 14 of Regulation (EU) No 345/2013; a manager of a qualifying social entrepreneurship fund registered in accordance with Article 15 of Regulation (EU) No 346/2013; a management company of an undertaking for collective investment in transferable securities (UCITS management company); or a credit institution which provides portfolio management.

13. The table does not purport to cover all global developments relating to sustainable finance, which is beyond the scope of this paper. We have sought to highlight some of the key developments at a global level. The United Nations Global Sustainable Finance Observatory has established a hub for data and resources on sustainable finance which includes information on national strategies, sustainable finance frameworks, taxonomies, product standards and sustainability disclosure regimes in different jurisdictions – accessible at https://gsfo.org/#:~:text=The%20Global%20Sustainable%20Finance%20 Observatory,exchanges%2C%20standard%2Dsetters%2C%20and

Originally Published by International Sustainable Finance Centre Of Exellence

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.