Forget everything you knew about beverage alcohol. Ready-to-drink (RTD) alcoholic beverages, specifically spirit-based products, aren't just trending: They're rewriting the rules of the game. For beverage companies, that means both opportunities and challenges ahead.

An evolving landscape

RTD has become a general term to refer to several beverage categories, typically sold in cans, including hard seltzers; hard teas; canned cocktails; wine spritzers; spiked sodas; and more. The landscape continues to evolve as established players and startups alike direct resources toward growing their presence in the category. According to IWSR, 81% of U.S. drinking-age consumers have purchased RTDs in the past three years. IWSR also projects that the total RTD category will generate over $21 billion in retail sales in the U.S. by 2027.

But not all RTDs are enjoying the same tailwinds. While malt-based RTDs still retain a 91% share by volume in the American RTD market (largely thanks to hard seltzers), spirit-based RTDs grew by 51% in 2021, approximately double the growth of the wine-and malt-based categories. Spirit-based RTDs have become a driving force in the alcoholic beverage industry, in a market where most straight spirits categories have been suffering from sluggish sales. Spirit-based RTDs are attracting a growing base of users through their innovation, increasing sophistication, and interesting flavors and expressions.

Drivers of seismic change

So, what's driving this tectonic shift? We can point to three key contributing factors.

1. Consumer attitudes and behaviors among Gen Z

Although RTDs are engaging consumers of all ages, Gen Z is the main demographic cohort propelling the RTD revolution. These digital natives aren't settling for your father's beer or your mother's chardonnay (or even your cousin's hard seltzer). Gen Z consumers are "beverage fluid." They are open to experimentation, embrace variety, are motivated by social validation, seek opportunities for self-expression, and value instant rewards and convenience. These young drinkers are constantly trying new drinks and brands, particularly the ones that authentically speak to their interests, lifestyle, and values. In a world where demand has become more fragmented, RTDs are hitting the mark.

2. Liquid and package innovation

Data published by IWSR indicates that the number of RTD brand lines available in the U.S. has more than tripled between 2018 and 2022. RTDs have evolved to offer more palatable, easier-to-drink, smoother, and often sweeter flavor profiles that are resonating with younger drinkers. As a result, RTDs are quickly displacing the role that beer has played in college campuses across the country as an accessible, social alcoholic beverage. From classic cocktail flavors, like margarita and Moscow mule, to innovative fruit-forward options, spirit-based RTDs are catering to evolving consumer preferences for bold, flavorful beverages. Cool branding and Instagram-worthy packaging designs also add to the allure of RTDs.

3. Lower barriers to entry

The availability of capable contract manufacturers, many of which with fairly low minimum order thresholds, allows new entrants into the RTD market to operate in an asset-light fashion with minimum initial capital requirements. In addition, digital marketing has enabled RTD brands to become sales hits almost overnight by targeting consumers with a greater level of precision, building their brands without the need for massive advertising budgets, and avoiding expensive retail listing fees by selling through e-commerce channels. Gen Z, more than any other generation, connect with and experience the world through their digital devices and are also more influenced by social media, whether by influencers or by their own peers.

Get in the mix and pull ahead

But before you rush to jump on the RTD bandwagon, take heed: The market is becoming increasingly dynamic and competitive (and, in some cases, even showing signs of saturation). If you want to stand out, you'll need more than just a catchy name, a sweet concoction, and a flashy can.

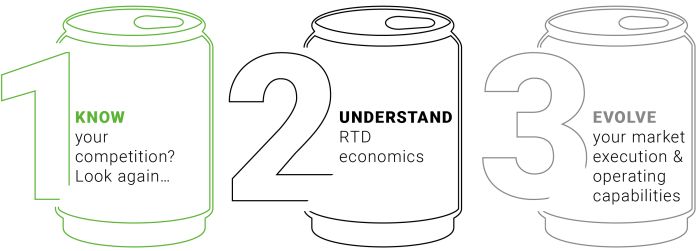

Here are three strategic pieces of advice to help you win in RTDs:

1. Know your competition? Look again...

The growth of RTDs has attracted an influx of new competitors, both from within and from outside the traditional alcohol industry. E&J Gallo, the largest winery in the U.S., has claimed its leading spot in RTDs with its vodka-based brand High Noon. Boston Beer, traditionally known for its Sam Adams' beer (and, more recently, its Truly hard seltzer), is riding the RTD wave with the successful launch of Twisted Tea. Coca-Cola has partnered with Brown-Forman to launch Jack & Coke in the U.S. in 2023. Amid the "gold rush", traditional category lines have blurred, with very meaningful implications from a competitive strategy standpoint.

Our advice: Throw out old competitive playbooks and start anew—you will face off against a new cast of competitors, and unconventional partnership opportunities may knock on your door (e.g., "coopetition").

2. Understand RTD economics

Don't get blinded by the prospects of incremental revenue growth. The economics of RTDs can be fundamentally different, depending on where you are coming from. If you are in wine and spirits, for example, margins in RTDs are generally lower per unit of volume, which may lead to a margin dilution dilemma if you are sourcing volume through self-cannibalization. If you are in non-alcoholic beverages, you are likely facing the need to form value chain partnerships, including brand licensing, co-manufacturing, and distribution agreements, all of which will eat into the total economic value added.

Our advice: Take a closer look at the full economics of RTDs, refine your financial planning, and ensure ongoing visibility as part of your financial reporting.

3. Evolve your market execution and operating capabilities

RTDs play by different rules. They are more akin to fast-moving consumer goods (FMCG): higher shelf velocity, different types of brand marketing investments, more dynamic pricing management, more heavily reliant on trade promotion tactics, faster innovation cycle (and shorter product lifecycle), different S&OP and supply chain management requirements etc. Those are all capabilities rarely found among wine and spirits companies, and that's a fundamental challenge to overcome. Suntory Global Spirits, which markets On the Rocks and -196 as part of its existing RTD portfolio, is a good example of a company that is realigning its business model and enhancing its capabilities to support its RTD, which is set to reach $3 billion in RTD sales by 2030. The company has established a dedicated operating unit (Suntory RTD Company) to drive purposeful RTD development and has been staffing leadership positions with executives with former FMCG experience.

Our advice: Understand requirements to win in RTD, tailor your business model, build new capabilities, pollinate the organization with FMCG experience, align incentives, evolve the culture. Business-as-usual will hold you back.

The RTD race is on, and the stakes are high. However, making it across the finish line will take a lot more than a winning product. For those who can understand the competitive landscape and the requirements to win (including operating model implications), the rewards in the RTD market will prove intoxicating (in a good sense).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.