Healthcare operators face growing denial rates and longer reimbursement timelines. AI can help, but it's just one facet of revenue cycle management, and can't be implemented without an understanding of the end-to-end processes.

Healthcare operators are facing a cash crunch. Insurance denials typically range from 10% to 20% of claims, according to a ProPublica investigation, though KFF has found Medicaid claim denials go as high as 49%, and advanced claims review systems have contributed to the issue. Several large insurers are facing litigation over their use of AI and advanced technology to review (and deny) claims, and legislators are looking at how to regulate that technology. For now, that means there's an increasing probability that providers have done the work ... but haven't been paid.

AI-powered solutions can efficiently manage complex billing procedures, reduce errors, and improve claims processing by predicting which charges are likely to go unpaid and forecasting payment lag times. Recent advances in large language models provide streamlined, automated solutions for claims appeals and dispute resolution.

For the majority of our healthcare clients, though, a better AI claims-lodgment process isn't going to solve everything—companies need immediate financial relief, and payor management is bigger than a set of new tools.

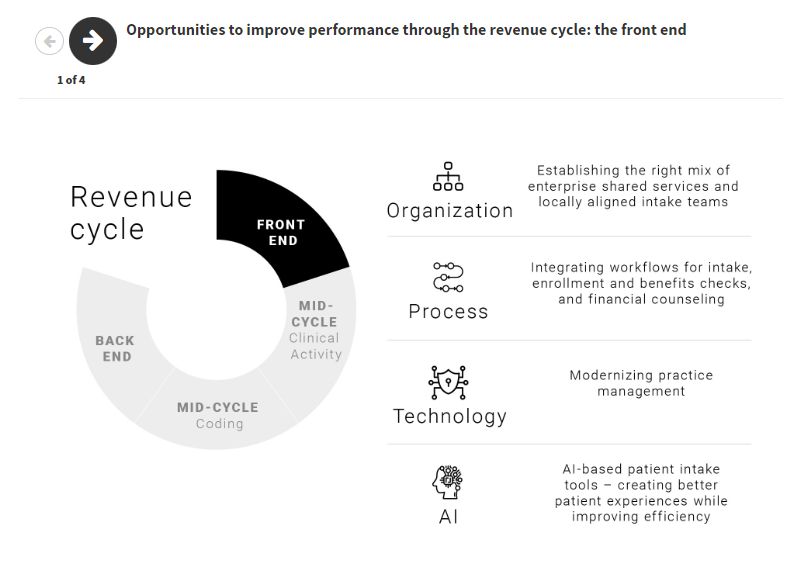

RCM sits at the hub of a series of complex processes and can't be toggled on its own. For that reason, we approach the financial puzzle from a holistic standpoint: when a company needs to enhance liquidity or may be in distress, we unpick the web of roles, processes, and systems, and locate where in the RCM function a company loses opportunity for revenue. From the front to the back-end of the revenue cycle, there are opportunities to improve data collection and management, integrate workflows, modernize practices, and improve efficiencies (figure 1). AlixPartners can deploy AI-enabled tools to consolidate, clean, and secure disparate data according to regulatory requirements to identify opportunities and unlock potential within the existing RCM process.

Done well, RCM improvements will focus collection efforts to improve yield, enable more granular portfolio management, and manage risk more efficiently. Ultimately, companies will see:

- Increased EBITDA by getting more yield from the work they've already done

- Improved cash management with faster collection times and lower reserve requirements

- A lower cost to collect through improved efficiencies

Figure 1

We know that the healthcare sector is facing intense challenges. Per the 2024 AlixPartners Disruption Index, 74% of healthcare executives say disruption is so pervasive they don't know where to allocate resources. Forty-two percent of healthcare companies surveyed by Healthcare IT Systems said they planned to increase their investments in AI revenue cycle management systems, and two-thirds plan to invest in AI technologies generally. Still, 30% said that uncertain return on investment was a barrier to investment in AI. Our experience supporting healthcare systems and other clinical operations bears this out.

Making changes to RCM can be a big undertaking. New processes must be designed or updated, vendors need to be vetted, and an improvement plan needs to be set. Disruption of the current system could have long-lasting ramifications.

As we will show below, it's impossible to make successful changes to RCM without bridging financial, organizational, and digital assets.

GUARDRAILS FOR RCM OPTIMIZATION

Don't overcomplicate it. Typically, companies come to us when they have an acute financial challenge in need of rapid relief. We help them focus on significant sources of leakage first—denials management, for example—to deliver results before tackling broader issues.

Take a clean-sheet view of organizations, processes, technology, and vendors. Design a purpose-built solution instead of trying to put Band-aids on a broken process. We help clients take the highest possible view, approaching the challenge from a board-level perspective in looking at how to define the problem ... then fix it to better support care delivery, patient services, and corporate functions.

Take an end-to-end view of payor management. While emerging tools can help with solitary pieces of the revenue puzzle, they cannot simply be plugged in. Optimizing RCM means taking a top-down view that coordinates care delivery, information technology, revenue cycle, and finance functions, and plotting out a strategy to support efficient and effective charge entry, denials management, and resulting revenue and cash management.

Build a tailored solution. AI won't solve all your problems, but it is an important tool that can help enhance a solid process. AI programs can help rapidly clean data and improve insights without requiring a long-term vendor relationship. You need to invest in this space, but in the rush to upgrade the toolkit, companies need to look at their specific needs and find the right vendors, the right processes, and the right technologies, to invest at the right time to limit disruption.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.