The 2024 A&D Outlook: Flying at the speed of disruption

AlixPartners this month published the 2024 Aerospace & Defense Outlook, providing analysis of critical issues affecting key stakeholders as they look to continue their momentum in the post-COVID-19 era. This study is valued for its timeliness, breadth, and ability to dissect a fast-moving industry that was once seen moving at a glacial pace. The report comes as executives and investors are under increasing pressure to make quick, consequential decisions without being able to rely on a tried-and-true playbook.

The Outlook arrives on the eve of the Farnborough International Airshow and at a consequential time for anyone connected to aerospace and defense. Political volatility—stoked by several factors—has shaped several pivotal elections in the West; armed conflicts are ongoing in Europe and the Middle East; China's global influence is under a microscope amid trade wars, a softer domestic economy, and regional tensions; and the pressure to decarbonize is relentless. These will be among the major themes as industry leaders gather to discuss a broad range of issues, spanning hiring strategies to M&A approaches to product innovation and beyond.

To be sure, A&D players are experiencing favorable tailwinds: travel demand is robust; defense budgets are growing in anticipation of further global conflicts; commercial aircraft orders are booming; aftermarket and MRO is in a golden age, and the appetite for anything related to space is healthy. The industry's foundation, however, remains unbalanced as choppy profit performances cloud the outlook at a time when global economies are volatile, deglobalization is accelerating, and a steep demand-driven ramp-up is accompanied by multiple operational and financial hurdles.

Radar cluttered with multiple interconnected blips

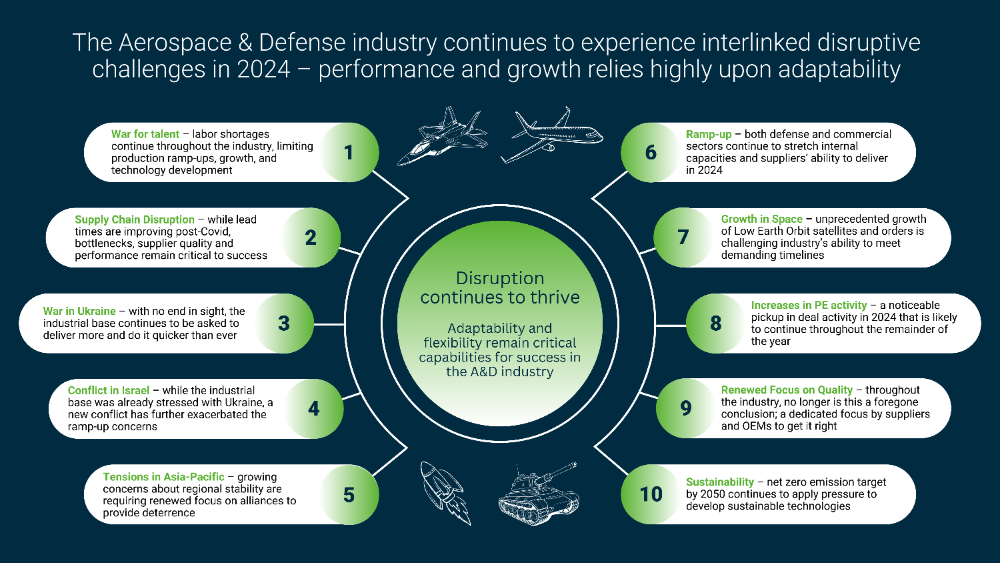

We've identified 10 disruptive challenges that are prominent in 2024 and clearly interlinked. Among the most relevant is a commercial backlog that has grown 18% to 15,000 orders, equal to more than nine years of production. Accelerating ramp-up, however, won't happen if several other issues aren't effectively addressed.

While lead times have improved in the supply chain, for instance, it remains plagued by bottlenecks, quality issues, and supplier performance. Talent shortages, meanwhile, affect everything from productivity to technology development. Private-equity investors, recently slowed by high interest rates, are showing renewed interest that will likely lead to increased activity over the remainder of the year. And, even though interest in space is hot, the industry will struggle to keep pace with demanding timelines.

Sustainability is a particularly tricky challenge. By 2040, the latest generation of aircraft will represent 61% of the fleet and will begin to be replaced by more efficient aircrafts. Policy updates provide opportunity for improvement in operations, potentially delivering sizable savings on both operating costs and emissions. But, to deliver on net-zero commitments, fleet renewal, SAF and flight and ground operations improvements, these pillars must be complemented by measures including demand reduction and carbon removal. The mandated SAF production ramp-up, for instance, will require an expected $150 billion per year in capital investment by 2035.

Key planning insights

Effective strategy relies on having an accurate view of the environment you are executing in. Key insights in the study include:

- Air traffic will exceed 2019 levels globally, led by Americas—EMEA and Asia are volatile

- Airline capacity and profitability growth is expected to continue against a mixed economic backdrop and labor/fleet challenges

- Global military expenditures will continue to rise following a 6% increase in 2023 to $2.3 trillion

- Traditional space industry players are increasingly pressured on cost and schedules amid escalating competitive forces looking for their piece of a $510 billion market

- Advanced Air Mobility has entered a critical phase, as many players are highly leveraged and potentially in need of financial restructuring and liquidity during a certification race

- M&A momentum will build in space, defense, and government services, driven in part by sustainability concerns, falling interest rates, and AI's growth

- MRO growth will slow from 30% CAGR rates to 2.1% in coming years, hitting the industry as more than half the current in-service fleet will be retired by 2033

Delicate balancing act

As we look at the state of play ahead of the Farnborough International Airshow, it's clear that companies and investors of all shapes and sizes must plant one foot firmly in the present while planning for a future colored by uncertainty. Winning requires an ability to approach short-term risks with a long-term mindset and commitment to flexibility, investment and adaptability.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.