AlixPartners recently collaborated with the American Frozen Food Institute (AFFI) to publish a "How to Win in Frozen" playbook, a landmark study on the state of the department. Download the comprehensive report here and stay tuned to this five-part series, "Opportunities in Frozen," for insight on how to capture the coming growth.

New products aren't generating all of the new dollars in the frozen aisle. They aren't even generating most of the new dollars. While trendy segments like better-for-you and global flavors tend to monopolize mindshare, conventional offerings are delivering the vast majority of category growth.

As brands and retailers strategize about how to capture their share of the additional $10 billion in top line sales growth projected in frozen over the next three years, they need to look at what's moving the needle in each subcategory and balance their investment between existing products and new ones.

While innovation remains important to attract new shoppers and energize the assortment, companies also need to invest in their current offerings to capitalize on the greater demand that mainstream and economy items are seeing from increasingly value-conscious consumers.

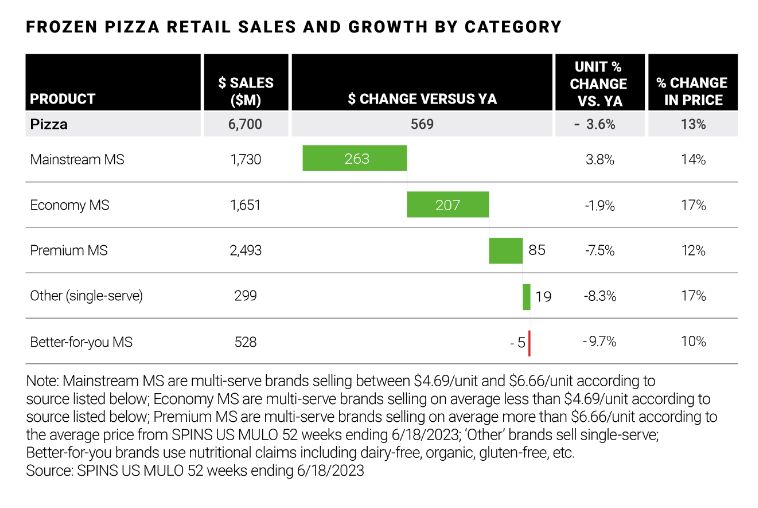

In frozen pizza, for example, mainstream and economy accounted for 83% of new dollars between 2022 and 2023.1 Mainstream sales jumped 19%, and economy grew 15%. Conversely, premium grew just 4%. Better-for-you also turned in an underwhelming performance, with sales falling 1%.

In frozen entrees, while brands that offer Asian- and Mexican-inspired snacks are on the rise, the growth of the single-serve segment has been propelled by traditional comfort food flavors, with demand for established brands remaining high even in the face of significant price increases.2

The uptick in consumer focus on value highlights the need for CPGs to explore reformulations and line extensions for existing offerings along with developing new products. Other ways to capture growth from current items might include increasing shelf space, fine-tuning direct-to-consumer advertising, and tweaking packaging to emphasize value.

The shift towards value-focused consumption should also remind brands to be judicious about trade funding for new products in particular. As they engage in joint business planning with their partners, rather than broadly offering trade funding to support launches, CPGs should solicit candid feedback about relevance of new products to each retailer's target customer sets.

For their part, retailers should be upfront, proactive and data-driven with their brand partners about customer preferences and pricing expectations. To maximize the relevance and velocity of their frozen assortment, retailers need to be selective and customer-first, including when short-term trade funding makes a new product seem attractive from a financial perspective but the product is unlikely to resonate with their shoppers beyond the initial launch.

Given the high inflation of recent years, many consumers have become increasingly selective about how they spend their money. Savvy CPGs will do likewise – and balancing their investment between existing products and new ones is the ideal place to start.

Footnotes

1. SPINS – US Food 52 weeks ending 6/18/2023

2. IRI US MULO 52 weeks ending 6/18/2023; SPINS US MULO 52 weeks ending 6/18/2023

Want more? Check out these other recent insights from the experts at AlixPartners.

Opportunities in frozen: $10 billion in growth up for grabs over next three years

Opportunities in Frozen: Achieve greater relevance by accounting for regional preferences

Opportunities in Frozen: Don't underestimate the Hispanic consumer

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.