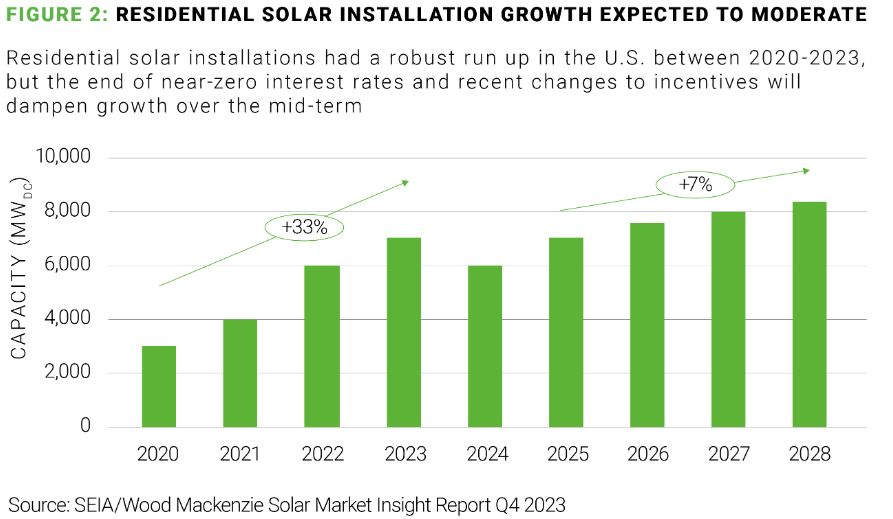

Residential solar has long been viewed as the easiest route to accelerate the energy transition, given low project and financing costs, and hefty tax incentives (i.e., IRA). Installations grew at a strong clip from 2020 through 2023 (see Figure 2).

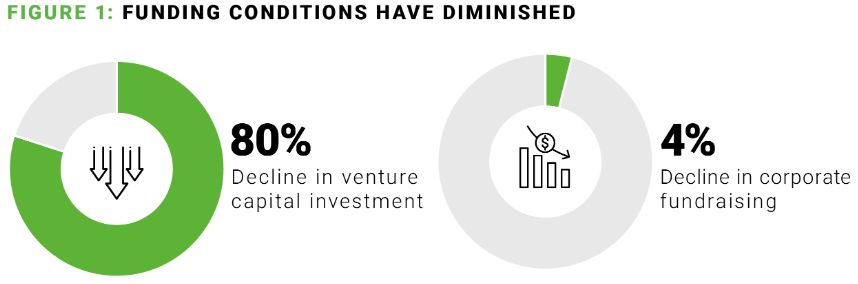

The solar market in the U.S, however, has experienced a fresh round of stress over the last year. Venture capital investment has declined approximately 80% versus the same period in 2023, and corporate fundraising is down 4%.

Homeowners in some jurisdictions face subsidy reductions despite increasing capital costs, which presents financial challenges when considering residential solar. Meanwhile, higher financing, labor, and customer acquisition costs squeeze the companies trying to sell to them. These factors are exerting pressure while the Inflation Reduction Act entices companies to move critical components production to the U.S.

Some of the uncertainty hovering over solar companies has been resolved, at least as it relates to whether rooftop solar is eligible for the Inflation Reduction Act's domestic content bonus credit: In mid-May, the Department of the Treasury and Internal Revenue Service released additional guidance on the domestic content bonus.

Notably, it confirmed that ground-mount and rooftop photovoltaic (PV) systems are included in the IRS' existing Continuity Safe Harbor, and qualify for the domestic content bonus credit—a win for domestic manufacturers and the owners of many recently installed systems.

The new guidance introduced a simpler method for homeowners to determine Domestic Cost Percentage and, subsequently, credit eligibility. Rather than relying on direct costs from component manufacturers, taxpayers can use a new safe harbor that includes pre-defined classifications and cost percentages for the components in calculations. This clarification alleviates the solar taxpayer's burden of gathering data directly from manufacturers, enabling easier verification and eligibility confirmation in hopes of stimulating consumer demand for renewable energy.

The pace of installation growth may be slowing, but residential solar is still a vital piece of the decarbonization puzzle. Solar PV is one of the most mature technologies among renewables, more cost-effective than emerging alternatives (even without subsidies). Further, with so many U.S. rooftops lacking panels, the case for residential solar, on an output-per-dollar invested basis, is sound from a policy perspective.

Understanding the background and drivers behind market changes can help investors capitalize on the change—and potentially displaced valuations—whether through consolidation or capital raises, while also identifying risks to be mitigated (e.g., helping investment companies through performance improvement).

Business model and structural finance woes

Much of the blame for the weakening residential solar growth outlook can be assigned to economic volatility, trade fights that impact solar PV panel availability and price, and inflation.

However, in addition to experiencing reduced or plateauing customer demand, residential solar companies face industry-specific problems. Business models, predicated on self-funding growth and therefore growth at all cost levels, have impacted the performance of domestic financiers and installers. Growth plans built on the legacy 33% CAGR realized over the past four years, for instance, have become too ambitious in an era where growth rates may have fallen to 7%.

The residential solar market is competitive, and to keep pace with projected system originations, players have sought to expand as vigorously as customer sign-ups will allow. Scaling geographically often results in installers and financiers entering partnerships with local installers and customer acquisition service providers, while establishing multiple layers of management for oversight. These layers not only compress margins, but result in fixed costs during periods of reduced demand, stressing domestic players' G&A.

Similarly, many of these companies that opted to scale up have done so inefficiently, relying on processes, controls, and management tools better suited to their previously smaller sizes.

The residential solar market has shifted to leasing systems to consumers to enable efficient monetization of the ever-important tax credits. But higher interest rates have impacted customer demand, as well as installer and financier business models.

In this environment and in the pursuit of continued growth, the temptation for installers will be to expand offerings to riskier customer segments. The resulting ABS securitizations of those systems should, however, attract less favorable terms from underwriters and investors. Legacy customer acquisition and pricing strategies are more important than ever in this harsher interest rate and monetization environment.

This backdrop can add up to stress across the entire sector's value chain. The business model issues of installers and investors, paired with moderating customer demand, could also result in reduced demand for residential-focused installation equipment, such as inverters or racking equipment. This industry-stress situation could depress valuations and limit access to capital for some while creating opportunities for others.

Opportunities to weather a hardened market

Even as cloudier skies loom, companies in the U.S. residential solar market have plenty of opportunities to improve performance. Companies in this space should focus on the inputs and levers that enable lean market presence sustainment, efficient liquidity and cash management, and realistic projections until cash flow margins reliably improve.

AlixPartners actively supports players in the sector. There are five factors that can improve operations for major value-chain players:

1. Design an efficient go-to-market strategy

Installation costs have nearly doubled in the past year, while the Lifetime Value/Customer Acquisition cost ratio rapidly deteriorates. An efficient go-to-market strategy is crucial in an unforgiving business climate.

- Improve accuracy of customer segmentation—or re-segmentation. Reassess the highest profitability segments for prioritization, and consider existing lower or unprofitable portions of the market

- Rebalance high-touch sales coverage with a lower cost-base approach

- Leverage machine learning for precise pricing and optimized revenue/margin tradeoff assessments and prioritization

- Design offerings so cross-selling is turbocharged

2. Optimize G&A

Fixed operating expenses associated with an organization that has geographically scaled can have higher G&A costs and be less competitive against smaller, localized competitors. This is in part due to multiple layers of management in an organization required to oversee different geographies, as well as intermediaries and dealerships involved in the customer acquisition and service delivery stages.

- Move management closer to customers, reducing cost and enabling more agile service offerings

- Enhance reporting of points of sale to upper management, streamline costs, and improve resource allocation and planning

- Reduce redundant layers of management to develop a cohesive team to respond to customer needs at a lower operating margin

- Automate and simplify internal processes and workflows to reflect best practices in a maturing market

- Assess model of partnering with localized, competitive installers or service providers vs. dealerships

3. Tighten cash management

Amid expectations for extended periods of reduced cash flow, tighter working-capital management is required, particularly when access to outside funds is constrained.

- Rationalize capex and balance-sheet-driven offerings, such as maintenance contracts or leasing backed by securitization

- Investigate alternative sources of capital, including asset (i.e., loan and lease portfolio) sales

- Increase scrutiny of borrowing bases and cash on hand, and couple this with optimization of accounts payable and receivable

- Accurately assess and implement working capital gaps in forecasting leads

4. Develop solid business planning

A reliable business plan is foundational to addressing important vulnerabilities while also supporting potential M&A and capital raising.

- Revise finance, planning, and analysis processes to account for changes in taxation, customer income, community application, and sales/lease ratios

- Refine business plan and make associated structural changes for contracts, bid development, pricing, and profitability analyses as needed

5. Identify consolidation plays

Shrinking access to public capital, given the size of the dominant players in the residential solar market, will lead to consolidation. Distress in the space will expose unprofitable companies, and attractive, moribund valuations will lead to asset and corporate transactions.

- Acquisitions for the sake of scale will only exacerbate profitability woes for a buyer straining to manage liquidity. Targets chosen for channel, regional, or supply chain efficiencies bring a higher likelihood of a transaction being accretive

- Asset acquisitions are unlikely to be on offer in the near term, as offerors of monetized assets will commonly be subject to seizure from entrenched lenders

- Corporate transactions can be had in the current economic climate, but financing is likely difficult to obtain. A successful transaction will require ruthless post-merger integration and cost-cutting to realize any efficiencies from a combination

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.