In our recent Harvard Business Review article "To Accelerate Growth, Analyze Your Company Like an Investor," we emphasized the importance of conducting comprehensive, investor-like company analyses to drive growth and value creation. Building upon that concept, this article delves into the transformative potential of expert-driven AI for private equity (PE) due diligence.

As generative AI (GenAI) proliferates, many companies are throwing caution to the wind by investing with euphoria around the hottest new technology.

To maximize return on investment and achieve actionable results, businesses have to apply expertise to build models and interpret outputs. For private equity due diligence, the incorporation of expert understanding and operator experience during the building and training phases results in AI models that are more comprehensive and more robust. These models are nourished by higher-quality data, and they provide pattern recognition by delivering high-impact, sustainable recommendations. Expert assessment of the output—in the form of the ability to parse out what is significant, what can be ignored, and what key information is missing—identifies immediately actionable insights for preserving—and creating—value. Those insights are underwritable, and they help firms confidently secure deal funding.

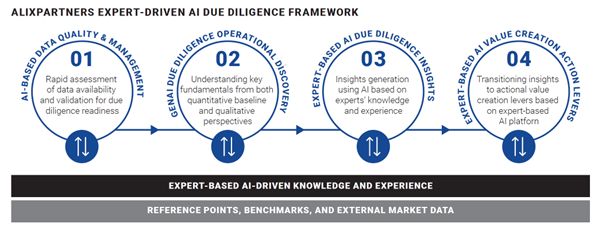

EXPERT-DRIVEN AI FOR DUE DILIGENCE is instrumental to delivering a customized offering for private equity firms and investors.

By taking advantage of both expertise and experience, ongoing training processes ensure that algorithms get continuously refined, thereby creating a reinforcement loop that enhances the quality and relevance of derived insights. If an AI model shares, say, 10 insights and if experts discern that 6 of them are strong and 4 are weak, then the model can learn from that feedback and improve output with each retraining. AI based due diligence has already uncovered insights that consultant teams have not, which in turn makes experts more productive and insightful. The symbiotic combination of in-house expertise with an ever-improving AI component is the cornerstone of expert-driven AI for due diligence.

Next, we dig deeper into the key benefits and differentiators that elevate expert-driven AI for private equity due diligence based on our research and ongoing AI model development.

EXPERT-DRIVEN AI FOR DUE DILIGENCE accelerates analysis, unlocks broader and deeper insights, and de-risks value creation plan implementation

An AI model is only as good as its training. GenAI accelerates processes but does not necessarily improve quality, because without details on deal theses and key value creation levers, AI output is limited in scope. Expert-driven AI for due diligence boosts both the speed of data quality analysis and the speed at which teams can derive key insights.

An operator approach that finds the why behind a GenAI model's findings for due diligence is critical. Experts should use the output to evaluate company performance and identify specific opportunities for improvement. From assessing costs and growth opportunities to reviewing a company's pricing structure and technology maturity, expert insight into AI-derived data finds actions that will work in the real world for a specific market and business.

Our approach to using GenAI for due diligence results in the following benefits, which expedite value plan creation development:

- INSIGHTS BASED ON OPERATOR EXPERTISE

Our AI for due diligence model is designed to harness the collective expertise of our professionals. The model provides comprehensive, expert-based perspectives on due diligence with a holistic view across the business—from operational and technology opportunities to head count-related and non-head-count-related savings levers. For instance, GenAI adeptly categorizes job roles based on our extensive experience across various titles and functions, ensuring accurate comparisons. Companies can use the data to arrive at comprehensive assessments of team costs, strengths, and capabilities relative to those of competitors, thereby uncovering valuable insights into organizational efficiency and potential avenues for value creation.

- INGESTION OF EXTERNAL MARKET DATA TO AMALGAMATE WITH INTERNAL

BENCHMARKING FINDINGS

We combine a deep understanding of external market factors with internal historical know-how to glean expert-based insights from the data. Using the insights, we can then adjust value creation levers and expectations accordingly. For instance, GenAI easily distills key themes and sentiments from customers, employees, and other stakeholders such as regulators, investors, and analysts. Expert analysis then unpacks the why behind sentiment shifts, new trends, and regional differences. The resulting nuanced understanding enables companies to link their findings to actions and risk-remediation strategies—i.e., which features a product most needs to improve.

- CREATION OF AN ACTIONABLE PLAN

Through our insights and analysis, we develop clear, actionable, and impactful value creation plans that are ready for execution from Day One. For example, we recently conducted a hyper-personalization campaign at a major musical instrument retailer. We first identified high-potential customers via AI models that forecast customer churn and future spend patterns. We then segmented those customers based on prior purchases and expert opinion. And we then applied GenAI to create tailored email subject lines and messaging for each segment. By testing AI-created messages and validating which ones resonated most, we could then send the most effective messaging to run a targeted marketing campaign, which delivered a 40% revenue lift compared to control.

EXPERT-DRIVEN AI FOR DUE DILIGENCE turns insights into underwritable findings

To make the most of the insights and value derived from expert-driven AI for due diligence, companies have to create immediately actionable, underwritable value creation plans. Underwritable investment theses represent the core of the due diligence phase. When experts unearth the most-practical opportunities to improve business performance, companies gain truly applicable insights that expedite revenue generation and margin results. And firms can more confidently move to secure deal funding.

EXPERT-DRIVEN AI FOR DUE DILIGENCE is a difference maker for the PE industry

Incorporating human expertise at every stage makes GenAI as impactful as it can be for PE due diligence. Experts must drive the construction phase by inputting data and prompt requirements to build the most robust models. Even more important, they have to analyze output by combining their knowledge base with AI insights to unlock the most-relevant findings—as well as what models miss.

By strategically combining the latest, most-advanced GenAI capabilities with expert-level analysis of the findings, AI models grow smarter, and experts become more efficient. As a result, the AI for due diligence process delivers outsized value and underwritable insights to PE firms.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.