Home goods retailers need advanced targeting to reach consumers in an era of tighter demand and strong pull-through of the consumer cycle. AlixPartners explains the playbook.

Stuck in their homes, U.S. consumers spent $12.1 billion in the second quarter of 2020 on furniture, appliances, and equipment. The sector saw 48% q/q growth in spending over the first quarter of 2020, per Comscore data, and one in three consumers said they bought a home-goods item on sale that they would not have otherwise purchased. Purchases tempered with the return-to-office phase and slipped in the second half of 2023, when inflation squeezed consumer wallets further. The spending spree was over.

That demand pull-through is key to understanding the current cut-throat conditions for home-goods retailers, who up until recently were working to right-size their inventory overhangs, sometimes by incentivizing their clearance with attractive sales. The paradox is that they saw two to three years of accelerated growth–well beyond the typical three-to-five-year cycle for natural replacement–and don't expect to see fresh demand until 2025.

AlixPartners Critical Consumer 2024 survey of 10,000 people across Europe and the Middle East found that 37% plan to spend less in 2024 than in 2023, with a strong focus on value for money. World Furniture Outlook Report 2024 forecasts a slight decline in furniture consumption in real terms in 2024, with a modest pickup in 2025(?).

Furniture and home goods companies are not anticipating any tailwinds for spending in the next two years. With lower demand and a higher cost of operations, earnings have been under stress, which in any case were artificially buoyed by price-hikes amid inflation.

With demand parked for now in the proverbial recliner, the onus is on leaders to ensure their companies are maximizing results across the consumer pipeline. That means a laser-sharp focus on traffic generation, conversion, and maximization.

Capturing consumer attention

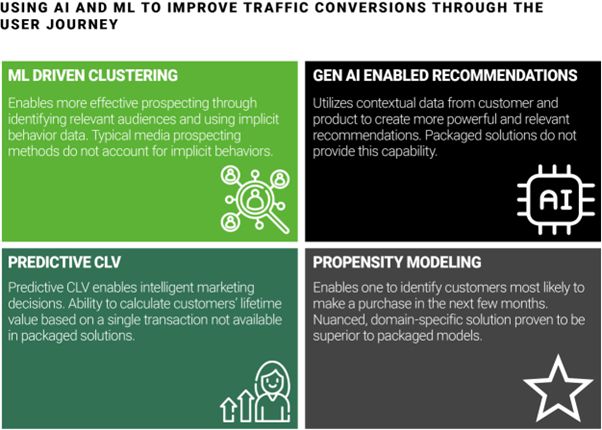

In order to win in a hypercompetitive environment you need to target customers better than the rest of the field. The level of specification has increased dramatically with the advent of AI and machine-learning technologies, which bring hyperlocalization and other consumer-driven techniques for engaging with the consumer.

Marketing begins with one key question: Do you know who your consumer is? Knowing who to target will shape your messaging strategy. Companies may have pre-empted demand, but consumers who have recently moved homes or have higher discretionary spend or at a seasonal inflection point in their market could be high-reward targets. We expect a good payoff for marketing efforts driven by consumer intelligence. That means drilling down on key facets of your market:

- Priority customer segments: Identifying the most valuable customers–those who buy premium or core products–and ascertaining where they are, what they value, and their key demographic characteristic.

- Product and offer strategy: Establishing clear points of differentiation against competitors and looking at how augment the product portfolio to align with the offer strategy.

Getting to a buying decision

Once a potential customer is on your website or in a store, the job is to reduce friction in the buying journey. Technology, sales conversations, and interfaces can work to accelerate their journey, while decelerants like shipping costs and out-of-stocks can delay or disrupt purchases. AI and ML tools can help retailers to establish customer priorities around features, benefits, and price points, as well as leverage hyper-personalization to offer geotargeting, intel about like-consumer profiles, and high-propensity activation targeting.

This information can be used to finesse the go-to-market strategy. Companies must optimize the channel mix and messaging to attract and convert the most valuable mix of customers. They need to assess whether omni assets and investments are effectively driving the right strains of consumer visibility and activity to drive revenue, profit, and shareholder value.

Maximizing the basket

When a consumer is at the buying decision, there is a critical opportunity to maximize a company's share of their wallet. Part of this will depend on the customer experience, which covers the online interface as well as in-person interactions with sales associates.

We advise clients to focus on sustainability and repeatability. We help assess the adjustments they can make to internal processes, decision-making, data-analysis, and information flows to accelerate profitable demand growth.

Marketing through connectivity

Looking into the living rooms of America, the big-ticket purchases of 2024 and 2025 are already installed, and consumer wallets are tight. At a macro level, we don't expect any tailwinds for spending: the Fed funds rate remains at 5.3%, the highest since before the Great Recession, and the Fed is not expected to take the brakes off in 2024. There is an opportunity, however, to deploy customer-focused technology. Companies can use data tools to look at how local audiences differ, and market to the specific demographic groups that exist around access points.

The retailer capable of fully tailoring the experience to customers through seasonal weather shifts, local trends, and other opportunities can win a customer through the next cycle (a recent Reddit post asking "Who makes non-crappy furniture these days?" shows customers bemoaning shorter lifecycles for some "new" furniture).

The era of the same couch being backordered across the country is past. Hyperlocalization is the solution for spotty demand and unpredictable purchase patterns.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.