In January 2024, the Federal Tax Authority (hereinafter - "FTA") issued a Corporate Tax Guide (hereinafter - "the Guide") focusing on Tax Groups, which helps Taxable Persons to understand the taxation of juridical Resident Persons that form a Tax Group, including key aspects of transfer pricing (hereinafter - "TP"), providing relevant examples.

A Tax Group is treated as a single Taxable Person for the purposes of the Corporate Tax Law (hereinafter - "CT Law"), and consequently for the purpose of calculating Taxable Income. Hence, all intra-group transactions, whether between subsidiaries or between the parent company and a subsidiary, will be eliminated for TP purposes. This implies that separate TP documentation for transactions between the members of the same Tax Group is not required, which alleviates the burden for the Taxable Persons.

However, there are certain exceptions when transactions between members of a Tax Group are still to be determined consistently with the arm's length principle (hereinafter - "ALP"), in particular:

| Conditions | Consequences |

|---|---|

| A member has recognised a deductible loss in a Tax Period in respect of those transactions prior to joining or forming the Tax Group | If a member has recognised a deductible loss on transactions before joining the Tax Group, such transactions are not eliminated until the deductible loss is fully reversed. Any income relating to the transaction, like a reversal of impairment, is included in the Taxable Income of the Group up to the amount of the previously deducted loss. This ensures income from intra-group transactions that reverse a previously deducted loss is taxed. |

| Leaving a Tax Group or cessation of Tax Group on transfers within the Tax Group | In a Tax Group, transfers of assets and liabilities are usually not counted for tax. However, if the transferring or receiving member leaves the group within two years, the gain or loss from that transfer should be considered for tax. |

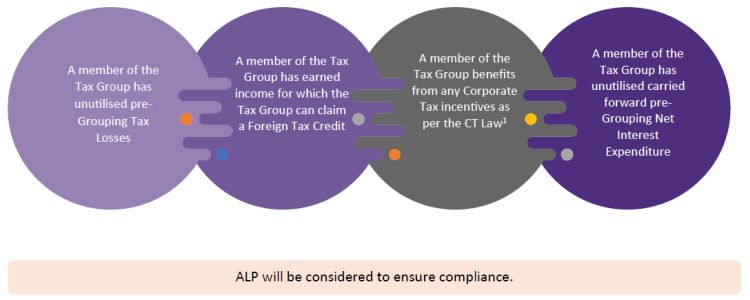

Consistent with the Ministerial Decision No. 125 of 2023, the Guide highlighted that the Taxable Income is required to be calculated to one or more members of the Tax Group in certain situations:

In any of the above cases, where the Tax Group is required to calculate the Taxable Income that is attributable to any of its members, the Tax Group must do it in accordance with ALP to adhere TP requirements.

Hence, it is important to assess whether to add loss-making entities or any other entity that falls under any of the above criteria in the Tax Group and avoid potential TP burdens.

Key Takeaways

- It is crucial for entities involved in or planning to form Tax Groups to consider potential consequences and appropriately apply these changes.

- When a Tax Group is formed, all intra-group transactions—whether between subsidiaries or between the parent company and a subsidiary—are eliminated, with certain exceptions.

- It is essential for the members in a Tax Group to evaluate their transactions with related parties and connected persons. In scenarios outlined in the Guide where the Taxable Income needs to be determined for one or more members of the Tax Group, adherence to the ALP is essential to ensure compliance.

Footnote

1. As per Article 20(2)(g) of the CT Law, any incentives or special reliefs for a Qualifying Business Activity as specified in a decision issued by the Cabinet at the suggestion of the Minister.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.