Important Consideration for Individuals

In the framework of the constant efforts deployed by the United Arab Emirate (UAE) towards tax transparency and international tax cooperation, the Ministry of Finance (MoF) has recently issued a set of Cabinet Decisions aiming at harmonizing and clarifying the rules applicable to tax residency. This Tax Alert is summarizing key takeaways of Cabinet Decision No. 85 and Ministerial Decision No. 27 relevant for individuals. A summary of tax residency rules for legal entities can be found in our previous Tax Alert.

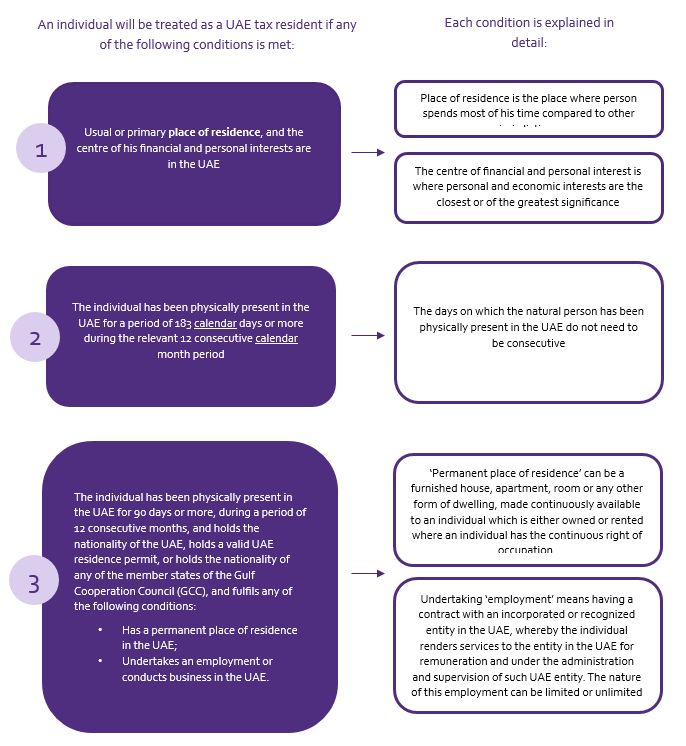

- UAE Tax residency criteria for

individuals

The below table is based on the above-mentioned Cabinet Decisions and should help to determine a tax residency status of an individual.

- Important Considerations

- In order toobtain a tax residence certificate ('TRC') from the UAE Federal Tax Authority ('FTA') those individuals who are meeting relevant conditions should submit their TRC applications online on the Federal Tax Authority portal. It is yet to be seen how the FTA will in practice issue tax residency certificates to individuals who have been physically present in the UAE for less than 183 days but have met other conditions, and what documents the FTA will request from such individuals.

- For instance, in determining whether the centre of financial interest is in the UAE, the FTA will assess a combination of factors, such as occupation of the individual, familial and social relations, cultural or other activities, place of business, place from which the property of the natural person is administered etc. Thus, we may expect a variety of documents to be requested by the FTA to prove that such condition is met.

- In case an individual has spent time in the UAE due to exceptional circumstances (an event or situation beyond the individual's control, such as war, etc.), such days should be disregarded in determining whether such an individual has met the condition of spending 183 or 90 days in the UAE.

Food for Thought

- As of today, the UAE does not levy personal income tax on the income of natural persons, thus even when an individual is recognised as a UAE tax resident, such an individual should not be subject to personal income tax. However, it should be noted that the UAE Corporate Tax Law levies corporate income tax on individuals if they conduct certain types of business activity in the UAE.

- New tax residency rules are important for many individuals who come to UAE for employment, business, or other purposes since they could be still taxed in their home country on income received in the UAE.However, such rules should be read in conjunction with the applicable international tax treaties and provisions of the domestic tax laws and regulations.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.