Tax Registration Application Timelines

The Federal Tax Authority (FTA) has issued Federal Tax Authority Decision No. 3 of 2024 which shall be effective from 1 March 2024 and specifies timelines for registration of taxable persons for UAE Corporate Tax (UAE CT) purposes on the Emara Tax Portal. This Decision abrogates all provisions that are contrary or inconsistent with the new Decision.

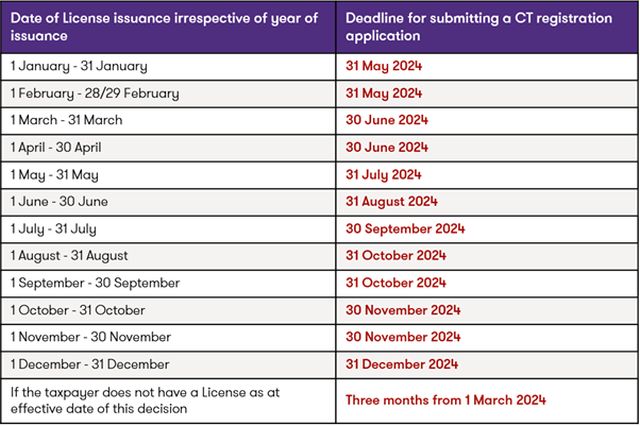

The Decision has provided the following timelines for registering taxable persons for UAE CT purposes:

- Timelines for CT registration for Resident Juridical Persons

- A UAE resident juridical person who was incorporated prior to 1

March 2024 should submit a Tax Registration application in

accordance with the following dates in the Table below:

Based on the above, the timeline for CT registration is linked to the date of issuance of the trade license. For instance, if an entity has a trade license that was issued 10 January 2023, the deadline date to submit a Tax registration application shall be 31 May 2024.

If a resident juridical person has more than one license, the license with the earliest issuance date shall be used to determine the tax registration submission deadline.

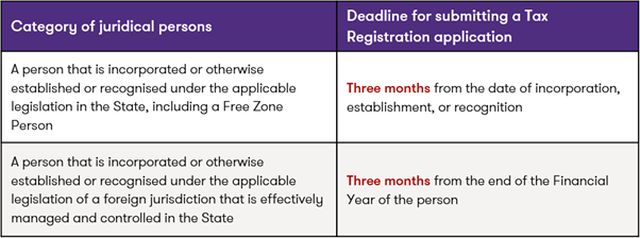

- Juridical persons that are incorporated on or after 1 March

2024 are subject to the following registration timelines:

- A UAE resident juridical person who was incorporated prior to 1

March 2024 should submit a Tax Registration application in

accordance with the following dates in the Table below:

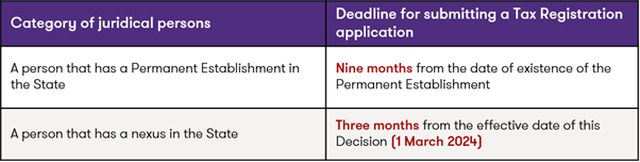

- Timelines for CT registration for Non-Resident Juridical Persons

A Non - Resident UAE resident juridical person that was incorporated prior to 1 March 2024 should submit a UAE Corporate Tax Registration application in accordance with the following dates in the Table below:

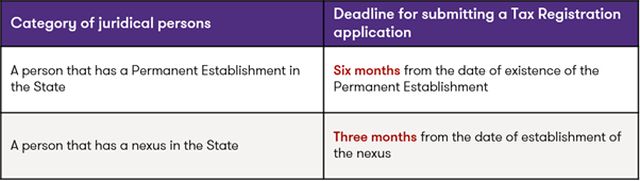

If the juridical person is a non-Resident person on or after the 1 March 2024, the following registration timelines shall apply:

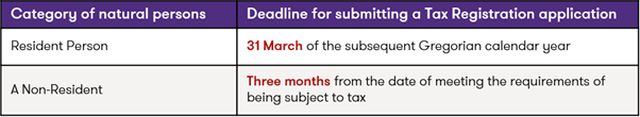

- Timelines for CT registration for Natural Persons

A Natural person conducting business activity in UAE during the 2024 Gregorian Calendar year or subsequent years and deriving turnover exceeding AED 1 million should submit a UAE Corporate Tax registration application in accordance with the following dates in the Table below:

Administrative Penalty for delay in submitting registration application.

It should be noted Cabinet Decision No. 75 of 2023 has also been amended with Cabinet Decision No. 10 of 2024 to introduce a penalty for failure to submit a tax registration application within the above timelines. If any of the above persons fails to submit a UAE Corporate Tax Registration application as per the above stated timelines, they will be subject to a penalty of AED 10,000.

The relevant cabinet decisions be assessed through the following link here.

It is advisable to review the trade licenses and start the process of UAE CT registration immediately. We are happy to support in the process of UAE Corporate Tax registration on the Emara Tax Portal.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.