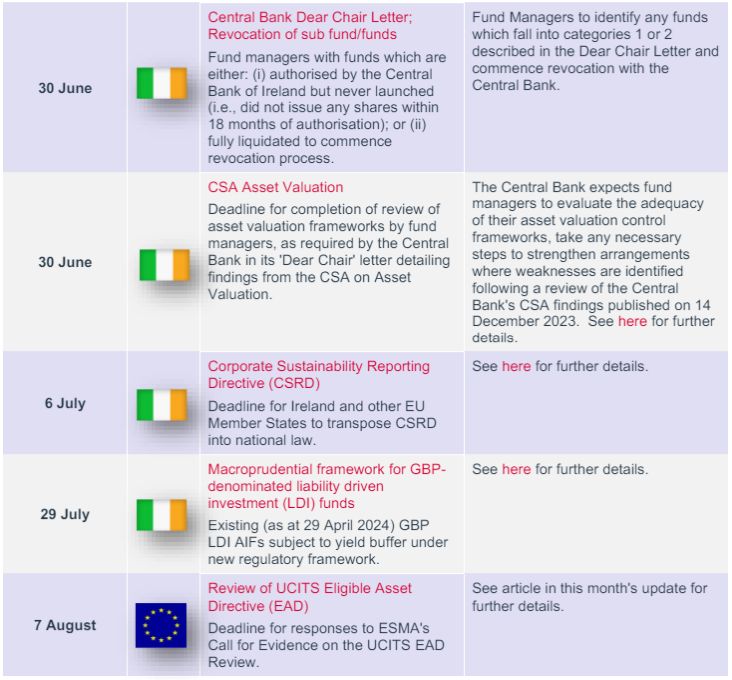

Key Dates & Deadlines: Q2/Q3 2024

The following are key dates and deadlines in Q2/Q3 2024 along with possible impacts and action items arising for fund managers.

ESMA's Call for Evidence on the UCITS Eligible Assets Directive

On 7 May 2024, ESMA published a Call for Evidence (CfE) on the review of the UCITS Eligible Assets Directive (UCITS EAD). This follows the Commission's June 2023 request to ESMA for technical advice on several aspects of the UCITS EAD including the assessment criteria for eligible assets, the presumption of liquidity for transferable securities, ineligible asset exposures and efficient portfolio management techniques.

Timeline

Industry responses to the CfE will inform ESMA's technical advice to the Commission on the UCITS EAD, which advice is due by 31 October 2024. On receipt of such advice, the Commission has indicated its intention to carry out a consultation on EAD amendment proposals in Q4 2024/early 2025.

Purpose of the EAD Review

The CfE notes that "Since the adoption of the UCITS EAD in 2007, the number, type and variety of financial instruments traded on financial markets has increased considerably, leading to uncertainty in determining whether certain categories of financial instruments are eligible for investment. in turn giving rise to divergent interpretations and market practices in terms of the application of the UCITS Directive and possible investor protection concerns." The review is perhaps therefore timely, although challenging for industry to consider further regime changes following the recently finalised UCITS amendments under the AIFMD Review.

The CfE

The CfE is divided into separate sections designed to collect evidence on the following aspects of the ESMA mandate for technical advice:

- Convergence issues and clarity of key concept and definitions (Section 3.1). This section asks for evidence and views on the clarity of key concepts and interpretation and convergence issues including on a wide-range of rules such as those for financial indices, money market instruments, liquidity, ancillary liquid assets, foreign currency, the UCITS trash bucket, transferable security criteria, valuation and risk management, derivatives, delt-one instruments, other fund investments including EU and non-EU ETFs, and efficient portfolio management;

- Direct and indirect exposure to certain asset classes and related data collection/analysis (Section 3.2). This section focusses on the possible risks and benefits of UCITS gaining exposure, either directly or indirectly, to asset classes on which there are divergent views as to UCITS eligibility including loans, Cat bonds, CoCo bonds, unrated bonds, distressed securities, unlisted securities, crypto assets, commodities and precious metals, ETCs, real estate, REITs, SPACs, EU and non-EU AIFs, emission allowances, delta-one instruments, ETNs, ABS and MBS.

Next Steps

Responses to the CfE will be accepted until 7 August 2024.

ESMA Funds' Names Guidelines Published

On 14 May 2024, ESMA issued guidelines on the use of ESG or sustainable terms in the name of a UCITS or AIF (the "Guidelines").

As further detailed below, the Guidelines set out minimum requirements for UCITS managers and AIFMs which use ESG or sustainable terms in the names of funds under management. The Guidelines apply without distinction to all types of UCITS and AIFs, whether open or closed-ended and regardless of investment strategy (including index-tracking funds).

The published intention of the Guidelines is to address greenwashing risk arising from the use of ESG or sustainability-related terms in fund names to market the fund's sustainability features.

Background

Publication of the Guidelines follows an industry consultation in Q4 2022 and a December 2023 public statement from ESMA on intended adjustments, in the final form Guidelines, to those published for consultation. The Guidelines are in line with the December 2023 proposals (as reported on by us in our January 2024 publication here).

The Guidelines are published under ESMA's new mandate, created by the AIFMD Review, to develop guidelines on fair, clear and not misleading fund names. As a result, while squarely in the sustainability promotion space, the Guidelines are not issued under SFDR and do not apply to SFDR financial products other than UCITS and AIFs. While this was a key point of contention raised in feedback to the consultation on the Guidelines, ESMA confirms that it focussed on the investment fund sector as being 'the one with the higher risk of greenwashing risk' but will consider, in conjunction with the other ESAs, the widening of the scope of the Guidelines to SFDR financial products other than UCITS and AIFs.

Timeline to application

The Guidelines apply three months after the publication of their translation on ESMA's website. New funds will be immediately subject to the Guidelines, while existing funds will benefit from a 6-month transition period. While there is no set timeframe for publication of the translations, this is expected sooner rather than later given ESMA was ready to issue the Guidelines last December but held off pending receipt of its abovementioned new mandate under UCITS and AIFMD.

The Guidelines

The key provisions of the Guidelines are as follows:

- Use of transition, social and/or governance terms

in a fund name requires:

- the fund to use at least 80% of assets to meet its environmental or social characteristic (in the case of Article 8 funds) or its sustainable investment objectives (in the case of Article 9 funds); and

- the fund to exclude investment in companies listed in Article 12(1)(a)-(c) of the Climate Benchmark Regulation (EU 2020/1818) i.e., companies involved in controversial weapons, tobacco or found in violation of the UNGC principles or the OECD Guidelines for Multinational Enterprises (MNE) (the Climate Transition Benchmark ("CTB") exclusions). The exclusions apply regardless of how investment in those companies is made or which financial instrument those companies may issue i.e., there would be no distinction between what kind of financial instrument an investment is made in, the company would still be excluded.

Transition terms include "transitioning", "transitional", "improving", "progress/ion", "evolution", "transformation", and any terms derived from these words. ESMA confirms its intention to catch a wide set of terms that give the impression of a positive evolution towards the goals described in the objectives.

Social terms include "social", "equality" and any other words giving the investor any impression of the promotion of social characteristics.

Governance terms include "governance", "controversies", and any other words giving the investor any impression of a focus on governance.

- Use of an environmental or impact term in the fund

name requires:

- the fund to use at least 80% of assets to meet its environmental or social characteristic (in the case of Article 8 funds) or its sustainable investment objectives (in the case of Article 9 funds); and

- the fund to exclude investment in companies listed in Article 12(1)(a)-(g) of the Climate Benchmark Regulation EU 2020/1818 i.e., companies involved in controversial weapons, tobacco, found in violation of the UNGC principles or the OECD MNE Guidelines, coal, oil, gas and high intensity electricity generation companies (the Paris-aligned Benchmark ("PAB") exclusion criteria). The exclusions apply regardless of how investment in those companies is made or which financial instrument those companies may issue i.e., there would be no distinction between what kind of financial instrument an investment is made in, the company would still be excluded.

Environmental terms include "green", "environmental", "climate", "ESG", "SRI", and any other words giving the investor any impression of the promotion of environmental characteristics.

Impact terms include "impacting", "impactful" and any other terms derived from the base word 'impact'.

- Use of sustainable term in a fund name

requires:

- the fund to use at least 80% of assets to meet its environmental or social characteristic (in the case of Article 8 funds) or its sustainable investment objectives (in the case of Article 9 funds);

- the fund to exclude investment by the fund in companies listed in Article 12(1)(a)-(g) of the Climate Benchmark Regulation EU 2020/1818 i.e., companies involved in controversial weapons, tobacco, found in violation of the UNGC principles or the OECD MNE Guidelines, coal, oil, gas and high intensity electricity generation companies (the Paris-aligned Benchmark ("PAB") exclusion criteria). The exclusions apply regardless of how investment in those companies is made or which financial instrument those companies may issue i.e., there would be no distinction between what kind of financial instrument an investment is made in, the company would still be excluded; and

- the fund to commit to invest meaningfully in SFDR sustainable investments, referred to in Article 2(17) of the SFDR.

- With the exception of transition terms, the Guidelines apply cumulatively meaning that the use of a combination of the above terms in the fund name requires the application of the requirements relating to each term used. Where the fund name combines transition terms with non-sustainability-related environmental, social, governance, or impact terms, only the requirements for the use of transition terms will apply but if the transition term is used in combination with a sustainable term, the requirements for use of a sustainable term apply.

Breach of the Guidelines

The requirements at 1-5 above apply for the life of the fund and any deviation is to be treated as a breach of the Guidelines. A temporary deviation will be treated as a passive breach provided it is not due to a deliberate choice by the fund manager (i.e., an advertent breach). NCA supervisory action is recommended for any advertent breach of the Guidelines, insufficient level of investments to use in-scope terms or where a fund name is considered unfair, unclear or misleading.

Next steps

As set out above, the Guidelines will apply to new funds immediately and existing funds will have 6 months from the date of application of the Guidelines to comply. Notably, ESMA has confirmed that it will consider guidelines on non-ESG/sustainable unfair, unclear or misleading names under its new UCITS and AIFMD mandate.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.