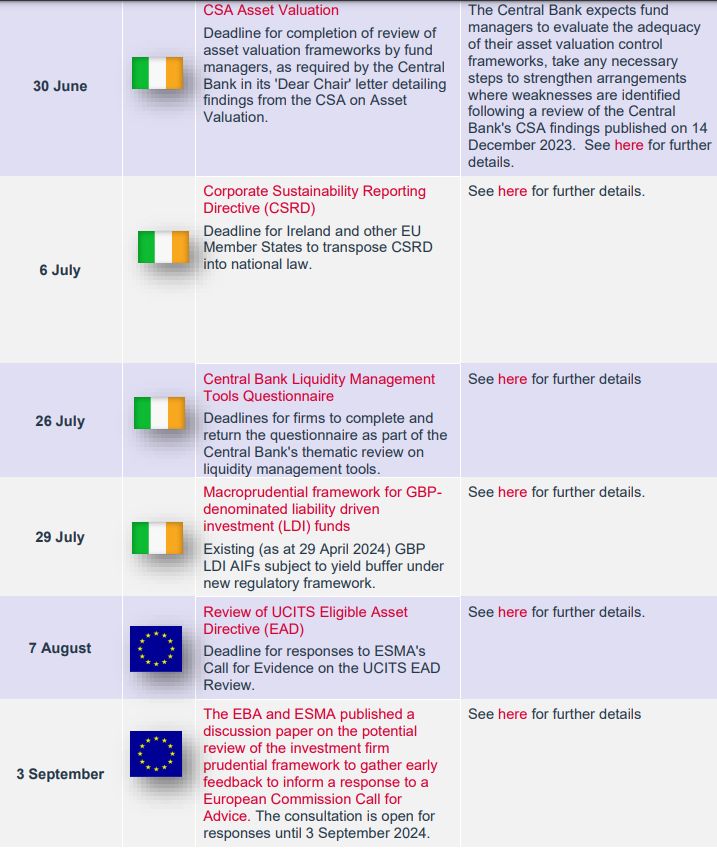

Key Dates & Deadlines: Q2/Q3 2024

The following are key dates and deadlines in Q2/Q3 2024 along with possible impacts and action items arising for fund managers.

ESMA statement on good practices in relation to pre-close calls between an issuer and analysts

On 29 May 2024, ESMA published a statement in relation "pre-close calls" and good practices. "Pre-close calls" are communication sessions between an issuer and an analyst or group of analysts who generate research, forecasts, and recommendations related to the issuer's financial instruments for their clients. These "pre-close calls" usually take place immediately before the periods preceding an interim or a year-end financial report during which issuers refrain from providing any additional information or updates. "Pre-close calls" can influence market expectations and instrument prices.

ESMA considers that "pre-close calls" carry inherent risks of inadvertent unlawful disclosure of inside information increased by the lack of publicity of these events and the absence of records of what was presented.

Issuers are reminded about the prohibition of unlawful disclosure of inside information and that public disclosure of inside information should take place in accordance with Article 17 of the Market Abuse Regulation and Commission Implementing Regulation (EU) 2016/10552.

Central Bank Update on the Markets in Crypto Assets Regulation (MiCAR) authorisation process

On 29 May 2024, at Blockchain Ireland Week, Gerry Cross, Director for Financial Regulation, Policy and Risk at the Central Bank of Ireland (Central Bank), updated the crypto assets industry on the Central Bank's approach to applications for authorisation under the Markets in Crypto Assets Regulation (MiCAR).

Mr Cross confirmed that the Central Bank plans to outline its authorisation and supervisory expectations in detail at an industry event in July 2024 and that they will be published thereafter. The Central Bank intends to open its MiCAR authorisation gateway in early Q3 2024.

While further details are awaited, Mr Cross encourages firms seeking to provide services or products under MiCAR to engage with the Central Bank as soon as possible. He also took the opportunity to outline some high-level expectations for firms and to recommend steps that the industry can take now to prepare for the MiCAR authorisation process.

Approach to authorisation and key expectations

The Central Bank's approach to assessing MiCAR authorisation applications is underpinned by consumer and investor protection risks associated with these assets and services. The assessments are guided by several perspectives, including the use case and utility, suitability for target markets and risks associated with the crypto products or services. As a rule of thumb, the higher the inherent conduct and investor protection risks in the products offered to customers and investors, the higher the Central Bank's expectations will be regarding a firm's ability to manage those risks.

Key Central Bank considerations/expectations include:

Governance. Firms must be able to demonstrate an appropriate level of "substance" in Ireland and be led by a local crypto-competent executive and board with a strong grasp of the local regulatory environment. Firms must maintain high-quality governance and risk management arrangements.

Target customer and investor base. Whether the services are retail-focused or aimed at institutional clients, shapes the Central Bank's view of risk.

Backed by underlying assets. It is important whether and how the crypto product/service that is issued or offered is backed by underlying assets.

Business model sustainability. The Central Bank pays close attention to the sustainability of the business model of the crypto issuer or crypto-asset service provider. The Central Bank takes a sceptical view of business models where profitability is driven by the heavy marketing, offering, and distribution of unbacked crypto to retail customers for speculative purposes.

Client Assets. The local firm must have full control of all client assets and prompt access to reserve assets to meet redemption demands.

AML risks. Firms must always know who their customers are and how they are funding their crypto activities and ensure these funds are not emanating from criminal activities.

Conflicts of interest. Conflicts of interest must be identified and managed appropriately. Firms must ensure a robust system is in place, which can proactively identify and subsequently remedy any conflicts in a timely manner so that no risks are posed to consumer interests.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.