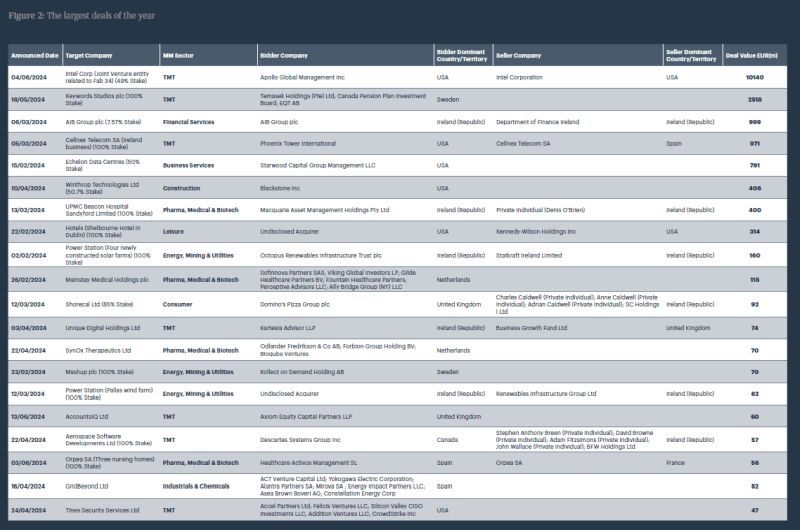

However, despite the preponderance of middle market deals, there has been a slew of transactions at the higher end of the scale. Indeed, with only half the year gone, there have already been five deals worth more than €500m each – the same number as in the whole of 2023.

The two biggest deals of the year so far both involved private equity firms and their desire to acquire innovative technology – although in very different sub-sectors of the industry.

The largest deal was announced at the beginning of June, when PE firm Apollo Global Management stated its intention to acquire a 49% equity interest in a joint venture for Intel's Irish manufacturing facility Fab 34 for €10.1bn.

Located in Leixlip, Fab 34 is Intel's leading-edge high-volume manufacturing facility designed for wafers using the Intel 4 and Intel 3 process technologies. To date, Intel has invested $18.4bn (€17bn) in the plant.

Intel noted that the deal would allow it to retain majority ownership of the factory while having the opportunity to redeploy capital into other parts of the business.

Apollo said that the deal was "among the largest private investments of its kind" and underscored "its role to help build the New Economy including next generation AI technology."

The other deal which climbed above the €1bn mark saw the Swedish private equity investor EQT swoop for Keywords Studios. EQT has agreed to pay €2.6bn for the gaming company, which is listed on London's Alternative Investment Market (AIM) but headquartered in Dublin. Keywords has built a strong business providing services to the developers of some of the world's most highprofile games, including Fortnite, Clash of Clans, League of Legends and Assassin's Creed.

The third largest transaction of the year so far was a very different type of deal. AIB Group is set to pay €999m to buy back a tranche of its shares from the Irish government, which has been a major shareholder in the bank since intervening in 2010 to recapitalise it during the global financial crisis. This is the latest in a series of such deals, with the Irish state's stake in AIB now standing at around 33%, down from 71% at the beginning of 2022.

Meanwhile, US-based Phoenix Tower International's €971m acquisition of Cellnex's Irish business was the fourth largest deal of the first half. Cellnex, a Spanish infrastructure business, has been operating in Ireland since 2019, when it acquired the tower operator Cignal, but is now looking to divest.

In sector terms, these four major deals helped technology, media and telecommunications (TMT) and financial services lead the way for total deal value during the first half of the year. TMT was also the busiest sector by volume, though both business services and industrials and chemicals accounted for more deals than financial services.

As the two biggest deals of 2024 demonstrate, private equity investors – both international and domestic – continue to take a keen interest in Irish businesses, though there have been fewer deals so far this year. PE buyers accounted for 35 of the transactions seen during the first half of the year, a 19% reduction compared to 2023. However, the value of such deals, at €14.4bn, was up 585% (the Intel Corp-Apollo transaction contributed 70% of this total).

While high interest rates and the rising cost of capital have inhibited deal volume for private equity players, the higher value figure demonstrates that financial sponsors are willing to match and even outstrip corporate valuations for the right company – particularly in Ireland's innovative technology sector.

Click the image below to download the report

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.