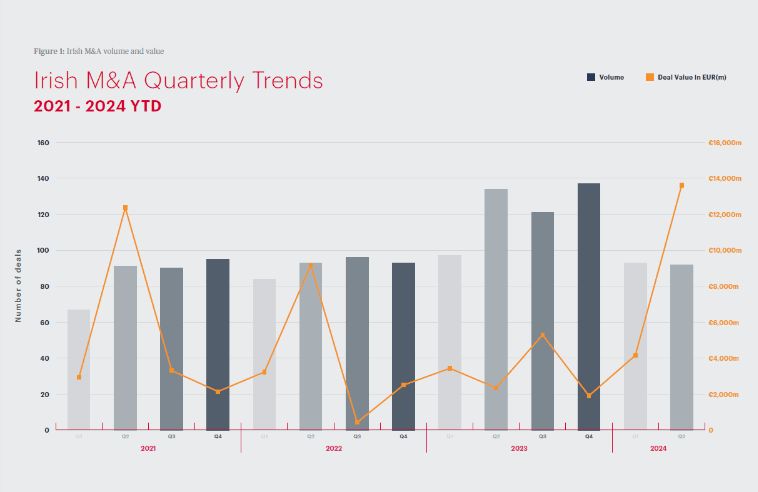

The first half of the year has seen two very different trends in the Irish M&A market.

On the one hand, against a background of macroeconomic volatility and geopolitical tension, the number of transactions in Ireland slowed somewhat with business leaders emphasising caution and holding fire. On the other, two megadeals in the country's flourishing technology sector have pushed deal value to its highest half-year total in three years.

In terms of volume, the year to date has seen 185 announced transactions for Irish companies – a 20% decrease compared to the same period in 2023. In part, that reflects the economic environment globally and in Ireland, with analysts becoming more cautious about growth in the country. The International Monetary Fund (IMF) now expects the Irish economy to expand by just 1.5% during 2024; as recently as October last year, the forecast was 3.3%. The downgrade follows mounting concern about slower momentum across Europe as a whole.

Dealmakers also appear more reluctant to commit to transactions in the current uncertain political climate, with elections across Europe and the US, and Ireland itself due to go to the polls by March 2025 (and even possibly before the end of this year).

However, in value terms, Ireland's M&A market has demonstrated remarkable resilience, proving that both corporates and their private equity peers are willing to go the extra mile for the right asset. Indeed, the €17.8bn-worth of transactions recorded during the first half of the year represents a 207% increase on the same period in 2023. The total was lifted by eight transactions at the upper end of the market – deals worth more than €250m. That figure included the largest deal of the year so far, which saw buyout firm Apollo Global Management agree to pay €10.1bn to acquire a 49% stake from chipmaker Intel in a joint venture entity related to Fab 34, Intel's high-volume chip manufacturing facility based in Leixlip, Ireland.

Despite the growth at the upper end of the dealmaking scale, Ireland's mid-market accounted for the lion's share of deal activity during the first half of the year. Some 84% of deals were worth between €5m and €250m.

To view the full article please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.