With the amendments proposed through Finance Bill (No.2), 2024, the Government has brought many changes to current tax laws. While some of these changes were anticipated and necessary, however the need for the others may be debatable. Many of the changes proposed have been widely discussed over and on the other hand, some of the important updates have gone under the radar. One of the said changes includes the government's proposal to reverse settled tax positions on two important issues that shall impact large number of taxpayers in the country. Such changes along with their impact have been discussed under –

Issue 1: Taxability of income from letting out 'Residential' House Property.

The issue relating to the taxability of incomes from letting out a 'Residential' House Property has been subject to a lot of debate over the years and has travelled to judicial forums for interpretation. These views range from taxing the said income under the head Income from House Property ('IFHP') to taxing the said income under the head Income from Profits and Gains from Business or Profession ('IFPGBP'). There are set of arguments for taxing the same income under the different heads of chargeability. Also, the benefits like claiming deductions are also different under both heads of chargeability.

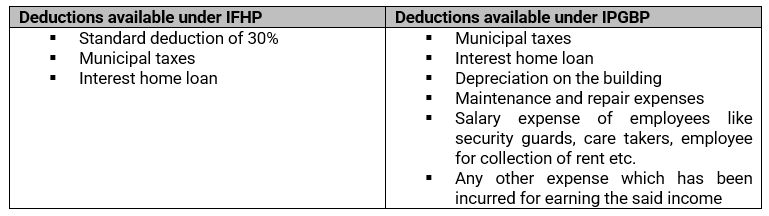

The main reason of contradiction for taxing the said income under the different head of chargeability is the deduction available under both views. A comparative list of deductions available to under both chargeability heads have been mentioned under –

Depending upon the situation and the expenses incurred for earning the said income, the taxability would vary under both the heads of income. For example, a taxpayer may not be incurring any expenses for earning the rental income, then offering the income under the head IFHP would be beneficial as the said taxpayer will be able to claim standard deduction of 30%. On the other hand, if the taxpayer is having depreciation, salary expense etc, which in aggregate exceed 30% standard deduction then offering the said income under the head IFPGBP would be beneficial.

To avoid such tax plannings, the judiciary through the Hon'ble Supreme Court in the case of Chennai Properties & Investment Ltd (373 ITR 673) settled the position with the logical rationale. It was held that in cases where the main object of any business is to acquire properties and earn income from letting out the same shall be brought to tax as business income and not as income from house property. Therefore, the intention of the owner was the main criteria for classifying the income.

A similar view has been observed in various other judgements. Some of the said judgement has been enlisted under –

- Hon'ble High Court Of Madhya Pradesh in the case of Principal Commissioner of Income-Tax V. M.P. Entertainment and Developers (P.) Ltd. [2024] 162 taxmann.com 6 (Madhya Pradesh)

- IN THE ITAT MUMBAI BENCH 'B' Nisarg Realtors (P.) Ltd. v. Assistant Commissioner of Income-tax [2022] 139 taxmann.com 163 (Mumbai - Trib.)

The above view of charging rental income as business income had become a settled tax position which was followed by many taxpayers over the years. However, the same has been recently reversed through a proposed amendment for certain category of property.

Proposed amendment in Finance Bill (No. 2), 2024

The Government has proposed a key change in provisions of Section 28 by adding an explanation w.e.f., 1st April 2025 (i.e. FY 2024-25 and AY 2025-26) that any incomes earned from letting out of a 'Residential' House Property or a part of the house shall be taxable as IFHP and not as IFPGBP. However, other types of property like industrial land, commercial spaces etc shall still be governed by the existing tax positions.

Impact of the proposed amendment

The proposed amendment by the Government will have a huge impact on several stakeholders including real estate developers, Airbnb hosts, owners running hostel business and other property owners. These taxpayers will not be able to claim any expenditure other than those specifically allowed under Section 24, even if they are actually incurred by them. For example, real estate owners have huge depreciation expense, Airbnb owner have platform fee, staff cost etc, owners running hostel business have staff cost, electricity cost etc. All these expenses would be covered under the standard deduction of 30% and thereby the said property owner shall be required to pay additional tax on letting house the property.

For example, a taxpayer has residential properties wherein on the upper floors are being used for letting out as residential house, and the ground floor is let out to banks/ other commercial institutions. Also, there may be a situation, where the residential property is entirely given to bank/ commercial institution on rent.

On the above facts, a question arises that in such a situation under which head of income the said rental income would be offered to tax. The income tax department would argue that the property is a residential property, therefore, the income should be charged to tax under the head IFHP. On the other hand, the taxpayer would argue that the main business of the taxpayer is earning rental income from such properties and because of the notification of the municipalities, the said property is being used for commercial purpose and let out to bank/ commercial institutions. The said properties cannot be termed as residential house as the said property is not used for residential purpose. Hence the income should be offered to tax under the head IFPGBP.

Likewise, above, the same problem would arise for Airbnb owners, real estate companies and taxpayer running guest houses (like PGs for students etc).

The above amendment not only reverses the settled position but also opens the Pandora's box of litigation on the subject matter.

Issue 2: Amount incurred to settle proceedings initiated for contravention of law.

As per the provisions of the Income Tax Act, 1961, it has been provided that any expense incurred solely and exclusively for the purposes of business shall be allowed as an expense in calculating the total income of an assessee under IFPGBP. However, the section 37 of the Act, further provides that any amount paid which is considered as an offence or is prohibited by any law shall not be allowed as deduction.

Here an issue arose before the judiciary in respect of admissibility of any amount paid for settlement of an ongoing proceedings without admitting to any offence or guilt. Settling the issue, the ITAT Mumbai in the following cases:

- DCIT v. Shri Anil Dhirajlal Ambani [TS-291-ITAT-2018(Mum)

- ITO v. Reliance Share and Stock Brokers (P) Ltd. [TS-664-ITAT-2014(Mum)]

held that any amount paid for settlement of a proceedings shall be allowed to assessee as deduction where the assessee did not admit to any guilt and wrongdoing since the expenses did not relate to any infraction of law or any offence.

Amendment in Finance Bill (No. 2), 2024

The Government has proposed a key change in provisions of Section 37 by adding clause (iv) stating that any paid towards settlement of a proceedings initiated in relation to contravention under such law as may be notified by the Central Government in the Official Gazette in this behalf shall not be allowed as deduction. The said amendment shall be effective from 1st April 2025 (i.e. FY 2024-25).

Impact of amendments

The proposed amendment by the Government will have a huge impact on taxpayers who pay humongous amount to the authorities to avoid litigation. The intention of the taxpayers at many places is to avoid litigation even though whether the offence has been committed or not. In such a situation a bonafide taxpayer would have a double whammy on him, as the taxpayer would be paying the amount for settlement of dispute and on the other hand the taxpayer would not be allowed to claim deduction of amount paid. Hence, leading to hardship to the taxpayer.

Bottom Line

Through the recent changes proposed in the Finance Bil (No. 2), 2024, the Government has reversed the settled tax position on both the issues. The said changes have also introduced some ambiguity and new challenges for the taxpayer. It would be interesting to see how the government addresses these uncertainties.

For additional insights and a broader overview of the 2024 budgetary changes, please refer to the Coinmen Budget 2024 Report

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.