The most awaited changes expected in the budget are relating to personal income tax. This was a historic 7th budget for our Finance Minister, Nirmala Sitharaman and the first of the Modi Government 3. The focus of the budget has been to create employment and thus schemes for skilling youth with industry relevant courses, promotion of internship of youth in top companies, PF reimbursement for additional employees employed during the year etc. have been introduced.

The Government introduced the new regime of taxation for individuals a couple of years back which was without any deductions or incentives. The individuals could optionally apply the old regime or the new tax regime. Last year, the new tax regime was made the default regime of taxation clearly indicating that the government wanted to promote the new exemption and deduction free tax regime.

In the current budget the beneficial amendments have been proposed in the new regime only leaving the old regime of taxation untouched. A few significant amendments are discussed below:

Changes in the New Tax Regime: Latest Income Tax Slab FY 2024–25

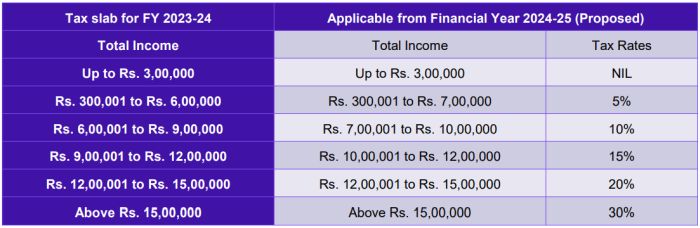

The tax slabs upto INR 15 lakh of income have been beneficially amended in the new tax regime. The new tax slabs are now as under for Assessment Year (AY) 2025-26 i.e., Financial year 2024-25 is given below:

The tax rebate applicable for income upto INR 7 lakh is continued. The proposed amendment makes the new regime lucrative especially for income groups upto INR 15 lakhs salary.

Apart from the tax slab changes, in the new regime, the standard deduction from salary has been proposed to be increased to INR 75,000 as against INR 50,000. Further employer contribution to NPS allowed as a deduction from income under section 80CCD(2) can now be claimed upto 14% of salary. This was 10% earlier. These changes are applicable only to individuals opting for the new tax regime.

The people were hoping for allowing set off of housing loan interest against salary income and some investment linked deductions akin to section 80C in the new tax regime. The major differentiating factor discouraging people to opt for the new regime has been set off of housing loan interest against salary income and claim of HRA. Unfortunately, these expenses are still not allowed as deduction or set off under the new tax regime. However, the tax slabs in the new tax regime have been made very lucrative and may also be more beneficial inspite of these allowances available in the old regime. Hence a careful comparison of income tax payable under both regimes is still required.

Standard Deduction on family pension

Currently the deduction available under family pension is lower of one third of the pension amount or INR.15,000. It is proposed to increase the deduction to INR.25,000 per year.

Changes in the Capital Gain taxation (with effect from the 23 of July 2024)

The capital gain tax scheme has been proposed to be changed with immediate effect. The proposal is to simplify the tax regime. Capital gain tax rate differs on whether the asset is a long term held asset or a short term held asset. Further, the rate also differs for various kinds of assets. The proposed changes are as follows:

Change in holding period to determine the Nature of Capital Gain

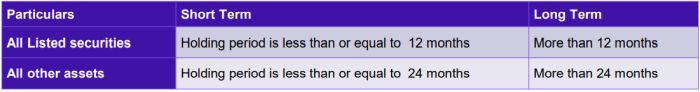

It is proposed that there will only be two holding periods, 12 months and 24 months, for determining whether the capital gains earned should be taxable as short-term capital gains or long-term capital gains as below:

Change in Rate of tax on Capital Gain

It is proposed that short term capital gains for all assets shall now be as per slab rates except listed securities. Whereas short term capital gains on listed securities (on which STT is paid), specifically listed equity shares, units of equity oriented mutual funds and units of business trust shall be taxed at 20% as against 15% currently.

In respect of Long-term capital gains, it is proposed to tax the same at 12.5% as against 20%. In respect of long-term capital gains on listed securities (on which STT is paid) the exemption of INR 1 lakh provided in section 112A has been increased to INR 125000. A significant change in long term capital gain computation proposed is the removal of indexation benefits.

Lastly, in the previous year, market linked debentures were made taxable as per slab rates irrespective of their holding period. These provisions have now also been made applicable to unlisted debentures and bonds.

STT rates have also been proposed to be increased.

While simplification of the taxation scheme is welcome, the benefit of lower rate of tax on long term capital gains at 12.5% off sets the removal of indexation benefit.

Tax on distributed income of domestic company for buy-back of shares (with effect from 1 October 2024)

As per the extant provisions of income tax, Buy back tax was payable by the company on buy-back of shares and the corresponding income was exempt in the hands of recipient shareholder. It is now proposed to tax buyback in the hands of recipient shareholder and buy back tax has been abolished.

It is proposed to tax the amount received by the recipient/shareholder on account of buy-back of shares by the domestic company as Dividends chargeable under the head income from other sources. And no deduction for expenses shall be available against such dividend income.

The purchase cost on shares brought back shall be treated as capital loss in the hands of the shareholder and this capital loss is eligible for set off against capital gain available. Any excess capital loss remaining will be eligible to be carried forward to subsequent years.

The taxation of buy back of shares has been made akin to dividends. However, the buy back consideration is immediately taxable as income from other sources at normal slab rates, whereas the loss due to extinguishment of shares is treated as capital loss. This is unfair for the investor who has opted for buyback.

Ease in claiming credit for TCS collected/TDS deducted by salaried employees (with effect from 01st of October 2024)

Last year the Government expanded the scope of TCS on many transactions including LRS, tour packages etc. TCS was not being considered as a credit of tax while computing the TDS on salary income and was claimed as a tax refund in the return of income. This also resulted in cash flow issues for individuals.

In order to avoid cash flow issues to the employees, the budget has proposed to consider TCS while computing the TDS liability under salary itself.

Conclusion

The government is clearly on the path of simplifying the tax structure and all the amendments have been made in that direction. It would have been great if some more amendments like investment linked deductions, set off of housing loan interest aiming to reduce tax liabilities on salaried individuals would have been made.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.