From January 2025, there will be full enforcement on incorrect classifications while a draft law to clarify employment relationships should come into effect in 2026

The distinction between being an employee or a contractor is crucial for businesses, with significant implications for tax obligations, social security contributions and employment rights. Incorrectly classifying a contractor who should be recognised as an employee can result in the retrospective recovery of taxes and social security contributions, and in certain situations, penalties may be imposed. Additionally, employment law implications may arise, as employment laws grant employees certain protections, including stipulated grounds for termination of employment.

In practice, while it is often quite clear when an employment relationship exists, there are also instances where it becomes challenging to differentiate between an employee and a contractor. Due to this ambiguity, the Dutch tax authorities have enforced their policy on incorrect classification only in cases where there is evident abusive. However, this is set to change in 2025.

Starting from 1 January 2025, there will be full enforcement of the Dutch tax authorities' policy on incorrect classification for cases as of 1 January 2025 (that is, no historical tax risk until the end of 2024). This shift from "enforcement in abusive cases" to full enforcement could lead to the reclassification of some contractors as employees, with the associated recovery of taxes and employment law implications.

How to manage the reclassification risk

This raises the question of how an organisation should handle a contractor if the relationship is or may be (re)classified as an employment relationship by the Dutch tax authorities. Also, what is the tax exposure if a business continues working with contractors whose relationships may be reclassified as employment?

This is what businesses can do to manage the risk:

- Assess whether they are currently working with independent contractors.

- Gather all facts of each contractor's case to evaluate each contractor's relationship if they are truly independent – this can be difficult in practice and employment law advice is recommended.

- Engage in discussions with those whose status may be (re)classified as employment to explore alternative ways to structure the relationship.

- If the situation cannot be negotiated into a compliant employment relationship, how to proceed further should be considered on a case-by-case basis (such as negotiating the risks/terminating the agreement).

- Develop a policy for future situations to prevent incorrect classification of a contractor's relationship.

Performing a tax calculation on the benefit or detriment that arises when the relationship changes from a contractor's relationship to an employment agreement can be helpful for negotiations between the employer and the employee/contractor.

Law on clarifying employment relationships is postponed

On a related matter, it has been announced that legislation that aims to clarify when someone is considered an employee (the so-called Wet verduidelijking beoordeling arbeidsrelaties en rechtsvermoeden (VBAR)) has been postponed, and will not take effect before 1 January 2026.

The draft legislation proposal of VBAR has been sent to the Council of State for advice. The draft proposal introduces an assessment framework for determining whether there is an employment or a contractor relationship based on certain indicators.

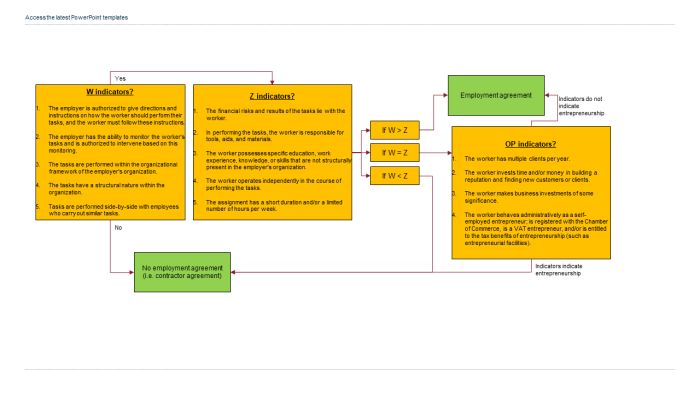

These indicators are the "W" indicators for employment characteristics, the "Z" indicators for contractors characteristics (that is, contra-indicators) and the "OP" indicators for entrepreneur characteristics. In essence, it is important to balance the W indicators against the Z indicators. If this balance is inconclusive, the OP indicators can help determine whether there is an employment agreement or a contractor agreement.

Draft assessment framework

Below is a decision tree of this draft assessment framework, including the indicators for determining whether there is an employment agreement.

Another key point of the draft proposal is the introduction of a presumption of employment based on an hourly rate (this is set at €33 in the current draft proposal). This element makes it easier for workers to enforce an employment contract. If the worker can demonstrate that they earn less than the applicable hourly rate, it is up to the employer to prove that there is no employment agreement.

The VBAR is intended to significantly reduce the number of incorrect classified contractors. However, different stakeholders have criticised the draft legislation proposal as, in their view, it does not effectively address the issues they have raised during the internet consultation phase of this proposal, one of which is a clear assessment framework on determining when there is an employment agreement.

Despite the delay to the VBAR, the Dutch tax authorities plan to stick to their shift of enforcement policy on incorrect classified contractors per 1 January 2025.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.