With the U.S. sector share doubling to $500 billion by 2030, companies must prepare for a deepening talent shortage.

While the U.S. remains a global leader in the semiconductor industry through its role in chip design, the nation's position in semiconductor manufacturing has declined in recent decades.

In 1990, the U.S. managed 37% of global fabrication. Today, that share has dwindled to 10%, as East Asian manufacturers now supply approximately 65% of the world's semiconductors. Following the pandemic and increased geopolitical tension with China, American vulnerability as a semiconductor importer has never been more apparent—a problem given that chips are needed for everything from computing and iPhones to war scenario simulations.

In reaction, the U.S. passed the CHIPS Act, allocating $52 billion for the advancement of American semiconductor research, development, manufacturing, and associated workforce development. This legislation is an aggressive attempt to reshape the U.S. semiconductor industry by fostering a self-reliant supply chain spanning from raw materials to end products. The U.S. government is betting it can reverse the trend of diminishing manufacturing capacity by incentivizing investments and creating opportunities for domestic production. The act's primary ambitions are to bolster the economy and national security by creating an entirely domestic "sand-to-product" semiconductor sector while extending U.S. technological leadership through 2050. There are three tactics operating in support of this strategy:

- Legislation and funding: $52B allocated under CHIPS Act for semiconductor industry, including $39B for manufacturing and $12B for R&D/workforce development

- R&D and manufacturing investments: Continuous R&D growth with 18% of revenue spent; significant investments in new manufacturing facilities like Intel's $20B and TSMC's $12B in Arizona

- Industry partnerships and M&A: Strategic partnerships and mergers, such as Intel with TSMC and Qualcomm with Microsoft, to increase capacity and specialization

Manufacturing expansion shows early promise

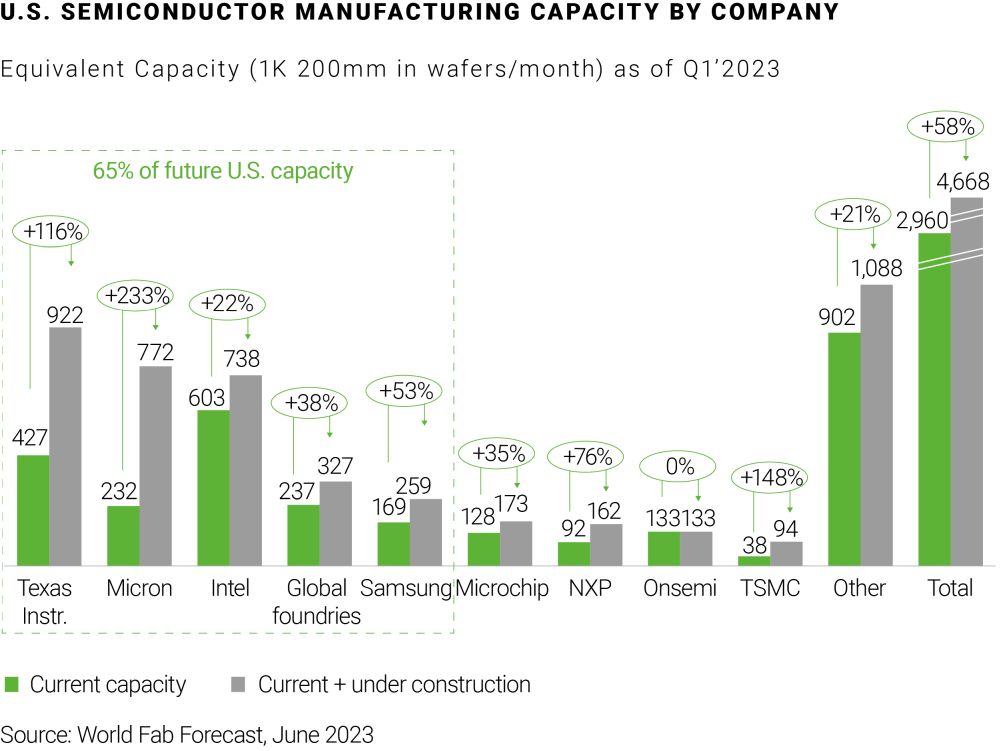

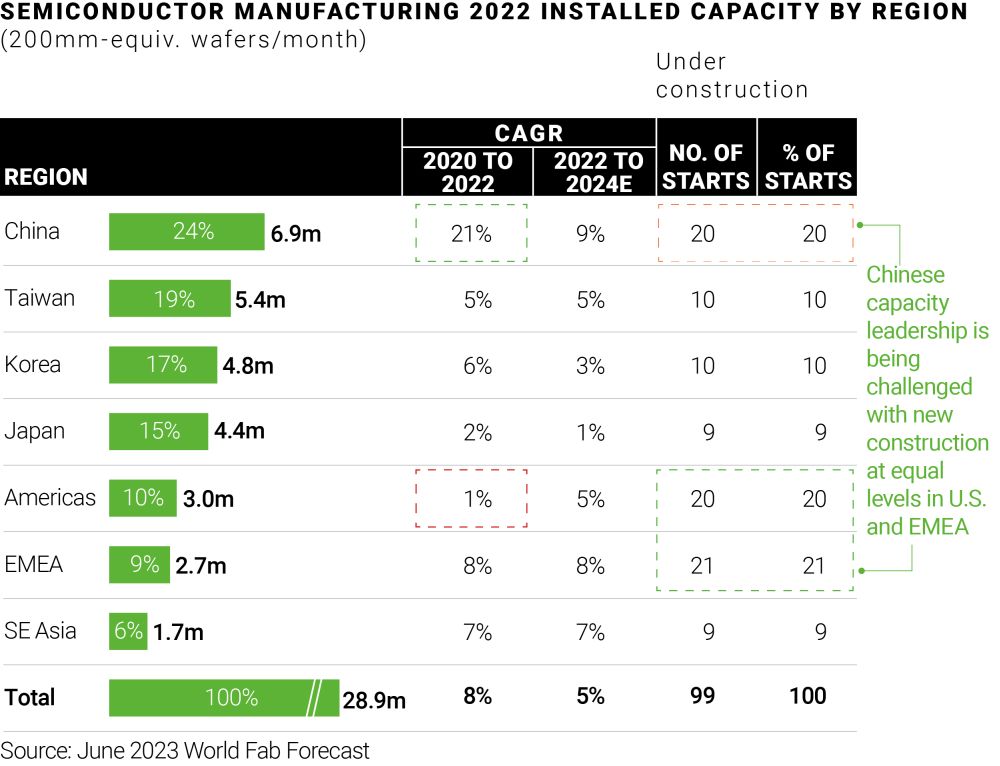

The U.S. is increasingly competitive with China in terms of the number of new facilities under construction. Domestic manufacturing capacity is set to increase almost 60% upon completion of major new U.S. fabrication facilities announced by Micron, Samsung, Intel, TSMC, and Texas Instruments(Fig 1). When fully operational, their combined output will bring the country up to a production parity with Taiwan and South Korea (Fig 2).

Figure 1

Figure 2

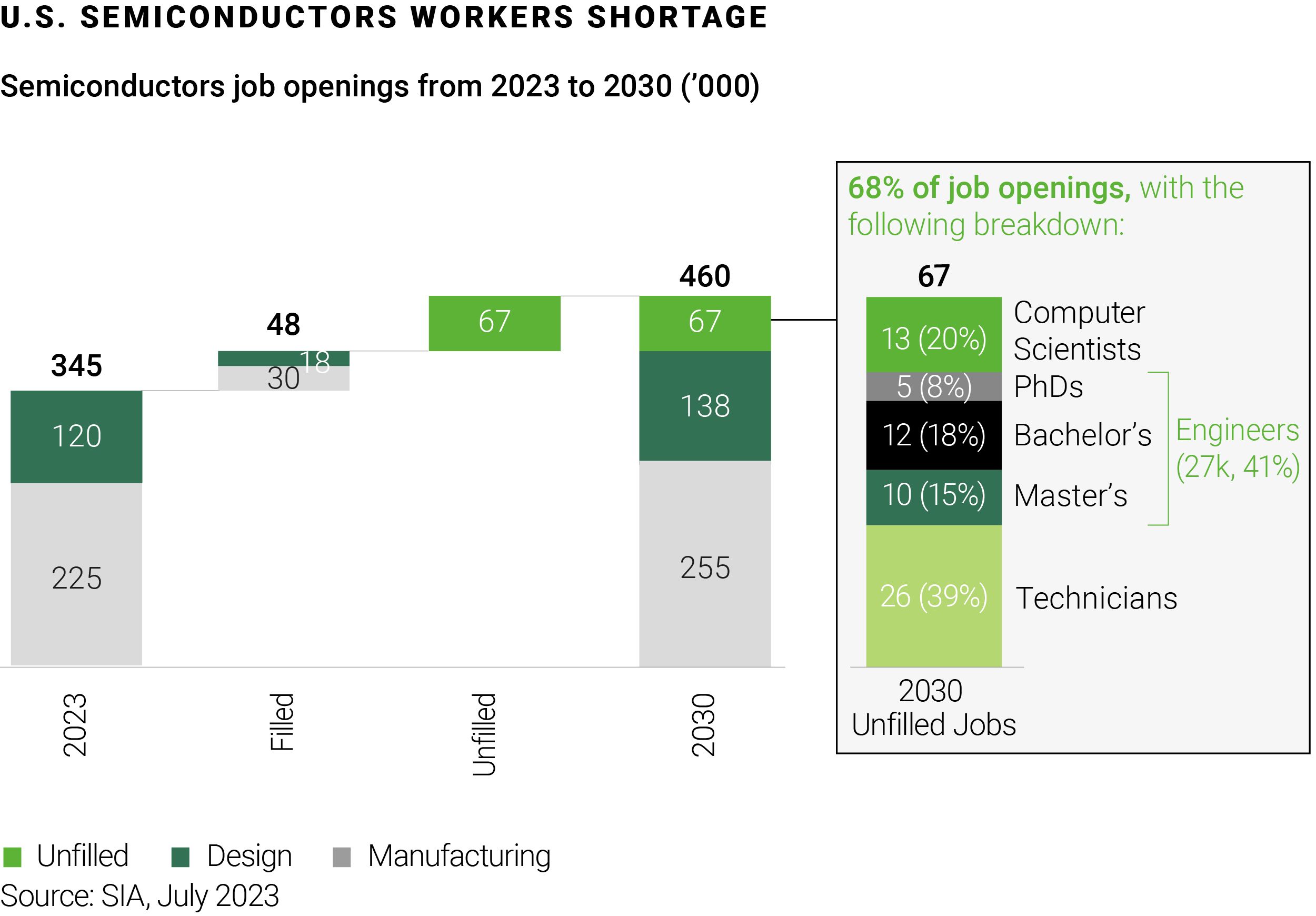

Despite the considerable investment in domestic manufacturing and technology, its effectiveness will hinge ultimately on the availability of a skilled and capable workforce—and the U.S. isn't ready. A tight job market exacerbated by a complex economic landscape has already left many industries grappling with workforce shortages. Based on AlixPartners' analysis, the employee shortfall will be significant, with far too few skilled engineers, technicians, and scientists available. On top of this, the industry needs to make substantial hires to meet expanding manufacturing tasks like running lines and testing, packaging, and shipping products. Even if worker productivity increases by the time new manufacturing facilities are functional, companies may need to address a gap equivalent to 67 thousand full-time employees to meet investment demands (fig 3).

Figure 3

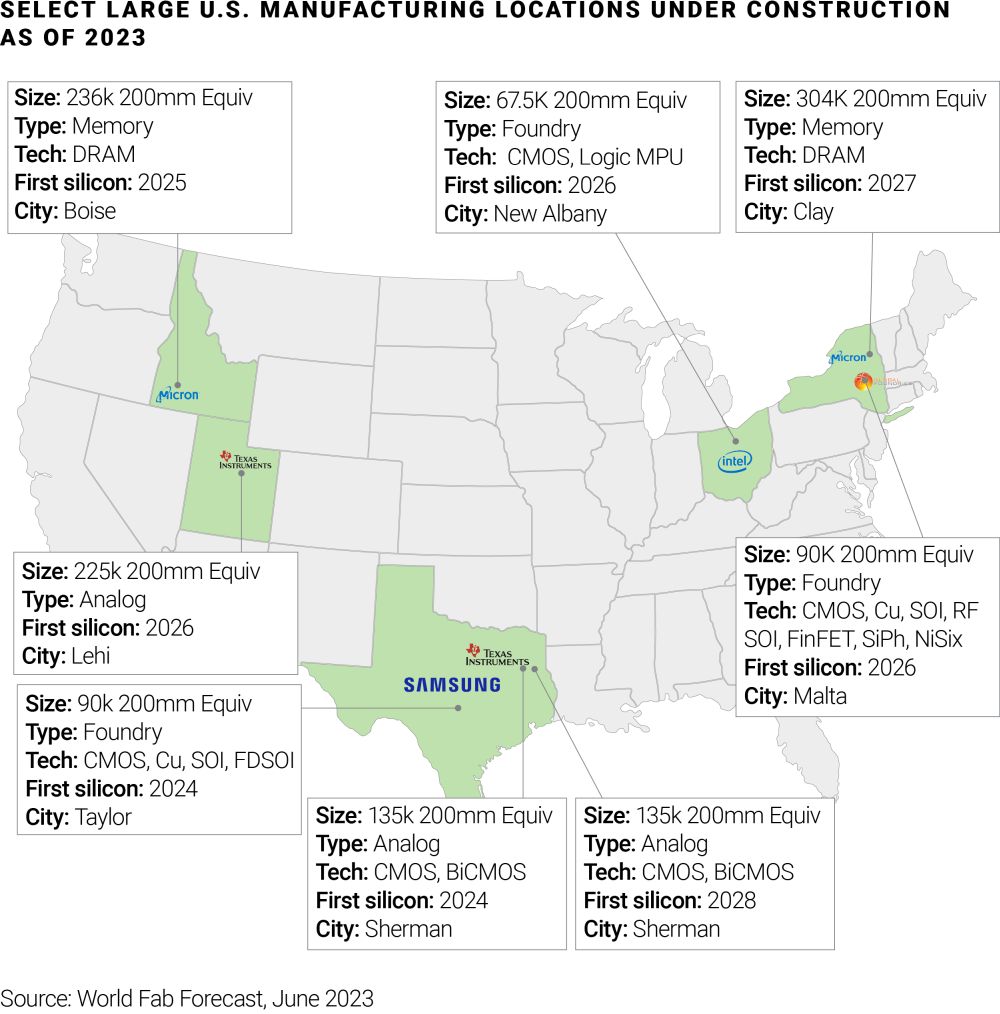

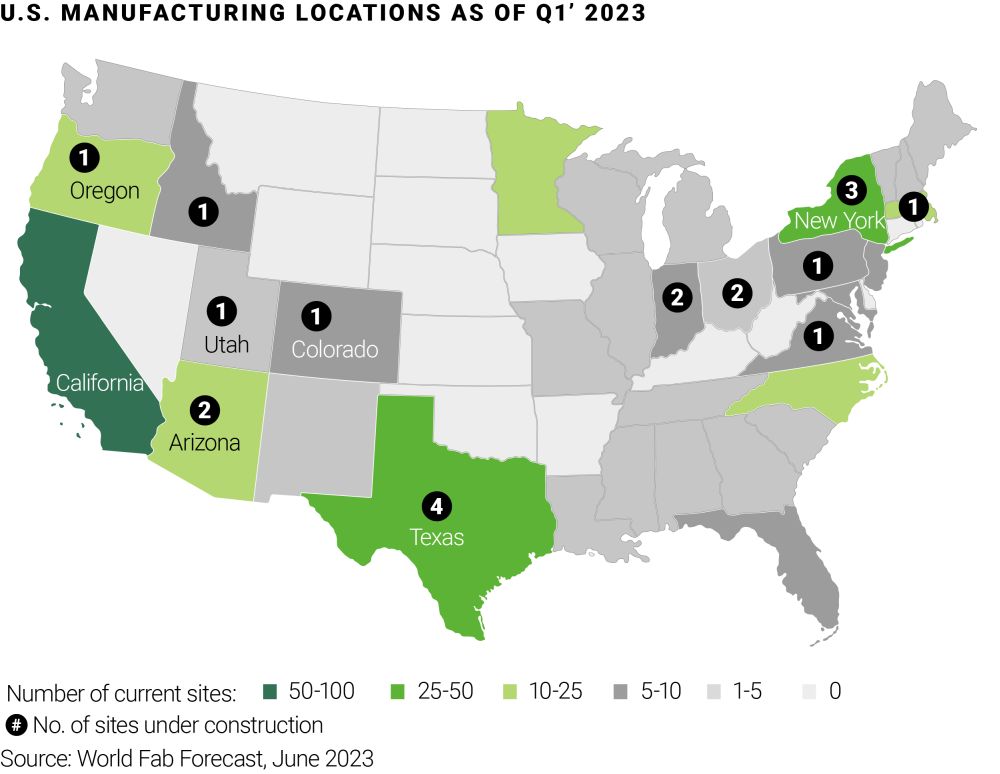

To compound the problem, new construction is geographically concentrated away from historical talent centers. California has the largest installed manufacturing base by fabrication count, but zero new construction (Fig 4). The Mountain West and Mid-Atlantic regions are relatively small regional players today but will soon be home to some of the most advanced chip production facilities in the world. Companies like Micron and Intel, enticed by a mix of low-cost energy, accessible real estate, and state and local incentives, are building massive facilities in communities such as New Albany (central Ohio), Clay (upstate New York), and Lehi (a Salt Lake City suburb) (Fig 5).

Figure 4

Figure 5

Clear implication: a looming and long-term war for talent

Given the scale of investment necessary for American manufacturers to succeed (as well as to qualify for subsidies), companies need detailed workforce development plans that outline robust hiring and upskilling strategies. Collaborating with local institutions may become table stakes for companies to keep up with demand. Talent acquisition, retention, and development strategies should be integrated within an organizational structure and supply chain designed to operate efficiently in a dynamic, competitive landscape.

The shortage is already here. Soon, several industries are likely to face skilled labor challenges; the medical technology, clean energy, AI, and advanced manufacturing fields are just a few likely to feel the pressure of a talent gap.

Talent strategies must rapidly adapt to this rapidly-shifting environment

As talent management strategies help separate the winners and losers in the U.S. semiconductor manufacturing race, others paying attention will benefit from the learnings. To effectively address this critical talent gap and ensure a capable workforce for manufacturing goals, semiconductor companies may consider a multi-pronged strategic approach including:

- Develop comprehensive workforce plans aligned with capacity expansion, ensuring the right skills are available at the right locations and times.

- Implement innovative global talent acquisition models like recruitment process outsourcing to access specialized semiconductor talent pools worldwide.

- Redesign total rewards strategies - compensation, benefits, policies - to enhance the ability to attract and retain scarce technical skills.

- Build corporate academies/universities to upskill/reskill the current workforce while creating tailored training for new hires.

- Facilitate cultural transformation to build an entrepreneurial, innovative workplace appealing to top engineering and technical talent.

- Leverage AI/machine learning tools for strategic workforce planning, targeted sourcing, predicting attrition risks, and proactive retention programs.

- Evaluate make-vs-buy decisions and outsourcing/offshoring opportunities for specific roles/skills to mitigate domestic labor shortages.

- Optimize site selection to enable access to localized talent clusters while meeting capacity needs cost-effectively.

Those firms that move quickly today to implement these strategies will best position themselves as magnets for talent as competition for those skills accelerates.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.