- within Law Department Performance topic(s)

This article is part of our "Planning for Success" series on supply chain planning and operations.

Global supply chain management has been buffeted by a number of headwinds in recent years, leading to rising costs and increased competition – a trend we expect will continue going forward.

Ongoing geopolitical tensions in Ukraine and the Middle East are disrupting supply chains and challenging visibility on the reliability of trade routes in the near future. Economic uncertainty and high inflation have led to rising costs just as companies are emerging from the impact of the pandemic and its aftermath, during which supply chains were hit hard by factory closures, trade bottlenecks, shifting consumer behavior and excess or insufficient warehouse stocking, among other issues.

To counter this, innovative businesses have invested in planning capabilities that allow them to make use of all the information as soon as it is available, to orchestrate or even redirect their supply chains. In some cases, this has only reinforced untenably high customer expectations. Businesses that don't keep up are at risk of seeing value leak at every step of the supply chain due to misaligned supply and demand, ultimately disappointing customers.

To stay competitive in this landscape, acquiring advanced planning capabilities is a must. In this article, we will look at the challenges and opportunities for businesses in supply chain planning.

Supply chain challenges have risen in recent years, making subpar planning or operational missteps far costlier than before.

- Movement of goods: Disruptions to major supply

routes are causing price jumps and delays globally. Spot shipping

prices have more than quadrupled since late 2023 amid the Red Sea

shipping attacks and the drought in Panama. On the Asia to Europe

route, many shipping companies are rerouting around the Cape of

Good Hope, adding 20-30 days to a typical round trip.

- Manufacturing products: Elevated levels of inflation in recent years

have made manufacturing expensive due to higher raw-material and

production costs. While overall inflation in most nations has

cooled from a 2022 peak, it may prove sticky in the near term. Global energy prices are also still above

pre-pandemic levels, making processes costlier in energy-intensive

industries.

- Resilience: Whether in the form of buffer

inventories or spare production capacity, tied capital is now more

expensive to hold given higher interest rates in key economies

– currently 3.75% on the deposit facility in the EU and

5.25%-5.5% Fed funds rate target in the U.S., for example.

- Disruptions: Be it extreme weather, financial

contagion, pandemic, geopolitics or blockage of a global trade

bottleneck, the number of major disruptive events is on the rise.

For example, the number of annual billion-dollar-impact weather and

climate events in the U.S. has increased from about 6 in the early 2000s to

between 18 and 28 in the past four years. Supply chains are still

deeply interconnected and susceptible to total disruption from a

number of single points of failure.

- Demanding customers: Customers have grown accustomed to faster and more personalized service, with options such as next-day delivery, free returns, last-minute order cancellations and product customization taken for granted by many. Retailers are also demanding high on-time-in-full (OTIF) levels – 98.5% is not uncommon – from their suppliers, imposing heavy penalties on any misses. This has led to very high safety stock requirements and constant, costly last-minute changes to the production plan.

For businesses, the combination of these factors means increasing pressure to ensure the supply chain is perfectly coordinated, leaving little scope for planning mistakes or delays in reacting to developing disruptions.

Businesses that are able to innovate their supply chain capabilities and keep up with the digitalization of the industry to meet these challenging requirements can put rivals at a cost disadvantage, or even cut them out of revenue opportunities altogether in the long run.

As customer demands grow and technology enables greater data analysis and predictive capabilities to manage the supply chain, the margin to conduct business without advanced planning capabilities will erode further.

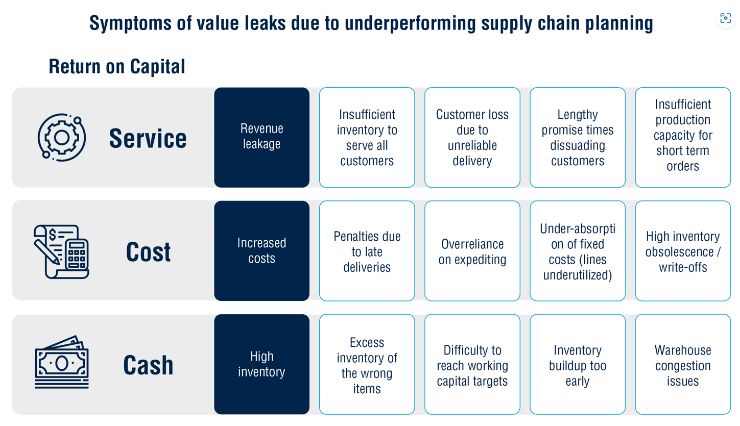

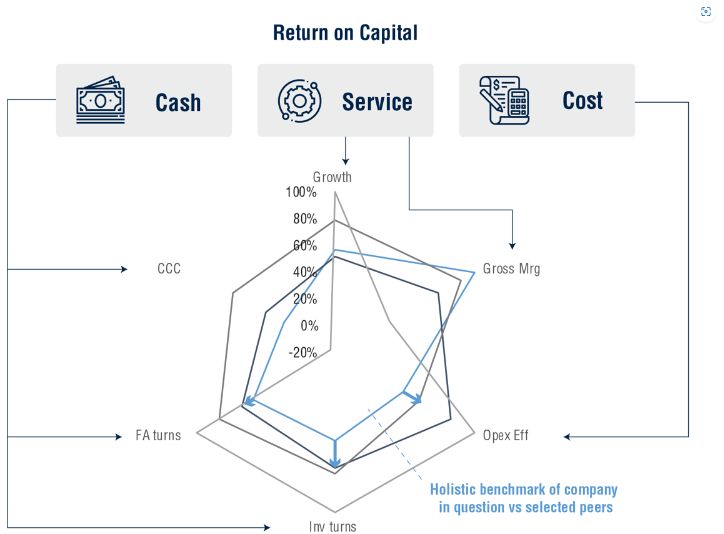

Unless the issue is addressed urgently, the resulting value leakage will end up hurting the company's return on capital, be it by causing revenue losses (e.g., by failing to deliver product), increased costs (e.g., by paying too much for rushed orders), unnecessary tied capital (e.g., excessive buffers on the wrong items), or all of these simultaneously. The symptoms we typically see are illustrated below:

The root cause of these symptoms can be traced to underperforming planning (misaligned supply and demand at every stage), often from the failure to use all available information including forecasts to make better supply chain decisions that result in higher return on capital.

Once the effects of poor planning set in (especially if caused by a fundamental change in the business environment), they tend to spiral into a vicious cycle that can only be stopped by addressing the root cause and improving the planning process overall.

The supply chain planning opportunity

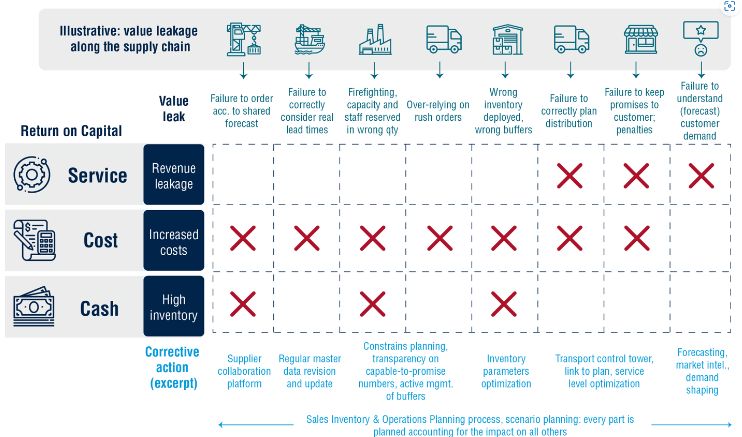

Advanced planning is the means to not just stop value leaking along the supply chain, but to synchronize supply chain activities to make the most out of your strategic assets.

To mitigate the value leaks along the supply chain, a company needs to develop the capabilities to make use of all information available and to make decisions considering the impact on every single entity of the supply chain. This requires proper process governance (e.g., in the form of the Sales, Inventory & Operations Planning process) to be in place and often a high degree of analytics and automation.

At its core, advanced planning is about predicting demand better and using this signal to steer the whole supply chain. And when demand is unpredictable, the supply chain is steered to hedge against uncertainty. Supply bottlenecks should become apparent and resolved (either directly or by working with alternatives). When the plan is submitted for execution, we know that each of the thousands of decisions made is congruent with meeting demand while achieving the highest possible return on investment.

To enable advance planning, a company needs to acquire a set of supply chain planning capabilities, and selectively lead the industry in a subset of them. This selection must be made with careful consideration and well-aligned with the longer-term strategy and ambitions of the company.

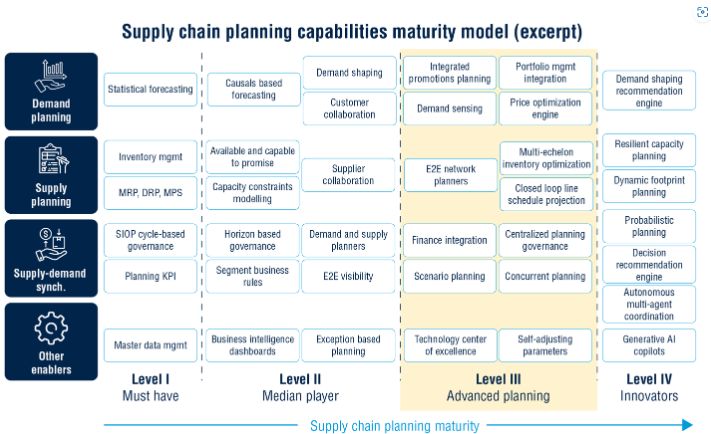

Advanced planning capabilities

Planning capabilities are in constant evolution, with a continuous shift in what is considered the minimum required level of maturity and variants by industry. The following is a non-exhaustive maturity model of planning capabilities:

In general, the capabilities listed under Level I are the minimum required. Most players in the industry will have Level II capabilities, and top players, Level III, which we consider advanced planning capabilities. Level IV capabilities are still experimental and are being pioneered by innovators.

Strategic selection of target capabilities

From a strategic standpoint, it is not necessary – or indeed, economically feasible – to develop all advanced planning capabilities. Selecting the right capabilities is a matter of strategic positioning against competitors, keeping in mind the following considerations:

- Winning industry factors: By nature, most

industries will demand high levels of sophistication in one area

(say, integrated promotions planning), while other areas may be

sufficiently covered with lower maturity capabilities (say, regular

inventory management versus multi-echelon inventory optimization).

Some industries may also have unique sets of capabilities (e.g.,

integration of regulatory aspects and qualitative analysis)

- Positioning relative to peers: Even within the

same industry, the supply chain planning capabilities differ based

on the company's positioning. For example, a product quality

leader may focus on demand management, manufacturing and/or

sourcing of highly differentiated parts, while a

breadth-of-offering leader may focus on managing a highly complex

product portfolio, and balancing its cost and capital needs, and a

cost leader may focus on efficiency with high volumes and low

margins.

- Unique strategic assets: A competitive position exploits an asset that no other peer has, be it IP, technology, branding or access to special materials. When translated to supply chain planning, this will often require level III or even level IV capabilities to effectively deploy the asset in question. Often, there may be limited or no examples of industry peers adopting them, but pioneering these capabilities will further cement the distinctive advantage of the strategic asset.

Linking planning capabilities to financial performance

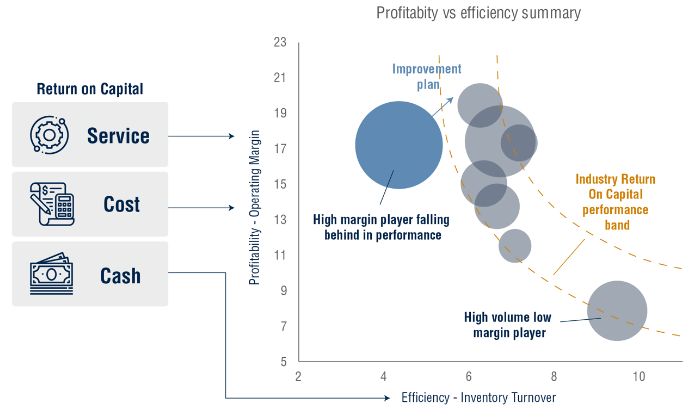

Ultimately, it is important to link the target supply chain planning capabilities to financial expectations and the performance improvement plan.

Performance improvement targets must be clear. Reaching and surpassing the industry's performance band will require a concrete improvement in margin and asset velocity. The combination of these factors must align with the company's competitive advantage.

In the second step, targeted improvement areas must be derived – which activities along the supply chain are either underperforming compared to peers or must overperform to support the company's strategy. This requires a benchmark of financial ratios against competitors, and an analysis of the company's value leakage along the supply chain in the context of the company's long-term ambitions.

How A&M can help

It can be challenging to navigate the complex and evolving landscape of supply chain planning capabilities while remaining focused on tangible performance improvements. This requires not only operational expertise and an innovative vision, but also a shareholder mindset with a strong focus on realizing value. This is what distinguishes the support you will receive from A&M:

- Senior resource depth: We are seasoned

professionals with in-depth operational experience, which enables

us to keep the analysis phase short and move straight into action.

Where necessary, we can also provide interim leadership to ensure

rapid implementation of advanced planning.

- Complex transformations: We have a proven

track record of managing complexity in high-profile situations. We

understand organizations and their processes, and ensure that

advanced planning is embedded in the operating model.

- Restructuring heritage: We leverage

A&M's restructuring heritage to deliver tangible outcomes.

With a focus on speed-to-results, we ensure that all aspects of

advanced planning in the implementation plan have a tangible

bottom-line or cash impact that is aligned with the business'

long-term ambition, while also initiating short-term action.

- Independence: As independent advisors, we base our recommendations on facts alone. We do not participate in partnerships with any of the advanced planning vendors.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.