01 INTRODUCTION

The last year and recent months have not brought European companies the relief that many had hoped. With the expected ratecutting cycle proceeding at a historically low pace and the "last mile" of inflation proving tricky to tame, the same operational and liquidity challenges that plagued businesses in the aftermath of the pandemic increasingly appear today

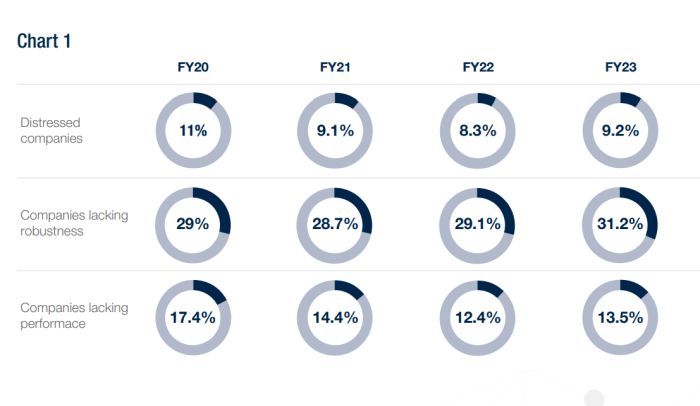

A&M's latest Distress Alert reveals how this weakened momentum is spelling trouble for firms in Europe and the Middle East. It shows that balance sheet issues are now affecting nearly a third of businesses in the region and that the share of those struggling with performance has increased over the past year. Overall, distress levels have risen to the highest since the peak of the pandemic, with 9.2% of firms in our analysis, equivalent to nearly 800 companies, facing financial distress.

The dismal economic outlook has been especially problematic for corporates with overleveraged capital structures. Those firms have been fighting simultaneous headwinds – slowing revenues, inflation and higher cost bases, secular shifts in consumer behaviour, net-zero regulation, and geopolitical risks and uncertainties – all while managing excessive debt burdens amid reduced investor appetite for risk. Deleveraging has been difficult because credit conditions remain tight, meaning cash levels are dropping as businesses dip into their savings to cover their interest payments.

Business models are vulnerable

In this tough environment, firms with business models that are no longer competitive or future-proof are particularly vulnerable to distress. Take the case of consumer businesses, which need to urgently realign their strategy and transform operating models to deal with the shift to e-commerce and rising demand for cheaper and sustainable products.

Similarly, the energy transition is pushing chemical firms to rethink the way they operate, from the sourcing of raw materials to the diversification of product portfolios. The most recent ADA highlights the scale of the challenge facing these sectors, with firms in the Fashion sector and Chemical sub-sectors among the most distressed.

The great unwinding of corporate leverage is currently underway, with defaults in Europe at their highest yearto-date levels since 2008, according to S&P Global Ratings1 . Notably, there has been an uptick in the number of distressed exchanges in the region, with over a quarter involving repeat defaulters (issuers with at least one previous default). The rise in repeat defaults shows that corporates have become accustomed to operating with high levels of leverage in their capital structures.

We anticipate that the surge in distress and restructuring activity, including waiver requests and "amend and extend" transactions, is set to continue in the coming months, particularly as refinancing dates come closer. According to S&P Global Ratings data, $763.2 billion in corporate debt across Europe is expected to mature until end of 2024, with the figure rising to over $961 billion in 20252.

At the same time, we view this turbulent period as an opportunity for companies to pursue simultaneous enhancements in balance sheets and operational efficiency, to strengthen themselves for the long-term.

In this report, we explore the key findings of our latest analysis and discuss how the current economic outlook is likely to shape corporates' financial health in 2024 and beyond.

02 EXECUTIVE SUMMARY

Distress is growing in most countries and sectors

Distress is growing in most countries and sectors Levels of financial distress have risen to the highest since the pandemic, with 9.2% of companies in the ADA dataset (which includes over 8,200 firms) facing distress by lacking both operating performance and balance sheet robustness. This equates to nearly 800 businesses, representing a 10% increase compared to the previous year. Notably, the deterioration of corporate financial health has been felt across the board as 10 out of 16 sectors, and five out of nine key countries/regions, saw distress levels increase in the past year.

Balance sheets fragile as companies struggle to deleverage

Since 2020, the share of businesses lacking balance sheet robustness has steadily increased, reaching a record 31.2%, which represents over 2,500 corporates. This trend highlights how companies' ability to generate cash and profits to service their debt is being eroded due to lower revenue generation and increased expenses in the new norm of higher rates and slower growth. With interest rates expected to come down slowly, we anticipate a further increase in distress as cash flow pressures continue and maturities come due in the coming quarters and years.

U.K., Germany and the Benelux are the most distressed markets

Benelux is the most distressed market covered in the ADA, with 10.2% of companies in distress in 2023. This is followed closely by the U.K., where corporate distress has increased significantly to 9.9% of companies from 8.4% a year earlier, the biggest year-on-year rise among all countries. Distress in Germany has reached 9.4%, the highest share since the pandemic and is also affecting more companies in France than the prior year, reaching 8.5%.

To view the full article click here

Footnotes

Originally Published July 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.