At the last election the Conservatives promised to not raise certain taxes, one of which was national insurance (NI). At the beginning of September, the government went against this and increased NI for the 2022/23 year by 1.25 percentage points and going forward are bringing in a Health and Social Care levy of the same amount. At the same time the dividend tax rates and therefore, the charge to loans from close companies, have also increased by 1.25 percentage points. All of the proceeds from these taxes will be ringfenced for health and social care costs.

The increase for NI will affect Class1, 1A and 1B, and Class 4. Class 2. Class 3 NI will not be affected. Therefore, employees and employers will be affected by this with an increased cost for the employer and employees receiving slightly less. Also, the cost of P11D benefits in kind will increase for employers. Partners and sole traders will also pay more, including Class 4 NI.

While averaging could minimise any Class 4 NI liabilities, this will only last for a few years until all profits will be taxed at the higher rates.

From the 2023/24 tax year, the NI levels will revert to normal levels and a Heath and Social care Levy of 1.25% will be chargeable. From this point the age limit for NI will disappear, meaning all employees will pay the levy with no age limit. Therefore, the older generation of farmers who still receive a share of profits will have an increase in their tax liabilities.

It should be noted that trading losses can reduce the chargeable amount.

With the increase in dividend tax, it may become less favourable to extract funds from a company via a dividend. Therefore, other options to withdraw funds should be looked at. For some farms, where the land has been retained outside of the company, or the company owes the directors money this is possible.

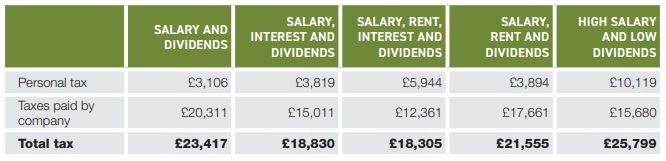

Where this is the case, the company can pay a rent, or interest on a loan from the directors, which would be tax deductible in the company. The individuals would then be taxed on this income. The below table sets out various options.

In each case, the director wants £50,000 out of the company, which makes £100,000 profits. This is for the 2023/24 tax year when corporation taxes increase to 25%. In each case the salary is £9,500, interest is £20,000, rent is £10,000 and dividends make up the balance. I have also compared receiving a salary of £39,500 and the balance as dividends.

While the extra dividend tax and Levy is not a significant rise in taxes, it reminds us that remuneration is no longer as straight forward as it used to be. The government are taxing employment and if it is possible to switch to other forms of remuneration, this can save substantial sums of tax.

Where there are more directors, the savings can be even greater.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.