The English private equity investor Matter Real Estate has acquired a majority stake in 15Degree and provided us with new equity capital. With this fresh capital, we are expanding our development pipeline with the aim of building a portfolio of 1,250 apartments by 2029. To achieve this, we will invest €250 million over the next three years.

Today's real estate market is dominated by negative headlines, marked by rising construction and financing costs and an unprecedented wave of bankruptcies. At the same time, the shortage of affordable housing is one of the greatest societal challenges today.

We believe that the timing for investing in the rental housing market has never been better.

In recent years, we have proven that high returns and social

responsibility can go hand in hand. Most of our developments

include 20-30% of rent-controlled apartments, which we let for

under €10 per m². In terms of sustainability, we achieve

the highest standards. Our buildings consume 40% less primary

energy compared to conventional residential buildings in Germany

(KFW40 + QNG).

With Matter Real Estate, we have found a partner who shares our

vision and has already established leading

"build-to-rent" platforms in the UK (Placefirst), Sweden

(Realy Bostad), and Denmark (Velkomn).

Why do we see a great opportunity in the rental housing market?

1. German cities are short of 1.9 million

apartments

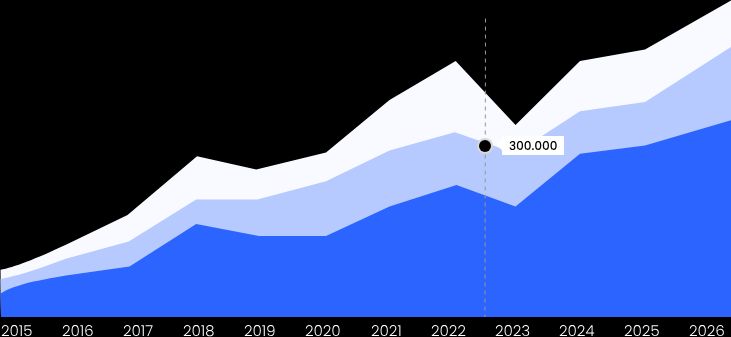

Housing has never been so scarce. German cities are short of two million apartments. Due to demographic changes and immigration, the demand is rising by another 300,000 units annually.

3 scenarios for housing needs in Germany

Source: RWI-Leibniz Institute

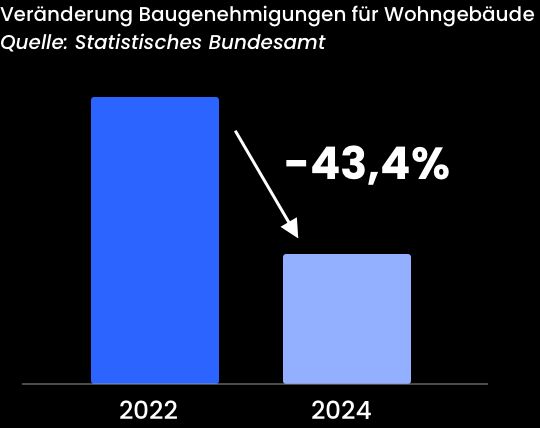

The crisis in the real estate sector is leading to a further shortage of housing. Compared to 2022, the number of building permits for residential buildings in 2024 has fallen by more than 40%. The shortage of urgently needed housing is increasing, with noticeable effects on rental prices. In metropolitan areas like Berlin, rents rose by an average of 15% in 2023.

2. Price Correction and market timing

We are at the end of a market cycle. The real estate industry has never seen as many corporate bankruptcies as in 2023 and 2024.

We believe that the bankruptcies of recent months significantly contribute to the price correction for land and developments.In this exciting market phase, we are among the few players with sufficient equity capital to acquire new land and completed developments.

3. Technology & digitisation as return levers

The construction and real estate sector is one of the least digitised industries in Germany. Together with strong partners, we are digitising the entire value chain of our developments —from construction to leasing and the subsequent operation of our portfolio. The result is happier tenants, lower costs, and higher returns.

The transaction was accompanied by:

LEGAL: Martin Schaper und Benjamin Müller (YPOG), Alexander Olliges und Dominik Pauly (Arendt & Medernach), Gerd Leutner und Martin Eichholz (CMS), Daniel Graskie (Taylor Wessing) VALUATION: Alon Brahm (Knight Frank), Benjamin Poddig (Savills), Moritz Chrambach (E&V) TAX: Andreas Röck (PWC), Matthias Iowa (Grant Thornton) COMMERCIAL: Oliver Richter und Nicolas Sauer (Laurus Capital)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.