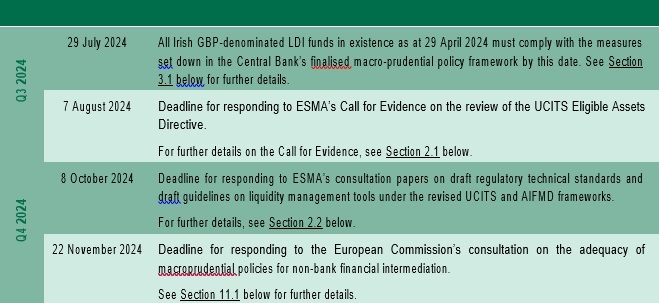

1. APPROACHING DEADLINES

2. UCITS & AIFMD

2.1 ESMA publishes Call for Evidence on the review of the UCITS Eligible Assets Directive

On 7 April 2024, ESMA published a call for evidence on the review of the UCITS Eligible Assets Directive3 (Call for Evidence).

This follows a request from the European Commission to ESMA in June 2023 to provide technical advice on the review of the UCITS Eligible Assets Directive, including an assessment of any divergences which have arisen in the implementation of the Eligible Assets Directive to date and a set of recommendations on how it should be revised to keep it in line with market developments.

In its Call for Evidence, ESMA has sought feedback from interested stakeholders on a range of matters including:

- inconsistentinterpretation or application of existing Eligible Assets rules;

- thenotion of liquidity and presumption of liquidity for transferable securities; and

- UCITSgaining direct and indirect exposure to certain asset

The deadline for responding to the Call for Evidence is 7th August 2024.

A copy of the Call for Evidence is available here.

A Dillon Eustace briefing containing a detailed overview of the Call for Evidence is available here.

2.2 Omnibus Directive amending AIFMD and UCITS frameworks enters into force

Directive EU) 2024/927 which amends AIFMD4and the UCITS Directive5entered into force on 15 April 2024 and must be transposed into national law by EU Member States by 16 April

Significant amendments made to the existing AIFMD and UCITS frameworks by the Omnibus Directive include the following:

- Delegation arrangements: strengthening of existing rules and increased supervision by ESMA and national competent authorities of such delegation arrangements through imposing enhanced reporting obligations on fund management companies relating to such arrangements

- Liquidity risk management: introduction of a new regime governing the use of liquidity management tools by UCITS fundsand open-ended AIFs

- Loan origination: introduction of a pan-EU loan origination framework which sets down a common set of rules for AIFMs managing AIFs which engage in lending to third parties and which allow AIFMs who originate loans on behalf of AIFs under management to passport such services into other EU Member States

- Depositary passport: the ability for an AIF to appoint a depositary located in another EU jurisdiction in certain specific circumstances

- Enhanced supervisory reporting regime: extension of the AIFMD "Annex IV" reporting framework to UCITS management companies and enhancements to the standardisation of reporting including the removal of duplications and inconsistencies between reporting frameworks of different sectors of the financial

Under the Omnibus Directive, ESMA has been tasked with preparing implementing regulations and guidelines on a range of specific matters relating to delegation, loan origination and liquidity management tools amongst others.

On 8 July 2024, it published consultation papers on (i) guidelines on the selection and calibration of liquidity management tools and (ii) regulatory technical standards on the characteristics of liquidity management tools.

A copy of the Omnibus Directive is available here.

A Dillon Eustace three-part video series on the changes being introduced under the Omnibus Directive is available here.

A copy of the consultation paper containing draft regulatory technical standards on the characteristics of liquidity management tools and the consultation paper containing draft guidelines on the selection and calibration of liquidity management tools are available here.

Key Action Points Fund management companies should review the proposals put forward by ESMA on liquidity management tools in their consultation papers and if desired, respond to same on or before 8 October 2024.

2.3 ESMA publishes new Q&A on Performance Fees

On 28 May 2024, ESMA published a revised edition of its Q&A on the UCITS Directive and its Q&A on AIFMD in which it provided additional guidance on its guidelines on performance fees in UCITS and certain types of AIFs (ESMA Performance Fee Guidelines).

The ESMA Performance Fee Guidelines apply to all UCITS funds which charge a performance fee. They also apply to any Irish-domiciled RIAIF which charge a performance fee save where the RIAIF in question (i) has been established as a closed-ended RIAIF or (ii) is an open-ended RIAIF following a venture capital, private equity or real estate investment strategy.

While one of the Q&A is not applicable to Irish funds given the Irish domestic rules relating to performance fees, the second of the new Q&A will be of relevance to any Irish UCITS or RIAIF funds which operates a fund-of fund (FOF) investment strategy and which is subject to a performance fee.

In response to a question as to whether a manager of a FOF can charge a performance fee, ESMA confirms that this is justified where the investment policy of the relevant FoF requires "active management of the FoF and the determination of the allocation in the underlying funds has a material impact on the FoF performance. The assessment on how performance fees are justified in light of the investment policy of the FoF should be reflected in the fund documentation, including the fund rules or the instruments of incorporation and may be reviewed, where needed, by the NCA on a case-by-case basis."

A copy of the revised Q&A is available here.

A copy of the ESMA Performance Fee Guidelines is available from here.

Key Action Points Management companies of UCITS and RIAIF funds which operate a FOF investment strategy and which are charged a performance fee should ensure that they can justify the charging of such a performance fee in light of the guidance provided by ESMA and where necessary update the fund prospectus to incorporate the justification for the application of the performance fee.

To view the full article clic here.

Footnotes

1. The "Approaching Deadlines" section does not include filing requirements in respect of any filing where the filing date is determined with reference to the relevant entity's annual accounting date (such as the filing of annual and semi-annual financial statements with the Central Bank) nor does it address any tax-related deadlines to which funds and fund management companies may be subject. Periodic reviews of matters such as the risk management framework, business plan and policies and procedures of fund management companies as well as any other actions required to be taken under the Irish Funds Corporate Governance Code are also excluded from the remit of this section as the dates for completion of same are determined by the relevant fund management company/fund rather than being set down in relevant legislation or guidance.

2. To the extent that they have not already done so, funds falling within the scope of Article 8 or Article 9 of the SFDR must file updated pre-contractual annexes contained in Commission Delegated Regulation 2023/363 which contain additional disclosure obligations relating to exposure to Taxonomy-aligned fossil gas and nuclear energy economic activities with the Central Bank "as soon as possible and at the earliest opportunity".

3. Directive 2007/16/EC

4. Directive 2011/61/EU

5. Directive 2009/65/EC

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.