The European Commission ("Commission") has mandated the European Securities and Markets Authority ("ESMA") to provide technical advice on the review of the UCITS Eligible Assets Directive ("EAD"). ESMA has been requested to carry out an assessment of the implementation of the UCITS EAD in the member states, to analyse whether any divergences have arisen and to provide a set of recommendations on how the EAD should be revised to keep it in line with market developments.

ESMA has therefore issued a call for evidence seeking stakeholders' input on a number of questions aimed at gathering insights on the manner and extent to which UCITS have gained direct and indirect exposures to certain asset classes that may give rise to divergent interpretations and / or risk for retail investors.

The UCITS Directive provides a list of assets eligible for investment by UCITS and uses broad concepts such as "transferable securities" and "money market instruments". The aim of the EAD, published in 2007, was to assist market participants and competent authorities to develop a common understanding of these key concepts and to provide clarity as to whether a particular asset is eligible for investment. ESMA has provided guidance in relation to UCITS eligible assets in the form of opinions, guidelines and Q&As since its inception in 2011, but this is the first legislative review of eligible assets.

The UCITS Directive requires that UCITS be invested in assets subject to stringent eligibility criteria with a view to ensuring adherence to the principles underlying the UCITS Directive, such as liquidity, risk-diversification, the ability of the UCITS to redeem its units or shares at the request of the investors and to calculate its net asset value whenever units are issued or redeemed. ESMA points out that, since the adoption of the EAD, the number, type and variety of financial instruments traded on financial markets has increased considerably. This has led to uncertainty as to whether certain categories of financial instruments are eligible for investment and to divergent interpretations and market practices.

The call for evidence is divided into two separate sections addressing:

- convergence issues and clarify of key concept and definitions; and

- direct and indirect UCITS exposures to certain asset classes and related data collection / analysis.

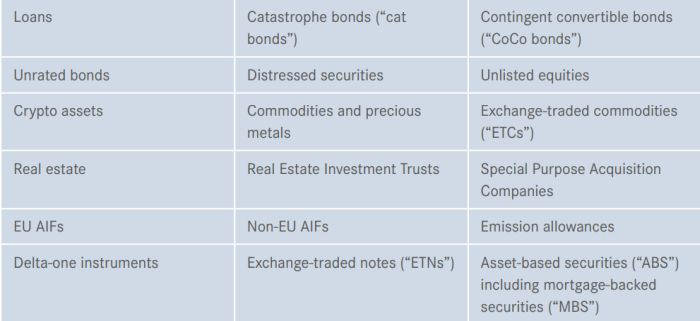

In this second section, ESMA has provided a table listing asset classes and has requested views, supported by data and evidence, on the merits of allowing direct or indirect UCITS exposures to those assets and related risks and benefits. The asset classes are as follows:

ESMA has requested comments on the call for evidence by 7 August 2024. The Commission has requested that ESMA deliver its advice by 31 October 2024.

The significant growth of the investment funds sector has attracted increased regulatory focus on its role in the wider functioning of key financial markets and concerns that investment funds present financial stability risks. This has led to a focus on leverage and liquidity in investment funds at a global level, and it is clear that this focus on liquidity is a driver in the Commission's mandate to ESMA.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.