Transitional services agreements (TSAs) are an essential part of a carve-out deal. They clearly define the expectations and agreed protocols between the buyer and seller during the critical period of business transition and govern the seller's temporary provision of services to the new company. It is therefore crucial that both buyer and seller are in alignment prior to the TSA commencing with as little uncertainty in the coverage of the TSA as possible. A poorly crafted TSA can turn an otherwise favourable deal sour.

Companies usually carve out — or sell — a division of their business when it no longer aligns with their current business strategy. The carved-out segment is therefore typically a fraction of the size of its former parent company and does not have its own independent operational framework. The primary function of the TSA is to provide a grace period that allows the new company to operate while a new and independent framework is established.

A properly negotiated TSA allows management to focus on key business processes, knowing that the operational needs of the new company will be temporarily met through the steps outlined in the agreement. It also serves to reassure employees who are affected by the carve-out, a key element during a period of uncertainty for employees.

Ensuring that the new entity's critical administrative functions will operate effectively and with compliance, potentially across multiple jurisdictions, is a complex process that requires specific knowledge and skills – aspects that the TSA will address during the transitional period.

However, the work doesn't stop once the TSA is complete. In reality, the post-TSA period is the most often overlooked element of a carve-out and is consequently the greatest risk area of the deal. Companies should not be lulled into a false sense of "business as usual" during the TSA time period and must be preparing for their new corporate identity. Legacy systems are often more bureaucratic, having to cater to the broader corporate operational needs. Management should not underestimate the work required to build their operations up and should embrace the leaner future as soon as possible.

What you should know about optimising a TSA

During the transitional period, the business being sold is still dependent on its former parent company's operations.

The buyer will need the seller's assistance to navigate key structural processes such as entity establishment, VAT registrations, new licensing agreements and setting up bank accounts. The seller will have to provide foundational functions such as accounting and tax and HR and payroll services until the new entity can set up its own independent processes.

As early as possible in carve-out negotiations, both buyer and seller must come to an agreement about the key aspects of the TSA based on the complexity of the deal.

Elements such as scope and duration should be clearly laid out with the aim of ensuring that the new company can operate independently as soon as possible, but without taking potentially costly shortcuts.

The TSA must also take into account the essential administrative functions of the seller, as they must be able to continue their own operations with minimal drain on their employees' time and energy. This requires a delicate balancing act.

Carve-out transactions place significant additional demands on management teams, resulting in increased workloads and more complex processes. The management team is also leaner than within the previous organisation, losing a number of support functions and peerages within the broader structure that will no longer exist in the new organisation. Since not all processes will be in place on day one, it's important to create a dedicated team on each side who will handle the duties outlined in the TSA.

"What you need for a successful TSA is to have absolute clarity. The buyer needs to be crystal clear about what the seller will be assisting them with," says Ben Fielding, Global Head of Sales - Global Entity Management, TMF Group. "What kind of access will they have to the seller after the transaction and how quickly will they be able to get information? For example, does the TSA include phone calls with the seller and the provision of information and documentation that the buyer is going to need for a simple and efficient handover? Management then also needs to be looking one year or eighteen months into the future and actively thinking about what services will be needed in-house and what should be outsourced."

The takeaway is that the buyer and seller must negotiate the terms of the TSA at the very beginning of the deal in order to avoid unforeseen problems and costs that were not accounted for.

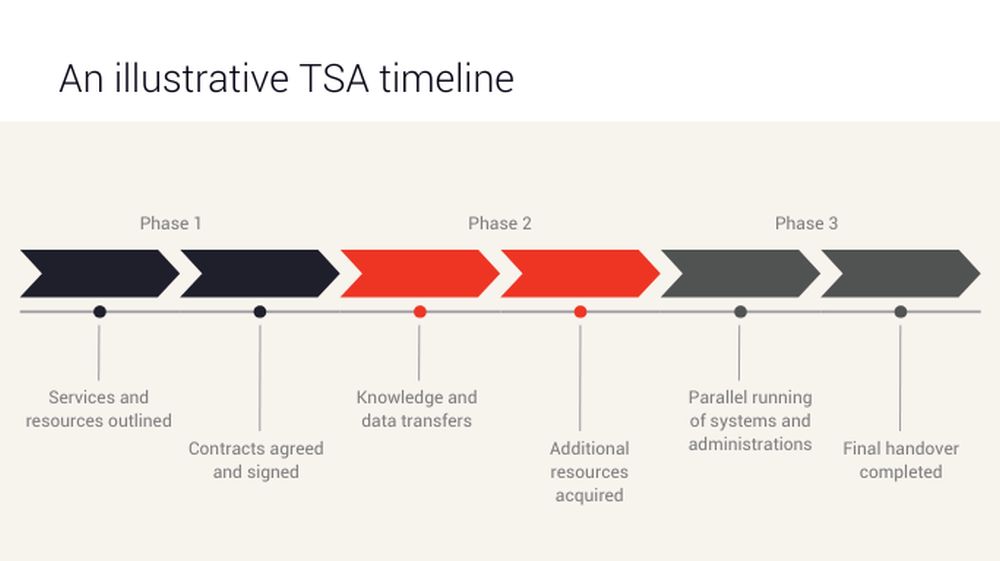

Often there is a very long list of activities that must take place to be operationally ready, and many of those processes can take a long time to complete or need to happen in sequence, requiring considerable planning and timelining.

Ben Fielding Global Head of GEM Sales

Key considerations for TSA negotiations:

- scope of services

- performance requirements

- review and audit rights

- data privacy concerns

- liabilities

- plans for major service continuity issues

- pricing mechanisms

- TSA duration and options to renew/extend.

Paving the way post-TSA

Once the negotiations are complete and the TSA is well underway, it's tempting to believe that the hard work is done. However, this common assumption is one of the main reasons why a new company can end up failing, despite the terms of the TSA being sound and well executed.

The period of transitioning from the TSA to full independence is especially tricky, as the buyer no longer has the former parent company to fall back on for support. It's at this point when the new company may want to consider a dedicated partner to help fill in the gaps. Collaborating with a team of experts provides support for the new lean management team, helping to smooth the way to full independence. The new entity can also stop paying high costs to the seller and work towards a more bespoke infrastructure that is tailored to its new format, both in services and cost.

These are the key areas to consider when planning for post-acquisition integration.

Legal and compliance

The new company will need a clear understanding of the legalities of their business functions and the requirements for compliance. Rules and regulations, jurisdictional considerations, shareholder requirements, assets protection and the structuring of equity and debt must all be taken into account. They may be different from those of the former parent company, so it can't simply be assumed that whatever processes were in place can be carried over.

One of the most common mistakes that companies make when it comes to legal functions is inaction. Buyers tend to focus on the financial aspects of the deal, often giving little thought to the legal structure until it is too late. Not taking the time to ensure compliance can directly affect the new company's ability to do business and severely devalue the purchase. In some countries, directors may also face grave personal liability.

Information technology (IT)

IT is central to managing complexity and efficiencies and mitigating risks. Planning for fully independent IT processes includes sourcing IT infrastructure partners, localising Enterprise Resource Planning (ERP) systems, migrating data and ensuring information security.

If the new company is taking over vendor contracts from the seller, the migration of data from the seller's systems to the buyer's systems can pose a significant security risk if not carefully planned out. Once the migration is done, the company must provide its newly acquired clients with complete peace of mind regarding data integrity and establish processes to maintain or improve the quality of its products or services.

At the end of the TSA, the new company should be ready to finalise the last migrations of all IT systems, ensuring they are fully operational and scalable to the company's structure. It should have robust cybersecurity measures in place, ensure that all relevant IP rights have been properly transferred or licensed and have a plan in place to alleviate any risks associated with the transfer.

The scale of IT system integration often requires specialist teams with experience in cross-company transfers. In the initial post-TSA phase, it might not be prudent to place the burden on in-house teams, but rather to outsource IT to a specialist partner who can assist with putting the new structures in place.

Accounting and tax (A&T)

During a carve-out, one of the most complicated elements to unravel is tax. Not only does the seller have to consider the tax implications of the sale, both the buyer and seller must abide by the new tax requirements for their transformed entities in the wake of the completed transaction.

Even when a solid TSA is in place, there is more to the tax process than who is responsible. Non-compliance is likely to result in stiff penalties at best and criminal liability at worst. It's crucial that the companies involved have clarity on all tax-related requirements and establish a clear plan from the start to avoid complications further down the line.

In the post-TSA period, the new company must have fully integrated and compliant tax processes in place that can operate without the oversight or support of the seller. Similarly, its financial reporting systems must be independent and must also work in conjunction with other business platforms,

There is no one size fits all approach to tax considerations in a carveout. If the new entity spans multiple jurisdictions, shareholders will need an A&T team with a broad understanding of global tax requirements as well as specific local tax laws. In most cases, the new entity is unlikely to have that kind of experience in-house, furthering the case for an outsourcing partner.

Human resources (HR)

HR and payroll are critical administrative functions that form the foundation of effective company management. They include key activities such as financial reporting, employee tax compliance contracting and people management. Success in HR and payroll hinges on both technical support and skilled personnel.

The strategy for HR and payroll services post-TSA is one of the most important considerations for a successful carve-out integration. Not only must the processes be flawless, but the managing of employees affected by the transaction should be transparent, coherent and supportive at every step.

Since payroll is a downstream function, its role in a carve-out deal is primarily reactive. As a result, it is often overlooked in the all-important planning phase when the attention is on budgets and profit margins.

Payroll managers should be involved in the deal process from the beginning, but even this might not be enough. In complex deals or cross-border carve-outs that span multiple jurisdictions, it may be essential to involve a specialist M&A team with experience in managing payroll effectively during the post-TSA integration.

While payroll can often feel like a background process, it is an essential element to get right during a carve out. Employees may be excited, but they are likely to be feeling a sense of uncertainty as well. Missing or making an error in their first pay period with the new company can be particularly destabilising.

Ben Fielding Global Head of GEM Sales

Companies should consider integration timelines and make sure they're realistic. If they need to be pushed back for any reason, this will add on additional costs and cause unnecessary uncertainty among employees. An experienced outsourcing partner decreases the likelihood of this occurring.

To view the original article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.