Goods and Services Tax (GST), which is considered the most significant tax reform since independence, proposes to subsume a majority of the indirect taxes prevailing in India and will change the way business is done. It will bring about a structural change in the current indirect taxation system by propagating an ideal consumption-based indirect tax system.

The GST Bill proposes a 'Dual GST structure' consisting of Central GST (CGST) and State GST (SGST) levied on intra-state transactions, and Integrated GST (IGST) which is a combination of CGST and SGST, levied on inter-state transactions including imports. Under the GST regime, GST paid on procurement will be allowed to be set off against the GST liability on the output.

A detailed discussion on the proposed GST Bill (122nd CAB, now 100th Amendment Act) is featured in SKP's GST Update: Issue 1 - On the way to GST. Our latest update outlines the progress towards GST and discusses the latest developments.

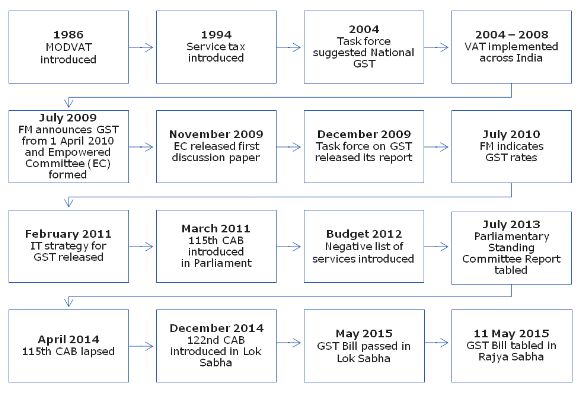

The evolution of GST in India

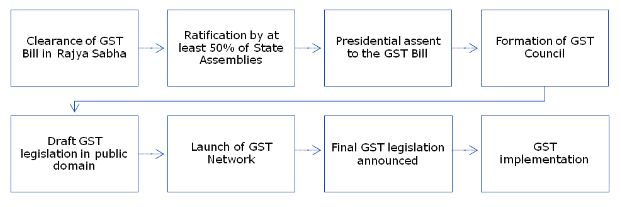

Way forward

Recent developments

The government is determined to roll out GST on the target date of 1 April 2016. After the Lok Sabha (lower house of Parliament) passed the GST Bill, the government has proactively been showcasing its preparedness through Select Committee meetings, industry engagement activities, and by setting up committees to gauge industry views on GST; however, these efforts will be known to the public only after the bill is approved by the Rajya Sabha (upper house of Parliament).

Some key recent developments with respect to GST are as follows:

1. Empowered Committee Reports

A majority of the work on GST has, reportedly, already been concluded or is in its final stage. At present, various committees and sub-committees have been formed under the Empowered Committee (EC) of State Finance Ministers to provide detailed reports on key issues including Place of Supply Rules, inter-state GST, thresholds, the GST model, etc. Most of these committees have submitted their final report to the EC:

|

Committees formed |

Final report status |

|

Committee on the Problem of Dual Control, Threshold and Exemptions in GST Regime |

Submitted |

|

Committee on Revenue Neutral Rates for State GST & Central GST and Place of Supply Rules (A sub-committee was constituted to examine issues relating to the Place of Supply Rules) |

Submitted |

|

Committee on IGST & GST on Imports (A sub- committee was set up to examine issues pertaining to the IGST model) |

Submitted |

|

Committee to examine Business Processes under the GST Regime (A sub-committee was constituted to examine issues pertaining to registration) |

Submitted |

|

Committee to examine Business Processes under GST Regime (Two sub-committees were constituted to examine issues pertaining to returns, refunds and payments) |

Submitted |

|

Committee to examine GST Network (GSTN) |

Submitted |

|

Committee to draft the model GST Law (Three sub-committees were constituted to draft various aspects of the model law) |

Pending |

2. Contentious issues for states

Though many of the contentious issues of the states have already been addressed by the GST Bill, a consensus has not been reached on the following:

Compensation to states: The central government has planned to provide Central Sales Tax (CST) compensation in a staggered manner over five years (100% for three years, 75% in the fourth year and 50% in the fifth year), while states are demanding 100% compensation for five years. In this regard, the Chairman of the EC, K M Mani, has reportedly stated that most of the states welcome GST; however, deliberations with respect to CST compensation are in progress.

Subsuming of taxes: In an EC meeting held on 4 June 2015, some states insisted that Entry Tax and Purchase Tax should be outside the purview of GST and if at all the Purchase Tax is to be subsumed, the government should compensate such losses for at least 15 years.

3. Select Committee of the Rajya Sabha

- The GST Bill is presently under the consideration of a Select Committee of the Rajya Sabha. The Committee has been instructed to present their report to the Rajya Sabha by the end of the first week of the upcoming monsoon session of Parliament (July 2015).

- The Select Committee has been deliberating on issues such as an additional 1% tax for manufacturing states, GST dispute redressal mechanism, etc.

- The Committee will be inviting various state representatives, trade associations and other stakeholder associations to share their views and recommend amendments if necessary.

- A senior opposition leader, reportedly, stated that the opposition is not against GST but insisted that the new elements of the Bill must be reviewed by the Select Committee before clearing the Bill.

- Thus, the opposition parties should be taken on board to ensure that the GST Bill is approved by the Rajya Sabha as well.

4. Two committees formed by the government to facilitate GST implementation

On 17 June 2015, the Finance Minister, Arun Jaitley, approved the formation of two committees: one to monitor the progress of IT preparedness for GST and the other to suggest possible tax rates.

A Steering Committee under the Co-Chairmanship of the Additional Secretary of the Department of Revenue and the Member Secretary of the EC has been formed to monitor the IT preparedness of GSTN/CBEC/tax authorities, the finalisation of reports of all the sub-committees on different aspects related to the mechanics of GST, and drafting the CGST, IGST and SGST laws/rules. It will also oversee the progress of consultations with various stakeholders such as trade and industry associations and ensure adequate training to government officers for administering GST.

Another committee has been formed under the Chairmanship of the Chief Economic Advisor, Ministry of Finance, to recommend possible tax rates (Revenue Neutral Rate) that would be consistent with the present level of revenue collection of the centre and states. It will also conduct sector-wise and state-wise studies for the impact of GST on the economy, and is expected to submit its report in two months.

Conclusion

These recent developments strongly indicate the government's willingness to implement GST in India from 1 April 2016. With the introduction of GST only a few months away, it would be prudent for businesses to be adequately prepared for the changes in order to benefit from potential business opportunities.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.