After the successful passage of the 122nd Constitutional Amendment Bill, 2014 (Goods and Services Tax (GST) Bill) in the Lok Sabha (lower house of Parliament), the GST Bill was sent to the Rajya Sabha (upper house of Parliament). However, due to disagreement over a few provisions of the GST Bill, it was sent to the Select Committee of the Rajya Sabha. The Select Committee is comprised of 21 members and is headed by Bhupender Yadav (Member of Parliament, Bharatiya Janata Party).

The Select Committee reviewed the GST Bill and submitted its report on 22 July 2015. In its report, the Select Committee endorsed most of the provisions of the proposed GST Bill. However, there were a few dissent notes submitted by some parties.

This GST Update summarises the following:

- The Select Committee's key recommendations

- Dissent notes on the GST Bill submitted by the Congress, AIADMK and the Left parties

The Select Committee's key recommendations

- Revenue of local bodies should not be adversely affected

The Select Committee recommended that the revenues of local bodies need to be sustained and protected by the state governments, to ensure standards of local governance are maintained.

- Band rates

The Select Committee proposed to include the definition of 'band' in Clause 12 (4)(e) of the GST Bill. The 'band' may be defined as "The range of GST rates over the floor rate within which Central Goods and Service Tax (CGST) or State Goods and Services Tax (SGST) may be levied on any specified goods or services or any specified class of goods or services by the central or a particular state government as the case may be." The definition of 'band' will provide some flexibility to states to decide the GST rates (provided the rate is within the specified band).

- Definition of supply for 1% additional tax

To avoid cascading of taxes, a definition for 'supply' is recommended by the Select Committee as "All forms of supply made for a consideration". Thus, inter-state supply of goods without consideration (such as stock transfer) will not attract the additional 1% tax. However, this definition would be applicable only for the purpose of an additional 1% tax on the inter-state supply of goods.

- Compensation to states for loss in revenue

The Select Committee has recommended that revenue loss to the states should be compensated for a period of five years.

- Shareholding in GSTN

The Select Committee recommended that the government should take immediate steps to ensure non-government financial institution shareholding is limited to public sector banks or public sector financial institutions as the GST Network (GSTN) will be a repository of a lot of sensitive data on business entities.

- Banking services should be kept outside the GST net. If not, then ensure GST credit is available to them

The Select Committee recommended banking services be kept outside GST as followed by most countries across the globe.

- Moderate GST rate

The Select Committee discussed that it was imperative for the GST Council to keep the needs of consumers in mind and arrive at a moderate GST rate to secure the confidence of consumers. The Select Committee also noted that a high GST rate may lead to inflationary pressure on the prices of products and services.

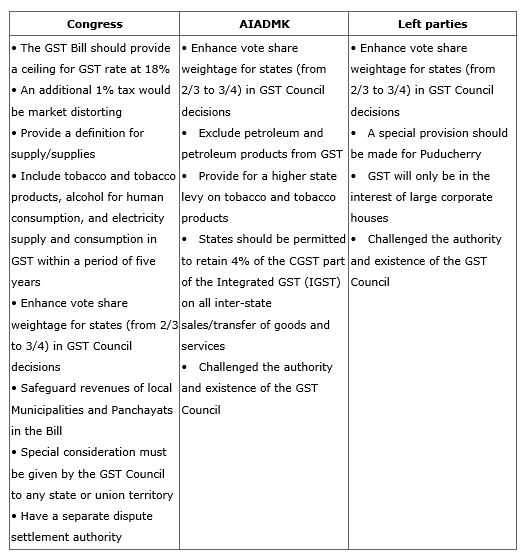

Dissent notes on the GST Bill by the Congress, AIADMK and the Left

The GST did receive some contention in the form of dissent notes from the Congress, AIADMK and the Left parties as shown below:

The way forward

According to news reports, the Union Cabinet (headed by Prime Minister Narendra Modi) has approved the amendments to the GST Bill (including the amendment for compensation to states for five years).

Given the aforesaid, the GST Bill now stands for approval by the Rajya Sabha. It would be prudent for the Rajya Sabha to prioritise and expedite the clearance of the GST Bill to ensure the implementation target date of 1 April 2016 is met.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.