The Union Budget 2024-25, presented on July 23, 2024, is a strategic blueprint designed to enhance India's economic resilience and foster inclusive growth. It prioritizes agriculture, employment, infrastructure, and innovation, setting a promising path for national progress.

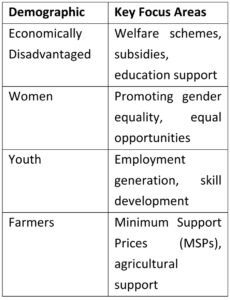

The budget addresses the needs of four key demographics: the economically disadvantaged, women, youth, and the farmers. It offers welfare schemes:

This budget is a significant step towards sustainable and inclusive growth, inviting us to examine its positives and negatives for a comprehensive understanding of its impact:

In this regard, it is imperative to mention some of the key highlights of the Budget, concerning the legal sector.

1. Establishment Of Additional National Company Law Tribunals For Company Matters:

(i) The present Budget has focused more into establishment of additional tribunals to deal with the matters pertaining to company law. Since the introduction of Insolvency and Bankruptcy Code, 2016 (IBC), the IBC has played significant role in revival of companies and recovery of loan amount. The Finance Minister has proposed significant changes to improve the insolvency resolution process by establishing additional National Company Law Tribunals (NCLTs). These NCLTs would be specifically dedicated to matters relating to company law i.e. proceedings such as Oppression and mismanagement, Scheme of Merger and Amalgamation, and other company related matters. In India, the backlog of cases in the judiciary is a well-known issue. The NCLT currently handles cases under both the Insolvency and Bankruptcy Code, 2016, and the Companies Act, 2013, leading to significant delays. To address this, the Budget proposes establishing additional National Company Law Tribunals (NCLTs). This initiative aims to alleviate the burden on existing tribunals and ensure the timely delivery of justice.

(ii) Furthermore, when we talk about the IBC which was designed to expedite the insolvency process, setting a time-bound framework mentioned under section 12 of the IBC. However, recent trends have suggested that the average time taken to complete a CIRP has extended to 843 days. To address this issue, the Budget has proposed the creation of a technology platform aimed at assisting adjudicating authorities. This platform will not only expedite the judicial process but also ensure transparency and consistency in insolvency resolutions. The Budget also mentions that the Adjudicating Authorities have disposed of cases worth 10 lakh crores even before its admission.

2. Budget Proposes Establishment Of Additional Debt Recovery Tribunal for reforming and strengthening Debt Recovery Tribunals to speed up recovery. The pendency of matters in Debt Recovery Tribunal is of more concern. This step would significantly reduce the backlog of matters.

3. Stamp Duty: States which continue to charge high stamp duty will be encouraged to moderate the rates for all, and also consider further lowering duties for properties purchased by women. This reform will be made an essential component of urban development schemes and purchase of property in the name of women.

4. Land-Related Reforms By State Governments: Land-related reforms and actions, both in rural and urban areas, will cover (1) land administration, planning and management, and (2) urban planning, usage and building bylaws. These will be incentivized for completion within the next 3 years through appropriate fiscal support.

5. Rural Land Related Actions: Rural land related actions will include (1) assignment of Unique Land Parcel Identification Number (ULPIN) or Bhu-Aadhaar for all lands, (2) digitization of cadastral maps, (3) survey of map sub-divisions as per current ownership, (4) establishment of land registry, and (5) linking to the farmers registry. These actions will also facilitate credit flow and other agricultural services.

6. Urban Land Related Actions: Land records in urban areas will be digitized with GIS mapping. An IT based system for property record administration, updating, and tax administration will be established. These will also facilitate improving the financial position of urban local bodies.

7. Foreign Direct Investment & Overseas Investment: The Budget proposes making of the rules and regulations for Foreign Direct Investment and Overseas Investments to simplify the process. This shall ensure more investments by foreign based company in India and further strengthen our economy.

8. Data & Statistics: For improving data governance, collection, processing and management of data and statistics, different sectoral data bases, including those established under the Digital India mission, will be utilized with active use of technology tools.

9. Capital Gains:

(i) It is proposed that there will only be two holding periods, 12 months and 24 months, for determining whether the capital gains are short-term capital gains (STCG) or long-term capital gains (LTCG).

(ii) The holding period to be qualified as STCG is 12 months for listed securities and units of listed business trust (which was previously 36 months) and 24 months for all other assets including securities and immovable properties beyond which an asset shall be a LTCG.

(iii) The holding period for bonds, debentures, gold will reduce from 36 months to 24 months.

(iv) The rate of tax on STCG has increased from 15% to 20% and that on LTCG has increased from 10% to 12.5%.

(v) Indexation is proposed to be removed for calculation of any LTCG which is presently available for property, gold and other unlisted assets. The recent proposal by the Honorable Finance Minister suggests taxing capital gains based on the original purchase price, without adjusting for inflation or other factors that typically increase the value of long-term assets. While the tax rate has been reduced from 20% to 12.5%, this change means that investors will be taxed on the nominal gains rather than the real gains, effectively increasing the tax burden. This adjustment could deter long-term investments, as the higher effective tax could outweigh the benefits of lower nominal rate.

10. Tax:

(i) The government has decriminalized delay in TDS up to due date of filing. 5 per cent TDS rate is being made applicable on many payments merged into 2 per cent TDS rate. 20 per cent TDS rate on repurchase of units by mutual funds or UTI withdrawn.

(ii) Assessments now, can be reopened beyond three years up to 5 years from end of year of assessment, only if, the escaped income is more than ₹ 50 Lakh.

(iii) The Budget proposes to increase monetary limits for filing appeals related to direct taxes, excise and service tax in the Tax Tribunals, High Courts and Supreme Court to ₹ 60 lakh, ₹ 2 crore and ₹ 5 crore respectively.

(iv) To dispose of the backlog of first appeals, more officers are to be deployed to hear and decide such appeals, especially those with large tax effect. For resolution of certain income tax disputes pending in appeal, the Budget also proposes Vivad Se Vishwas Scheme, 2024. With a view to reducing litigation and provide certainty in international taxation, it is stated to expand the scope of safe harbour rules and make them more attractive and to further streamline the transfer pricing assessment procedure.

(v) Tax on consideration received by a person from any investor on issue of shares which exceeds the fair market value of the shares shall be chargeable to income tax, known as angel tax. Angel tax for all classes of investors has been abolished with an aim to bolster the Indian start-up eco-system, boost the entrepreneurial spirit and support innovation.

(vi) The income from buy-back of shares by companies shall be chargeable in the hands of the recipient investor as dividend, instead of the current regime of additional income-tax in the hands of the company. Further, the cost of such shares shall be treated as a capital loss to the investor.

(vii) MSME: Introduction of credit guarantee scheme for MSMEs to enable collateral-free term loans, enhanced credit assessment capabilities within public sector banks. Trade Receivables electronic Discounting System (TReDS) is an online electronic platform and an institutional mechanism for factoring of trade receivables of MSME sellers. The government plans to reduce the turnover threshold of MSMEs for mandatory onboarding on the TReds platform from INR 500 crore to INR 250 crore. The Mudra loan limit has been increased from INR 10 lakh to INR 20 lakh for previous borrowers. Small Industries Development Bank of India will open 24 new branches to serve MSME clusters.

Conclusion

The Budget presents a strategic roadmap for India's economic growth, highlighting urban development, energy security, infrastructure, innovation, research & development, and next-generation reforms. The Budget's successful implementation will depend on effective policy execution, stakeholder participation, and the overall economic environment. Some of the important factors such as establishing NCLTs, DRTs which is going to be pivotal. Legal professionals have a significant role to play in the successful implementation of the Budget, contributing to a stronger, more resilient economy for all stakeholders involved. Reduced Corporate Tax on foreign companies will bolster the investments in Indian market. It has abolished the concept of Angle Tax, which was first introduced in 2012, by then finance minister Pranab Mukherjee, giving much relief to startups. It increased standard deduction of salaried employees from ₹ 50,000/- to ₹ 75,000/- for those opting for new tax regime. The overall budget allocation for the Ministry of Law and Justice stands at Rs 6,788.33 crore, with Rs 5,940.95 crore designated for the departments of law and justice, Rs.525.49 crore for the Supreme Court of India and Rs.321 crore for the Election Commission. Going forward, let us wait for effective implementation of the Budget in a fruitful manner.

Click Here To View The Union Budget 2024-25

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.