1. Background and rationale

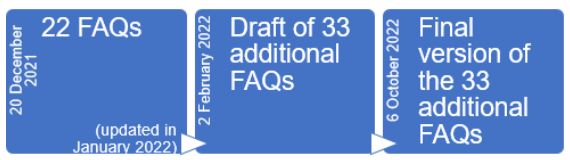

The 2022 FAQs, a first draft of which was published in February 2022, supplement the previous set of 22 frequently asked questions that the EC published back in December 2021 (the "2021 FAQs"), titled "FAQs: How should financial and non-financial undertakings report Taxonomy-eligible economic activities and assets in accordance with the Taxonomy Regulation Article 8 Disclosures Delegated Act?".

Like the 2021 FAQs, the aim of the 2022 FAQs is to clarify the content and help facilitate the implementation of the disclosure obligations imposed under Article 8 of the Taxonomy Regulation, according to which concerned entities are to include information on how and to what extent their activities are associated with taxonomy-aligned economic activities in their non-financial statements.

2. Concerned entities

Article 8 of the Taxonomy Regulation applies to both financial undertakings (such as asset managers, credit institutions, investment firms, insurance undertakings and reinsurance undertakings) and non-financial undertakings required to include a non-financial statement in their management report under Directive 2014/95/EU amending Directive 2013/34/EU as regards disclosure of non-financial and diversity information by certain large undertakings and groups.

3. Key considerations

The 2022 FAQs do not add any new content to the draft version of 2 February 2022.

They are divided into 8 sections:

- General FAQs

- Non-financial undertakings

- Financial undertakings

- Asset managers

- Insurers

- Credit Institutions

- Debt market

- Interaction with other regulations

The 2022 FAQs clarify in particular:

- the definition of "Taxonomy-eligible economic activity";

- how to weight holdings in a portfolio to report on Taxonomy-eligible assets;

- what activities to consider when reporting insurance and reinsurance underwriting activities in the context of Taxonomy-eligibility reporting;

- how to report Taxonomy-eligible economic activities in-scope of the markets in financial instruments directive (MiFID);

- how to assess and report the Taxonomy-eligibility of a debt asset such as a bond or loan;

- the possibility of reporting green debt instruments or green sovereign debt from non-EU entities as Taxonomy-eligible;

- which activities to consider when reporting underwriting activities by insurers and reinsurers;

- the interaction between the Disclosures Delegated Act and the proposed corporate sustainability reporting directive (CSRD).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.