The Labor Government’s Tax Plan

With the Labor Party winning 83 seats to the coalition's 58 in Saturday’s election the Federal Labor party has been elected into Government after 11 years in opposition. A final tally of 88 seats for Labor, 60 for the Coalition and two independents is predicted in the Lower House.

In the Senate, Labor is likely to have 32 Senators compared with the Coalitions 37 or 36. The balance of power will rest with the 5 or 6 Greens Senators, Family First’s Steve Fielding and South Australian Independent Nick Xenophon.

Labour will not have full control of the Senate and will need to work with the Greens and Senator Xenophon to ensure that future legislation supporting its pre-election "Tax Plan for Australia’s Future" can be realised. However, the Coalition is able to block any of the incoming Government’s tax reform in the Senate until 1 July 2008.

The Labor Government "Tax Plan For Australia’s Future"

One of the more controversial proposals is the intention to repeal some of the recent changes introduced by the Coalition in relation to Family Trusts. Elements of the laws (introduced on September 24) to be reversed include;

- Allowing family trust elections and interposed entity elections to be revoked or varied in certain limited circumstances;

- Broadening of the definition of "family" to include lineal descendants of family members; and

- Exempting spouses, former widows/widowers and former step-children from the family trust distribution tax by including them in the definition of "family group".

Included in the Labour Party’s pre-election taxation plan are changes to Income Tax & GST, the Welfare System, International Taxation, Superannuation, Tax Administration and individual tax rates.

Income Tax And GST

From 1 July 2008, an intention to reverse the changes to Family Trusts introduced by the Coalition Government in Tax Laws Amendment (2007 Measures No 4) Act 2007;

From 1 July 2008, abolish the tax deduction for all donations or contributions to political parties, including memberships;

Develop a more effective R&D tax concession scheme, including amending the current $1m cap on expenditure for the R&D Tax Offset. This will include a review of the national innovation system in considering the role of the R&D tax concession scheme in promoting R&D and innovation; and

Oppose any increase in the rate of GST or expansion of the GST base.

Welfare

A 50% Education Tax Refund for those families eligible for Family Tax Benefit FTB A;

- From 1 July 2008, limit access to Family Tax Benefit FTB B to families with an adjusted taxable income of less than $250,000;

- Increase the child care tax rebate to 50%;

- Halve the HECS fees for new maths and science students while they are studying, and also halve the annual repayments for up to 5 years of maths and science graduates if they take up work in a relevant maths/science occupation, including teaching;

- Reintroduce the voluntary Student Financial Supplement Scheme;

- Introduction of a new superannuation style "First Home Saver Account" to help aspiring first home buyers; and

- A National Rental Affordability Scheme would offer institutional investors annual tax incentives and financial support for building homes and renting them out at 20% below market rents. This would include an annual $6,000 rental tax incentive (or credit) to investors per dwelling per year.

International Taxation

- From 1 July 2008, halve the withholding tax on distributions from Australian managed funds to non-residents from 30% to 15%, to be offset by abolishing the claiming of debt as a deduction;

- The Board of Taxation will be directed to examine options to introduce a managed investments tax regime, including the potential of a specific tax regime for REITs, to effectively replace the current public trading trust rules contained in Division 6C;

- Remove the lodgement responsibility for overseas investors paying withholding tax; and

- A possible foreign source income tax credit paid at a lower rate than the domestic imputation credit to help address the bias against super funds investing in the international equities market.

Superannuation

- Develop and make available an optional Superannuation Clearing House for all businesses;

- Base the 9% Super Guarantee contribution on pre-salary-sacrifice salary and wages;

- A possible expansion to the super co-contribution scheme by either through lifting the $1,500 cap or relaxing the means test; and

- Implementation of an automatic consolidation of inactive lost superannuation accounts. Under the proposal, TFN’s would be used annually to automatically transfer lost accounts into the current or last active account.

Tax Administration

- Increase the resources available to the Tax Office for compliance activity, particularly in respect of high wealth individuals and large corporations;

- Abolish the role of the Inspector-General of Taxation; and

- Introduce a "BAS Easy" option for SMEs.

Tax Rates

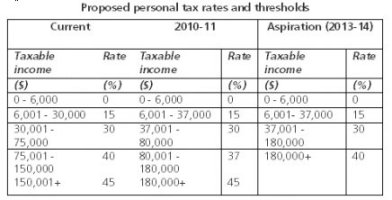

- Tax cuts of equal value to those proposed by the Coalition party for individuals earning up to $180,000 p.a however the Coalition’s proposed tax cuts for those individuals earning more than $180,000p. a. will be deferred;

- By 2013-14, a personal tax rate scale of 15%, 30% and 40% to be in place;

- The effective tax-free threshold would increase from $11,000 to $16,000 through an increase in the Low Income Tax Offset by 2010-11 and then to $20,000 by 2012-13;

- Adjustment of the Senior Australian Tax Offset;

- Reductions in the FBT rate would reflect reductions in the top marginal tax rate.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.