A CCIV is a type of company limited by shares that operates as a collective investment vehicle. A CCIV has a corporate director and must not have any employees. CCIVs operate as either retail or wholesale financial services providers and have at least one sub-fund registered.

A CCIV must have a constitution and cannot rely on the Replaceable Rules under the Corporations Act.

Each year a CCIV will receive an annual statement after its annual review date which will contain a statement of the CCIV's current details. The CCIV will also be required to pay an annual CCIV review fee.

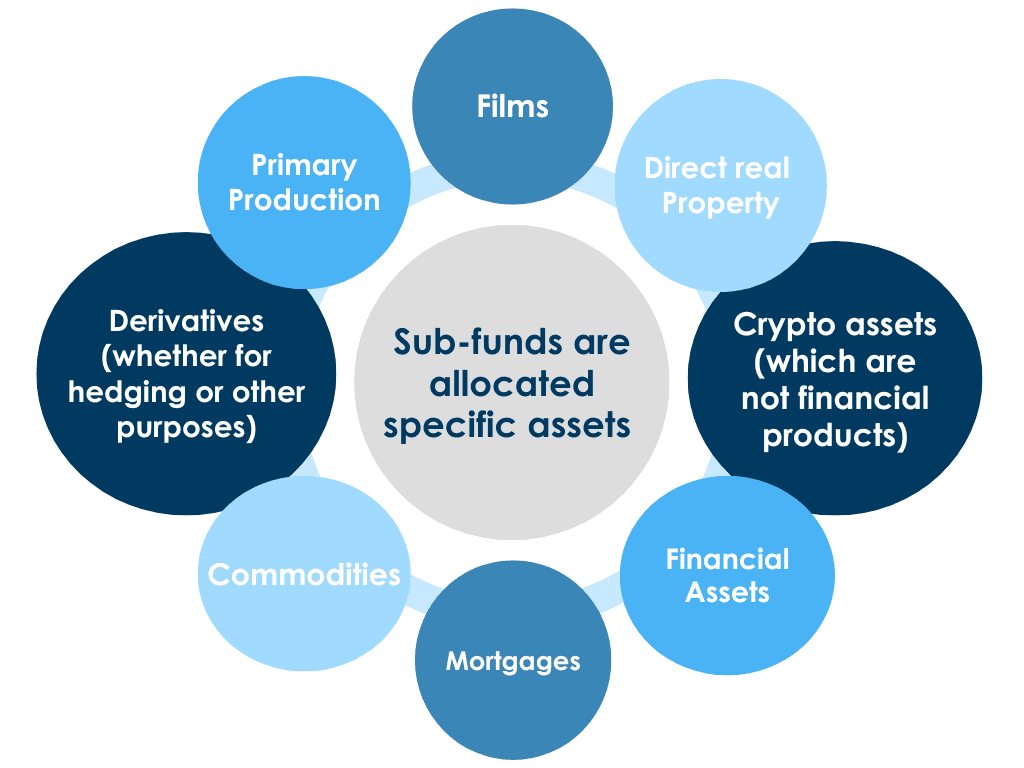

How do Sub-funds work?

Sub-funds are not separate legal entities and operate all or part of the business of a CCIV.

Commodities include raw materials, metals (including precious metals), agricultural products and energy products.

Financial assets include cash, cheques, orders for payment of money, bills of exchange, promissory notes, securities, deposit products and interests in managed investment schemes.

Primary production includes cattle breeding, forestry, horse breeding, horticulture, livestock grown for fleece, ratites, tea trees and viticulture.

Regarding films, the sub-fund must have the sole purpose of producing and/or exploiting a cinematograph film.

Corporate Directors

CCIVs must have a corporate director that:

- is a public company; and

- upon registration holds an AFSL authorising the corporate director to operate the business and conduct the affairs of the CCIV.

At least half of the individual directors of a retail CCIV must be external directors.

Corporate directors are responsible for the conduct of the CCIV.

AFSL Requirements

An entity seeking to obtain an AFSL to be authorised to operate a CCIV will need to demonstrate to ASIC that they have at least one Responsible Manager with knowledge and skills in relation to CCIVs. This means the AFSL applicant must have one or more Responsible Managers with knowledge or skills in relation to:

- operating the business and conducting the affairs of a CCIV; and

- the assets under management.

If an AFSL is granted which includes the authorisation to operate a retail CCIV, ASIC has the discretion to limit the retail authorisation to one sub-fund. Where the AFSL holder is seeking to operate multiple sub-funds, a variation application to ASIC will need to be submitted.

An entity that is an existing AFSL holder, that is a CCIV, must submit an AFSL Variation Application to ASIC to obtain authorisation to allow the AFSL holder to operate the business and conduct the affairs of the CCIV.

How do I know if my CCIV is retail or wholesale?

A CCIV is a retail CCIV if it satisfies the retail CCIV test contained in the Corporations Act or is notified as a retail CCIV under the Corporations Act. A CCIV that is not a retail CCIV is a wholesale CCIV.

Section 1222K of the Corporations Act states that a CCIV satisfies the retail CCIV test if any of the following apply:

- at least one member of the CCIV is a protected retail client;

- at least one member of the CCIV is a protected retail client under a custodial arrangement; or

- at least one member of the CCIV is a protected member of a passport fund.

Further information regarding the retail CCIV test can be found here.

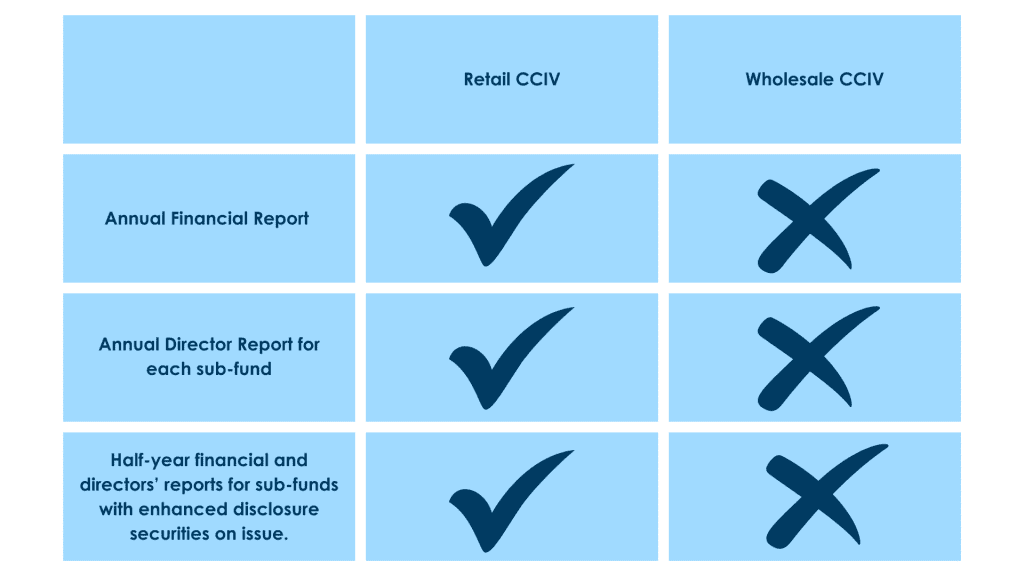

Financial Requirements

Both retail and wholesale CCIVs are subject to the rules surrounding financial records contained within Part 2M.2 of the Corporations Act.

Further Reading

- Corporate collective investment vehicles

- How to register a corporate collective investment vehicle and sub-fund

- https://sophiegrace.com.au/corporate-collective-investment-vehicles-an-afsl-variation-may-be-coming-to-you/

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.