AFSL holders (Licensees) can be authorised to provide financial services to retail clients, wholesale clients or both.

For those Licensees that provide services to wholesale clients, the process of determining whether a client qualifies as wholesale requires careful consideration and adherence to the tests contained in the Corporations Act. Failure to appropriately apply the existing tests and accurately classify clients can lead to significant consequences for Licensees, including potential legal and financial ramifications.

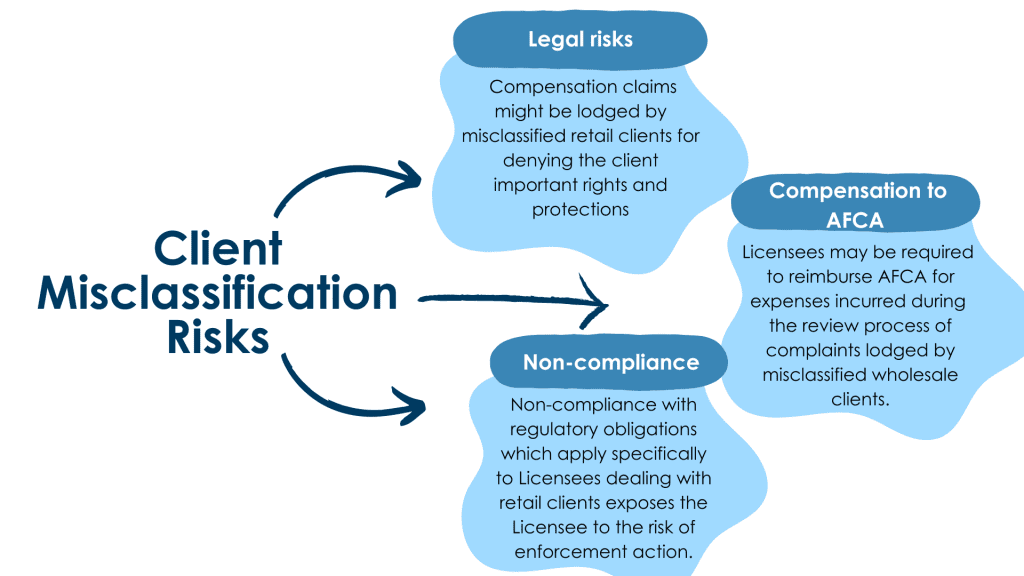

Misclassification of clients can expose Licensees to various potential consequences, including:

Exposure to legal risks

Reimbursement of Australian Financial Complaints Authority (AFCA) expenses

Licensees may be required to reimburse AFCA for expenses incurred during the review process of complaints lodged by misclassified wholesale clients.

If Licensee is authorised to provide financial services to retail clients, membership with AFCA is mandatory. AFCA is authorised to handle complaints from retail clients regarding financial services provided by Licensees. However, at AFCA's discretion, complaints from wholesale clients can also be accepted. In that case, the Licensee may be required to cover AFCA's costs for its review of the complaint.

Non-compliance with regulatory obligations

Non-compliance with regulatory obligations which apply specifically to Licensees dealing with retail clients exposes the Licensee to the risk of enforcement action by ASIC. Obligations which apply specifically to retail Licensees include:

- Internal dispute resolution procedures and the specific enforceable paragraphs of RG271;

- Design and Distribution Obligations;

- Best interests duty and conflicted remuneration provisions – for personal advice providers;

- Specific qualification and continuing professional development requirements;

- Prohibition on hawking financial products

Application of the Wholesale Investor Test to Trustees of Self-Managed Superannuation Funds (SMSFs)

There is ongoing legal uncertainty in relation to the application of the wholesale investor test to trustees of SMSFs. The tests which could be applied are:

- The professional investor test – that the trustee controls $10 million in assets; or

- The net assets or gross income test (the general test) – that the trustee has net assets of $2.5 million or gross income of $250,000 p.a. in each of the previous two years.

ASIC has stated that:

"...where the trustee of an existing superannuation fund receives advice about how to invest the fund's assets, ASIC will not take action if the person providing the advice determines whether the trustee is a wholesale client based on the general test mentioned above (e.g. if the trustee has net assets of at least $2.5 million), rather than applying the higher $10 million net asset test."1

This means that ASIC will not take action where the general test has been applied, rather than the professional investor test. ASIC's approach does not stop third parties who may have private rights of action from exercising these rights.

ASIC has cautioned Licensees that they should make their own commercial decisions about application of the test after considering the legal risks of potential misclassification.

Case study: consequences for misinterpretation

A recent case involving Oztures Trading Pty Ltd trading as Binance Australia Derivatives (Binance) highlights the importance of proper client classification. Binance mistakenly classified retail clients as wholesale, resulting in non-compliance with the Design and Distribution Obligations, including the failure to prepare a target market determination. . Binance made compensation payments of approximately $13.1 million to 523 retail clients between May and September 2023.

One of ASIC's key concerns when it takes enforcement action, such as the action against Binance, is consumer harm. Accordingly, it is important that Licensees understand the criteria for classifying any client as wholesale, the potential ramifications for misclassification and ensure compliance with relevant laws and regulations.

For more information about the classification of clients as wholesale or retail, and the key characteristics distinguishing these client types, please refer to our blog article: Types of Clients – Retail v Wholesale.

Further Reading:

Types of Clients – Retail v Wholesale

Regulatory Guide 175 Licensing: Financial product advisers—Conduct and disclosure (RG 175)

Media Release (14-191MR): Statement on wholesale and retail investors and SMSFs

Footnote

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.