There are two Product Intervention Orders (Credit PI Orders) prohibiting the provision of short-term credit and continuing credit contracts that include fees charged to retail clients that breach the cost caps established in the relevant exemptions outlined in subsections 6(1) and 6(5) of the National Credit Code.

ASIC has issued Consultation Paper 371, proposing an extension of the Credit PI Orders until 1 October 2032.

What are the Exemptions?

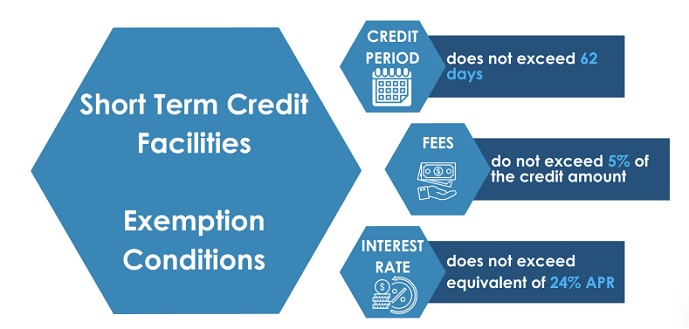

(a) Short Term Credit Facilities

Under the short-term credit exemption in s6(1) of the National Credit Code, the National Credit Code does not apply where:

- the provision of credit is limited to a total period that does not exceed 62 days;

- the maximum amount of credit fees and charges does not exceed 5% of the amount of credit; and

- the maximum amount of interest charges does not exceed an amount equivalent to an amount payable if the annual percentage rate was 24% per annum.

(b) Continuing Credit Contracts

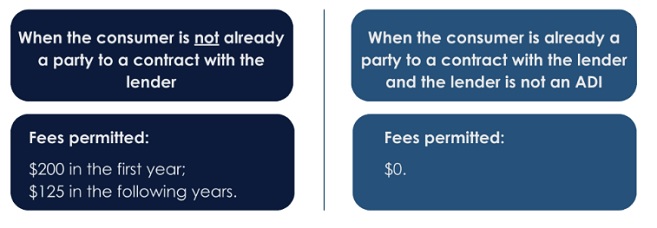

Section 6(5) of the National Credit Code provides an exemption for continuing credit contracts where the sole charge for providing credit is a periodic or other fixed, non-variable fee.

The National Consumer Credit Protection Regulations 2010 (Regulations) specify the prescribed maximum charges in relation to a continuing credit contract, for the purposes of the continuing credit contract exemption:

- If the consumer is not already party to a continuing credit

contract with the lender (or an associate of the lender):

- $200 in the first year;

- $125 in the following years;

- If the consumer is already party to a continuing credit contract (or was within the past 12 months) and the lender (or its associate) is not an ADI the fee must be nil.

Two Contract' Model in Practice

ASIC has identified a class of short-term credit facilities and continuing credit contracts being offered to retail clients in a model known as the 'two contract' model:

Contract One: A credit contract is provided by the lender, who charges fees consistent with limits prescribed in the exemptions in the National Credit Code and the Regulations.

Contract Two: In parallel, an associate of the lender offers collateral services, encompassing application, distribution, management, and collection services as such, all linked to the credit contract. These services often involve the imposition of substantial fees or charges under a separate collateral contract.

The Credit PI Orders were introduced to regulate and restrict the fees and charges that could be applied to retail clients, while relying on the exemptions provided by the National Credit Code.

A Recent Court Case

ASIC successfully brought an action against Cigno Pty Ltd (Cigno) and BHF Solutions Pty Ltd (BHF Solutions). These companies were alleged to have collectively operated a 'two contract' lending model and relied on an exemption in the National Credit Code.

In June 2021, the Federal Court initially dismissed ASIC's application on the grounds that Cigno and BHF Solutions' business model fell within the exemption provided by relevant sections of the National Credit Code.

ASIC then appealed to the Full Federal Court. In July 2023, the Court decided that this lending model was, in fact, unlawful, and that both parties had conducted credit activities without the necessary Australian Credit Licence.

Further reading

- ASIC Corporations (Product Intervention Order—Short Term Credit) Instrument 2022/647

- ASIC Corporations (Product Intervention Order—Continuing Credit Contracts) Instrument 2022/648

- 22-182MR ASIC Makes Product Intervention Orders for Short Term Credit and Continuing Credit Contracts

- 23-188MR Cigno and BHF Solutions Found to Have Engaged in Unlicensed Conduct

- 23-214MR ASIC Consults on Proposals to Extend Its Short Term Credit and Continuing Credit Contracts Product Intervention Orders

- National Consumer Credit Protection Act 2009

- National Consumer Credit Protection Regulations 2010