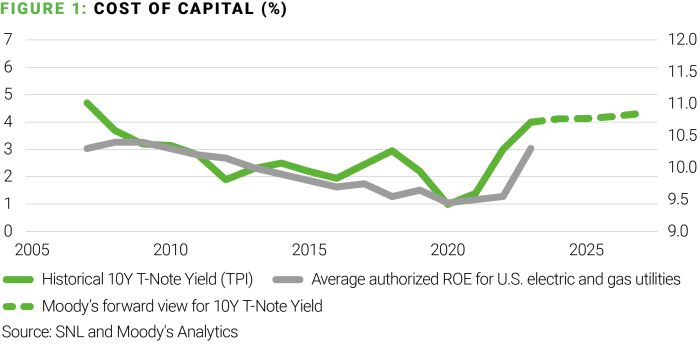

The energy transition has put power utilities on an unprecedented growth trajectory. With resource adequacy as one of the top challenges, capital spending is increasing faster than ever before in this century. CFOs across the industry consider various sources of capital to fund the growth but utility executives across the industry are uneasy given growing borrowing costs. Hence non-standard sources of capital gain popularity such as unregulated asset divestments and minority stake sales in core operations. We would like to explore a few more options available in the CFO toolkit before tapping into the equity markets.

The most effective way to increase cash is to...stop spending

Utilities who combine fundraising efforts with enhanced controls on spending will offer the highest returns to their investors. Executives focused on effective cash management must answer a critical question:

Where is all the money going?

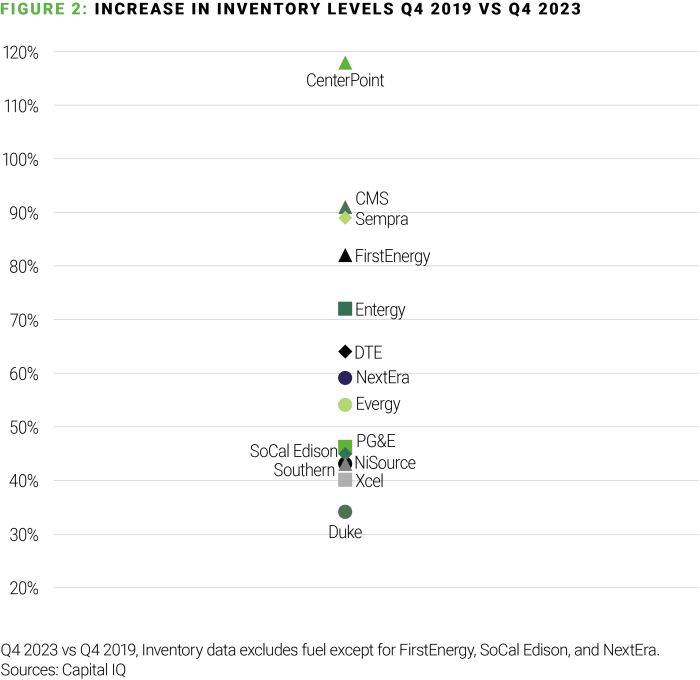

The answer is complex. Spend may increase with inefficiencies in managing large capital projects and pockets of excess costs across the organization. In post-COVID financials, we find a surprisingly dramatic increase in working capital needs, specifically with exponentially growing inventory levels. In the past 4 years, over 14 of the largest utilities in the US added a looming $4.5bn in T&D inventory.

Growth of Inventory (last 4 years)

The astonishing inventory increase across the industry has left many executives seeking answers to a key question: Why have the inventory requirements of our business increased so much in just the past few years?

We see common themes across the industry driving inventory levels up:

Many utilities operate on 'just-in-case' inventory stocking strategies given the high cost of failure associated with material stockouts. This results in companies holding excess parts when project requirements differ from expectations or when priorities change and plans are not executed. A quick x-Ray of stocking practices using AlixPartners proprietary tools may lead to both increased availability of critical parts and lower inventory volumes. In addition, it offers sustainable process improvement by equipping the in-house teams with tools enabling automated and AI powered analysis.

Inventory planning for projects is complex with the accuracy of the demand signal between design, permitting, supply chain, and construction rarely being measured. Similarly, companies hedge against unplanned disruptions such as natural hazards or emergencies which add complexity and make it difficult to abide by work plans set in place. As a result, inventory sits on the shelves unaddressed when projects in the field are delayed or cancelled. Enhancing the internal communication, developing a demand tower, and establishing a robust feedback loop to operations may help address process inefficiencies.

The pandemic era supply chain bottlenecks led to longer lead times and higher safety stocks. Inventory has continued to grow as many companies have not yet readjusted lead times and other MRP parameters to the new, post-pandemic conditions. Some suppliers, however, are still struggling to reach pre-pandemic lead times. Narrow supplier base in many categories significantly reduces optionality exacerbating the issue. In response, the utility may follow frameworks developed by other industries such as aerospace and automotive: deepen collaboration with selected suppliers, or even create dedicated SWAT teams to enhance operations of its supplier base. AlixPartners has readily available frameworks and experienced executives to help utilities establish such a supplier performance enhancement program.

You cannot manage what you don't measure

Coming from the era of "cheap money," only a handful of utilities, including AES, WEC, FirstEnergy and DTE Energy, include operational cash flow metrics in their incentive plans. Historic and industry-wide lack of focus on working capital creates an opportunity for many executives to capture enhanced returns to investors. This spring may be a good opportunity to refresh short- and medium-term liquidity forecasts, assess forecast accuracy, and consider including working capital into the KPI's tracked and reviewed by executive staff.

Our Firm's long history and deep experience helping companies manage their working capital has taught us several critical lessons that should be applied, now, by every utility - because this year even seemingly stable companies are facing continued uncertainty and difficult decisions on which road to take.

Act swiftly and decisively to capitalize on the opportunity – your peers are already taking actions

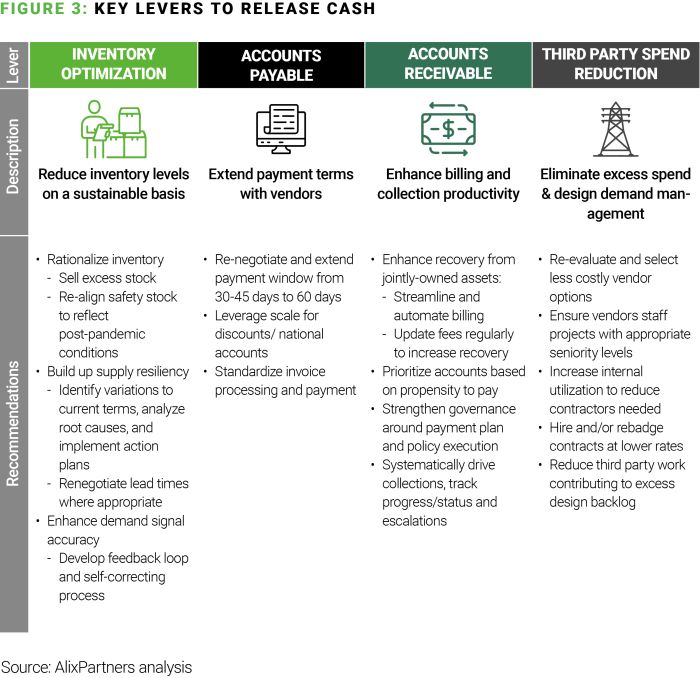

Stop buying and work down excess inventory

Existing purchase orders should be reviewed and reduced or cancelled, if possible, to avoid growth in excess inventory. Careful consideration should be taken before placing new orders, especially for bespoke materials which can become obsolete if not used. Obsolete or surplus inventory can be addressed by exploring options for resale or scrap.

Re-assess stocking policies

Stocking policies are impacted by a variety of factors including service levels, supply reliability and lead times. Each of these levers should be evaluated and re-assessed. AlixPartners' tools can enable easier, more sophisticated discussions of stocking policies by providing the ability to plan around scenarios such as declining supplier performance or inventory policy shifts.

Improve supply resiliency

To increase external supplier reliability, vendors must be engaged in discussions and committed to improving performance. To initiate this process, utilities should identify variations to current terms, perform root cause analysis, prioritize and develop action plans, and ultimately implement corrective actions.

Enhance demand management

Feedback loops should be established between design, supply chain, and construction. Timely notification of demand changes and regular alignment on work plans versus actual execution helps inventory teams to adjust purchasing decisions and respond accordingly.

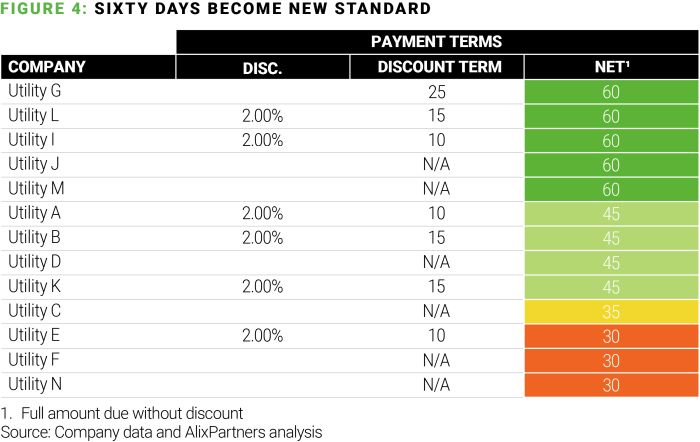

Extend payment terms to new market standards

Payment terms have been extended by many utilities beyond what was perceived as the pre-COVID market standard to reflect a new market benchmark of 60 days. Companies should seek to renegotiate select contracts, prioritizing accounts based on opportunity and downside risk. Embedding controls into the process can ensure adherence to policies and limit exceptions.

Collect what is due

Non-energy revenues often go under-collected but the process can be reinvigorated through several steps. The collections process in particular will need an active, strategic approach with a technology enhanced ability to clarify customer questions or disputes. To maximize collections, third party and internal backlogs should also be addressed through end-to-end process evaluations and the introduction of digitalization and automation. The introduction of AI based tools into collection processes can enable a more targeted approach by prioritizing customers based on their propensity to pay.

Utilities should expand their Accounts Receivable efforts beyond energy receivables, specifically to non-energy receivables, to capture quick wins. Non-energy receivables are often undermanaged, and companies typically only see a portion of the full opportunity, driven by hidden backlogs of items not yet processed and billed and thus not present in total receivables. This is also an area where we have frequently observed outdated / underpricing associated with billing for items including new connections, jointly-owned infrastructure repairs, and unauthorized attachments. Utilities can uncover untapped value by reinvigorating the collections process and enhancing end-to-end processes through increased collaboration, automation, and KPI tracking.

Eliminate waste

Throughout the end-to-end construction process, there may be bottlenecks, especially in the project execution stage, which can create backlogs further upstream. Changing the design inventory to a pull model to optimize for capacity bottlenecks can drive day-to-day savings through reduced third party spend while reducing waste of obsolete backlogs. These actions start with enhancing the process, winding down existing backlog, and managing the 'to-be' state via tools and metrics to monitor the process moving forward.

Find a partner to reduce risk

Significant value can be uncovered and captured by focusing on working capital levers to release cash. However, companies have limited resources available to redirect towards these efforts and may find themselves risk averse to large process changes across the organization. Finding a partner such as AlixPartners can help by adding experienced bandwidth when resources are constrained, lowering risk through collaboration with a trusted partner, and reducing time to impact through enhanced focus and accelerated efforts.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.